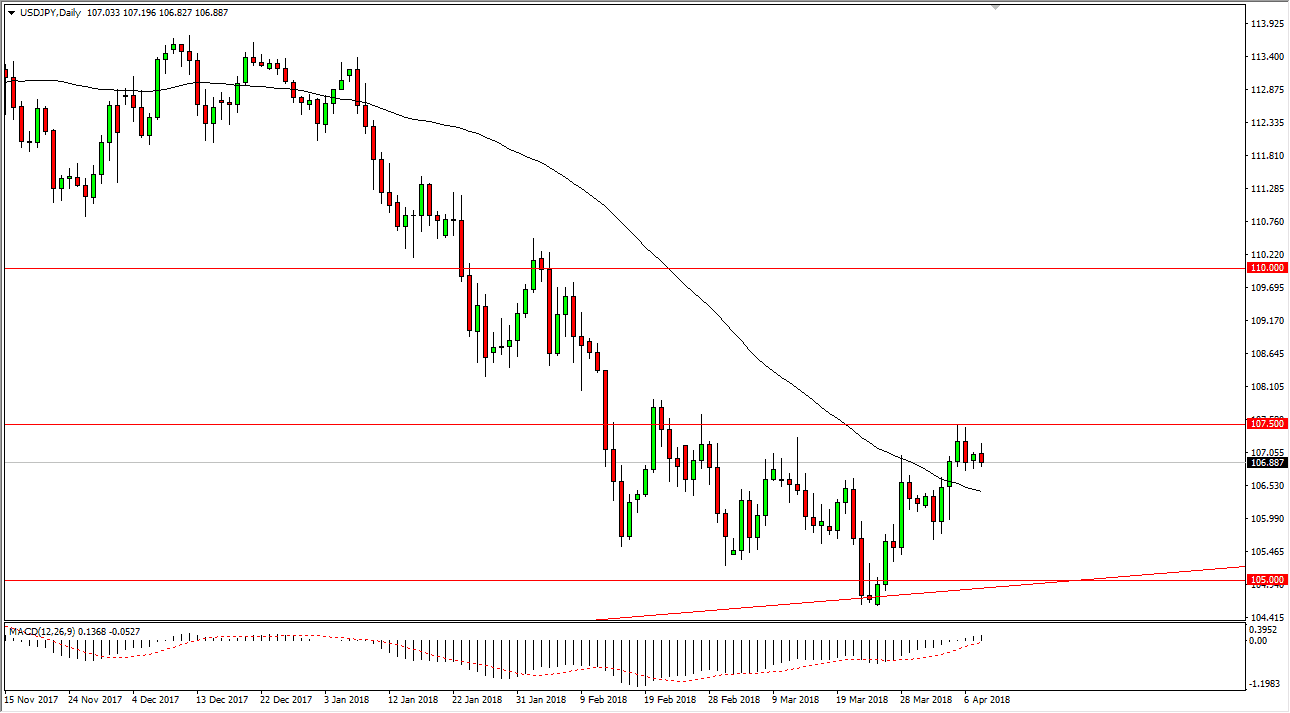

USD/JPY

The US dollar initially tried to rally during the session on Monday but found the 107.50 level to be too resistive to overcome. If we can break above there and more importantly the 108 level, the market should continue to go towards the 110 handle. On pullbacks, I suspect that there will be buyers coming back into this market, and this will certainly be influenced by stock markets in general, as this is a risk sensitive pair. The 105-level underneath should continue to offer support, especially considering that there has been a nice uptrend line just below that coincides with that level. I believe that we will continue to find buyers in that area, so don’t have any interest in trying to short this market. However, if we did breakdown below the 105 level, the market should then drop down to the 101 handle.

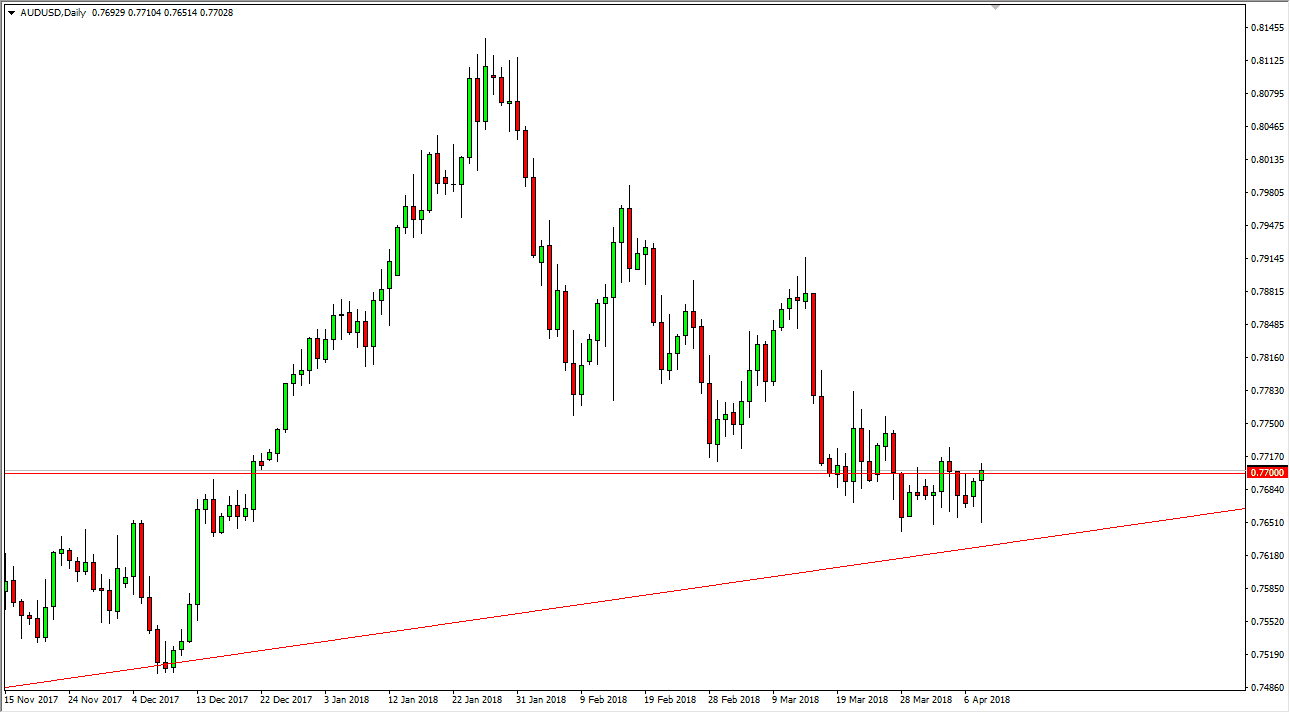

AUD/USD

The Australian dollar initially fell during trading on Monday but found enough support to turn around and form a nice hammer. I think that we will eventually find buyers, as the Australian dollar is sensitive to risk in general. I think that ultimately, if we can break above the 0.78 level, we could go higher, perhaps reaching towards the 0.79 level. Longer-term, I believe that the uptrend line underneath should continue to be the bottom of the daily uptrend channel, and I believe that the massive amount of support underneath should offer a lot of buying opportunity on the short-term pullbacks. Pay attention to gold, it has its effect on the Australian dollar as well, as Australia is the world’s largest exporter of that commodity. Ultimately, I think that the buyers will step in and pick this market up overall. It’s going to be choppy, but bullish in general.