S&P 500

The S&P 500 has broken down over 2% during the trading session on Friday, as we continue to see a lot of concerns about a potential trade war between the United States and China. Ultimately, I think that the markets will continue to see a lot of concern due to not only that but coming into the weekend people do not want to be long of the markets as there is so much risk out there due to a potential headline. I believe that the 2500 level underneath is massively supportive, and I think that it’s only a matter of time before the buyers return. However, if we break down below the 2500 level, it’s likely that we unwind rather drastically, reaching down much lower. However, I think that there is so much support below that it should keep the market somewhat afloat and I think value could present itself if you are patient enough.

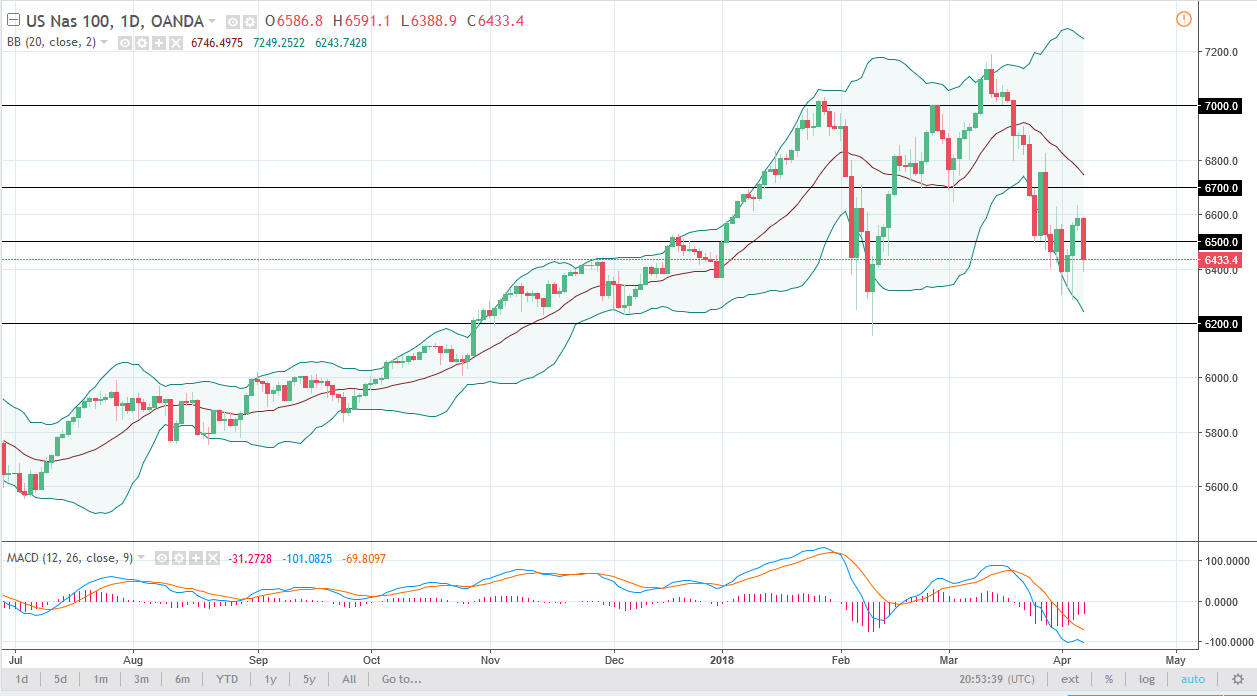

NASDAQ 100

The NASDAQ 100 fell significantly on Friday after forming a shooting star on Thursday. The market looks likely to test the 6300-level underneath, and after that the 6200 level. I think that the market continues to show a lot of noise in this area, and as traders are worried about a potential trade war, I think that the market will continue to be very noisy. I believe that if we get some type of bounce from here, we will probably try to reach towards the 6600 level. A breakdown below the 6200 level unwinds this market down to the 6000 level rather quickly. I believe that the market continues to be noisy and driven by sudden headlines, which of course are very difficult to trade.