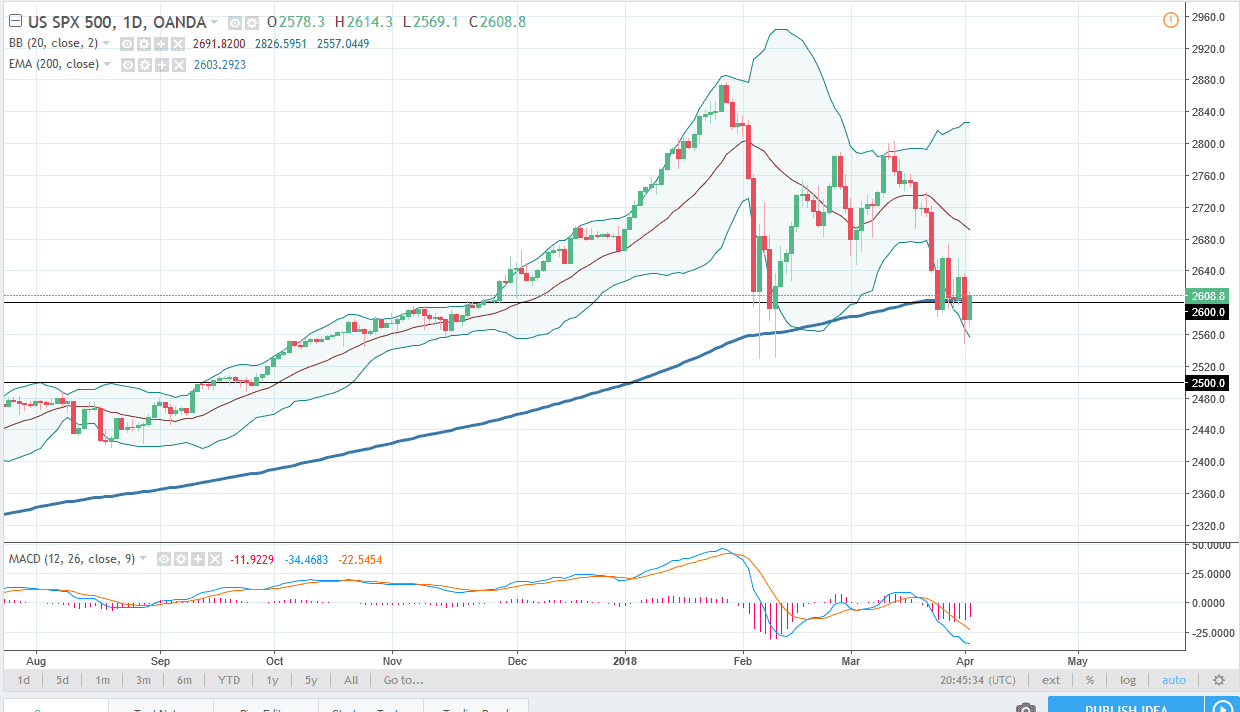

S&P 500

The S&P 500 rallied a bit during the trading session on Tuesday, breaking above the 2600 level. Ultimately, I think that the market should continue to reach towards the 2680 level, an area that is resistance. If we can break above the top of that level, then we should go looking towards the 2800 level. If we break down below the 2500 level, then I think the market unwinds rather rapidly. However, between now and Friday it’s likely that the talk of trade wars will continue to make this a market that is going to be difficult. On Friday, it will come down to the jobs number coming out of America. If they are good, that could help the market, but if they are horrible, it’s possible that we could breakdown. Quite frankly, I believe that the overall attitude of this market looks negative, especially considering that we had broken below the 200-day EMA. That obviously is a very negative sign, and at the close of the day on Tuesday, it looks as if we are testing it again. If we can break above there, then I think the market will consolidate and eventually make its decision. Ultimately, this is a negative looking market.

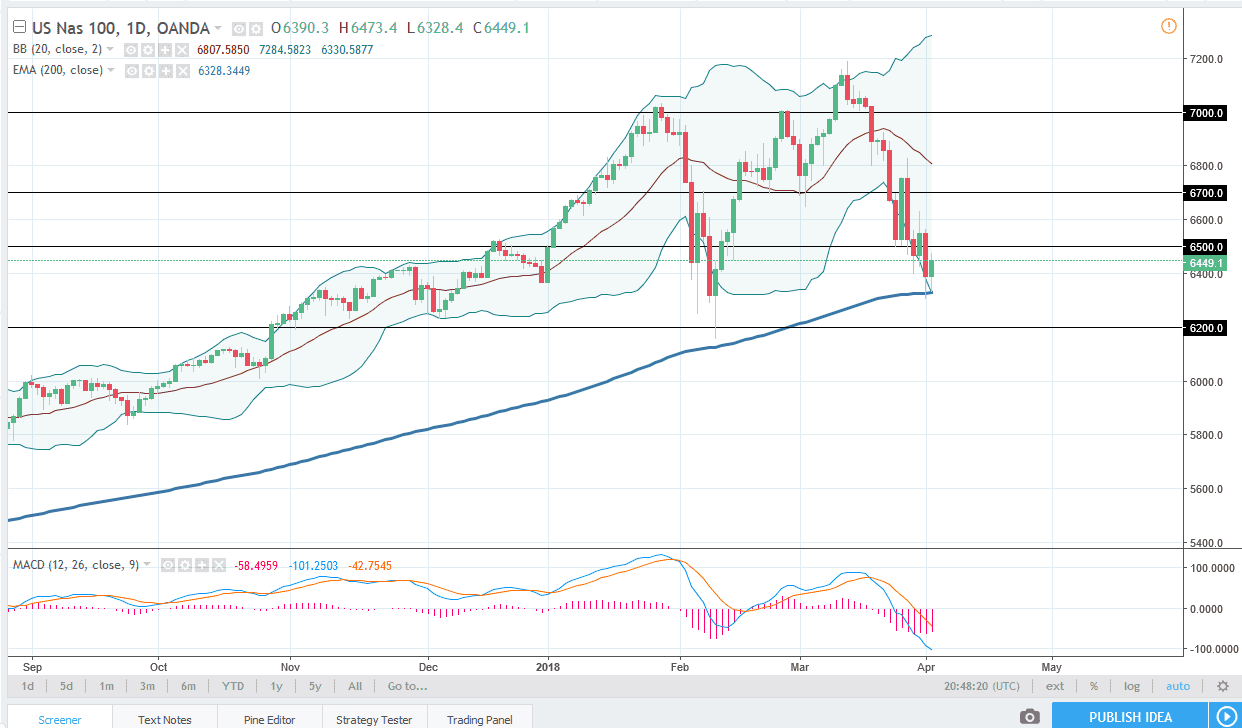

NASDAQ 100

The NASDAQ 100 on the other hand, has not closed below the 200 EMA yet, so it looks as if the NASDAQ 100 is trying to find some type of support. I believe that if we can break down below the 6200 level, the market breaks down rather rapidly. However, I don’t think that we get a major move between now and the jobs number coming out on Friday. Until then, I would anticipate that we consolidate in this area, with the 6500 level being a magnet for price.