S&P 500

The S&P 500 pulled back slightly during the trading session on Wednesday, reaching down towards the 2600 level, but turning around to form a hammer for the daily candle. Because of this, I think we will see this market go higher, and then perhaps the major selling is over, least in the short term. You can see that the uptrend line is just below, which coincides roughly with 2600. I think that the market will probably turn around and go towards the 2680 level, and then eventually the 2700 level. If we can break above the 2720 level, the market is then free to go to the 2800. If we break down below the 2600 level, then I think we could unwind rather rapidly, but this would more than likely accompany something along the lines of an increase in interest rates in America, or perhaps some type of major “risk off” move. At this point, I suspect a bounce is more likely than not.

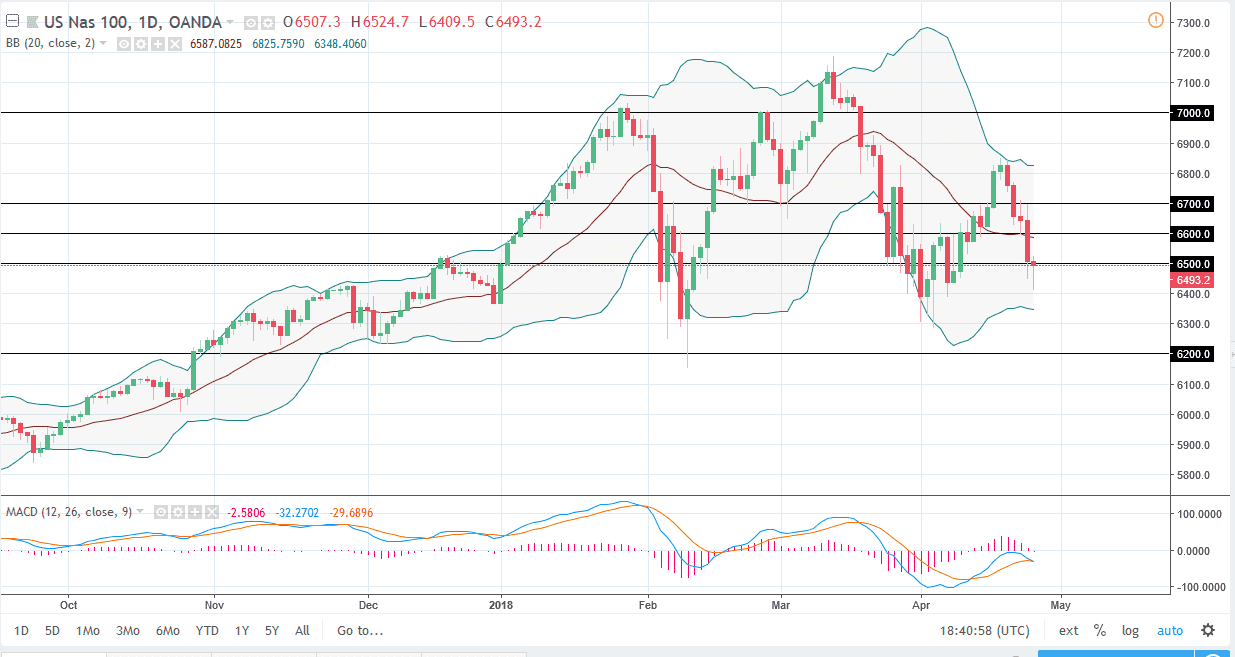

NASDAQ 100

The NASDAQ 100 initially fell during the trading session on Wednesday as well but continues to find support based upon the uptrend line, and I think if we can break above the top of the range for the session on Wednesday, the market should then go to the 6600 level after that, perhaps even the 6700 level after that. If we were to break down below the 6400 level, then the market comes unwound and goes to the 6200 level, perhaps even lower than that. The market has been very noisy, but right now I think we are due for a bounce as we have gotten a bit ahead of ourselves. Pay attention to the overall risk appetite, that will of course have an effect here as well.