S&P 500

The S&P 500 has gone back and forth during trading on Monday, essentially closing flat. The market is sitting above a significant amount of noise though, and there is a major uptrend line underneath. So, I believe that we could drift a bit lower from here, but there is a significant amount of noise that could come into play and lift the market. I think if we can break above the 2680 level, the market will probably try to break out to a fresh, new high for the month. If that happens, then I think the market goes towards the 2800 level. Otherwise, if we break down below the 2600 level, then we probably go to the 2500 after that. In general, this is a market that has been trying to grind higher, but that doesn’t mean it won’t be difficult. I am mildly bullish, but I would stress the word “mild.”

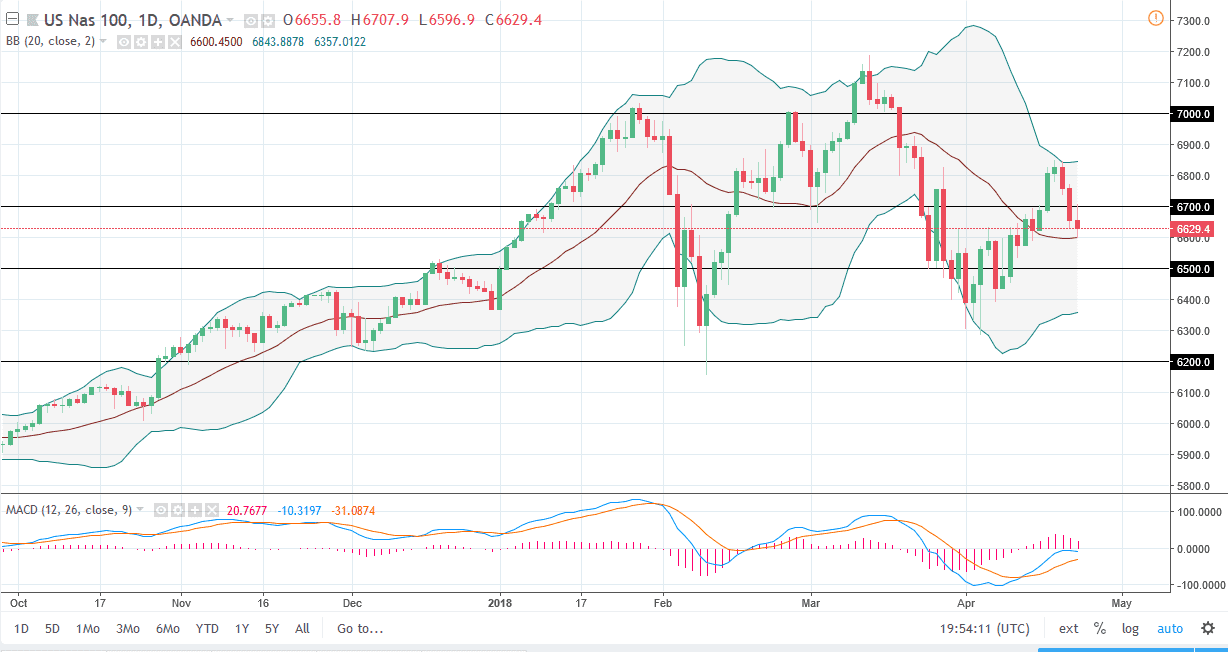

NASDAQ 100

The NASDAQ 100 tried to break above the 6700 level but turned around to form a bit of a shooting star at the 20 SMA. I think that if the market can break above the top of the shooting star like candle, then the buyers will probably reach towards the 6800 level, perhaps even higher than that. If we can break down below the bottom of the candle, then the market probably goes looking for support closer to the 6500 level. Keep in mind that this market will be highly sensitive to comments coming out of the United States and China, because they are likely to mention tech related stocks and companies. Ultimately though, I think that there is enough noise underneath to keep a bit of support in the market. I would love to see a breakout above the 6700 level as it is probably the easiest trade to take.