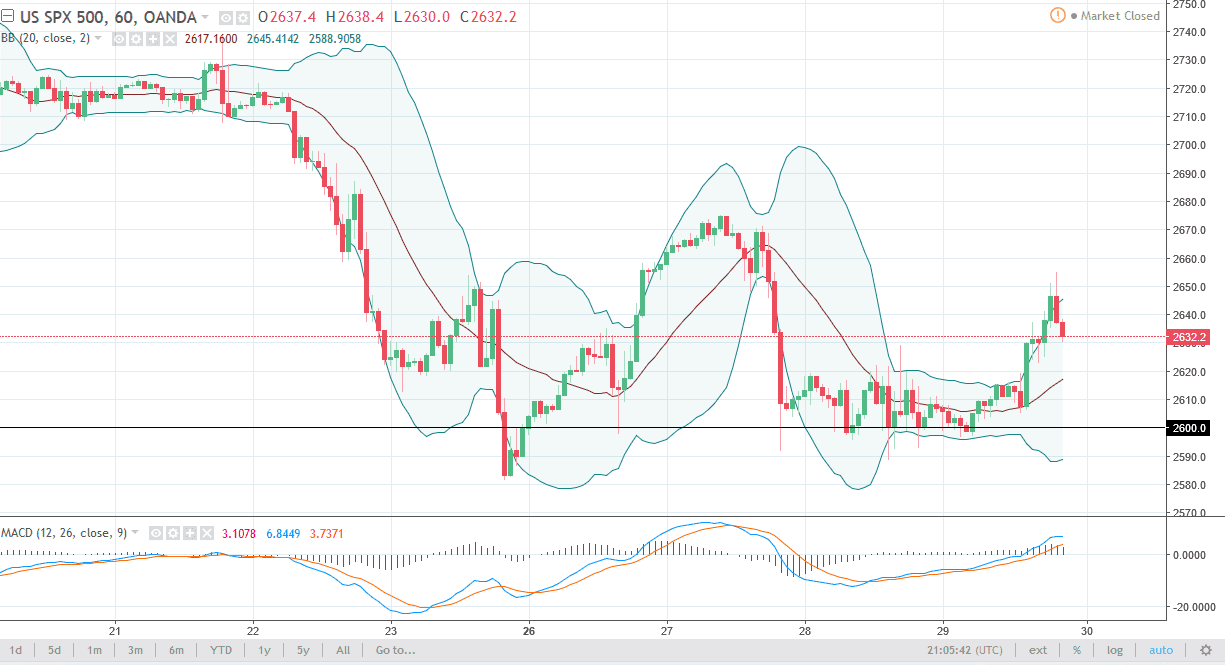

S&P 500

The S&P 500 tried to rally during the day on Thursday but rolled around a bit as we got near the 2655 level. Obviously, Friday was Good Friday, so there’s not much to say about that other than it has been a market that tried to rally but failed a bit. I think there’s plenty of support underneath though, and that could offer an opportunity to pick up a bit of value. If we can break above the highs from the Thursday session, we could then go higher, as it would show signs of building strength to the upside. I believe that the 2600 level underneath is the beginning of massive support, extending down to the 2500 level underneath. Ultimately, I think that the buyers will probably return. With this type of noise, I think it’s going to be difficult trading, so I would keep my position size small.

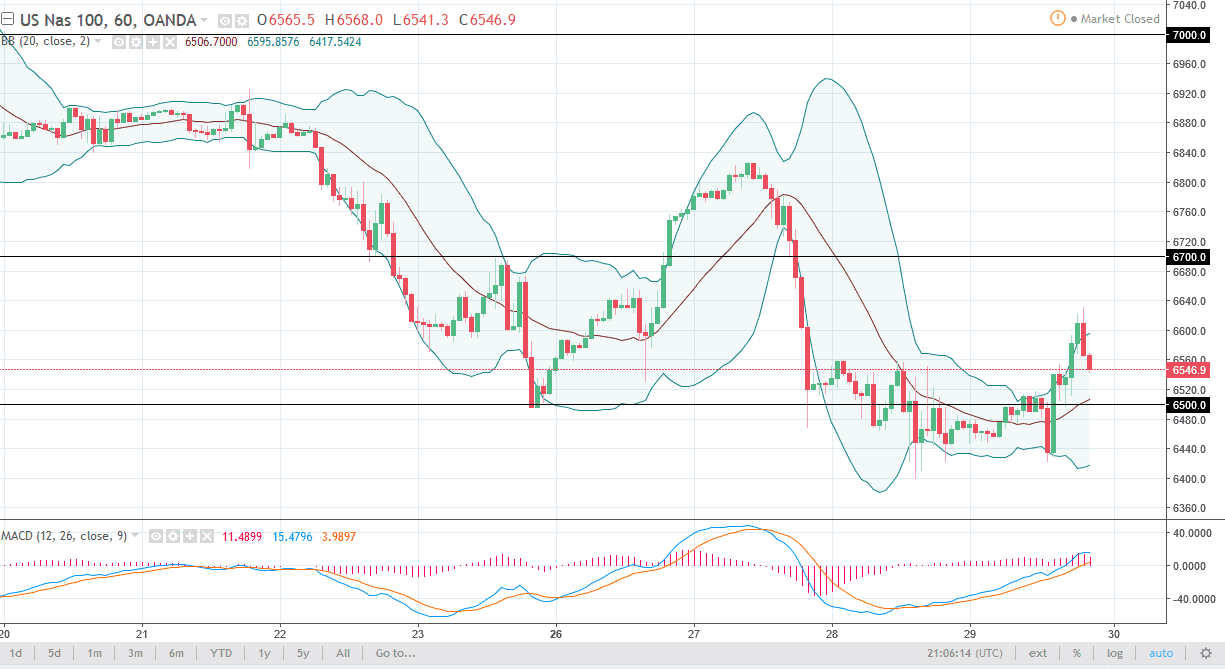

NASDAQ 100

The NASDAQ 100 of course was close during the day on Friday, as it was Good Friday, but overall, I think that the CFD markets show that we are going to pull back a bit, perhaps looking for some type of support. The 6400-level underneath is massive support, so I think that any type of bounce from here should be a nice buying opportunity. However, if we break down below the 6400 level, the market should break down a bit. Ultimately, I believe that the market will continue to find reasons to go higher, but this will hinge on a couple of factors. The first one of course is whether we are going to continue to hear troubles about a potential trade war. The other is LIBOR, which of course causes a lot of concerns when spreads widen. Ultimately, I think that it will be very noisy.