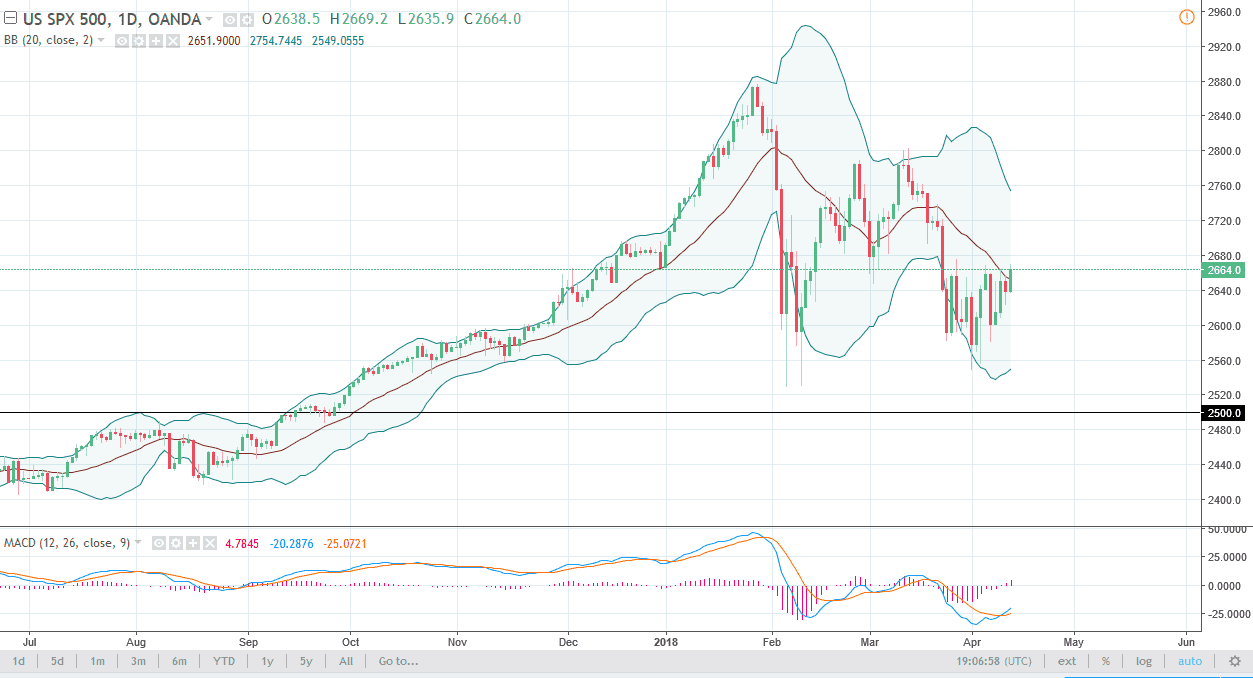

S&P 500

The S&P 500 rallied a bit during the trading session on Thursday, reaching towards the 2665 handle. If we can break above there, I think will go looking towards the 2680 level, an area that has been resistive. If we can break above that level, I think that the 2720 level above should be a target, followed by the 2800 level. I think that ultimately, buyers will come back into this market when we pull back, as tensions between the United States and China are slowing down. Beyond that, I think that tensions and worries about the United States attacking Syria have abated, so that should continue to put more of a “risk on” move in this market. I believe that the 2500 level underneath is the “floor” in the market. If we were to break down below there, then I think the market would unwind rather rapidly.

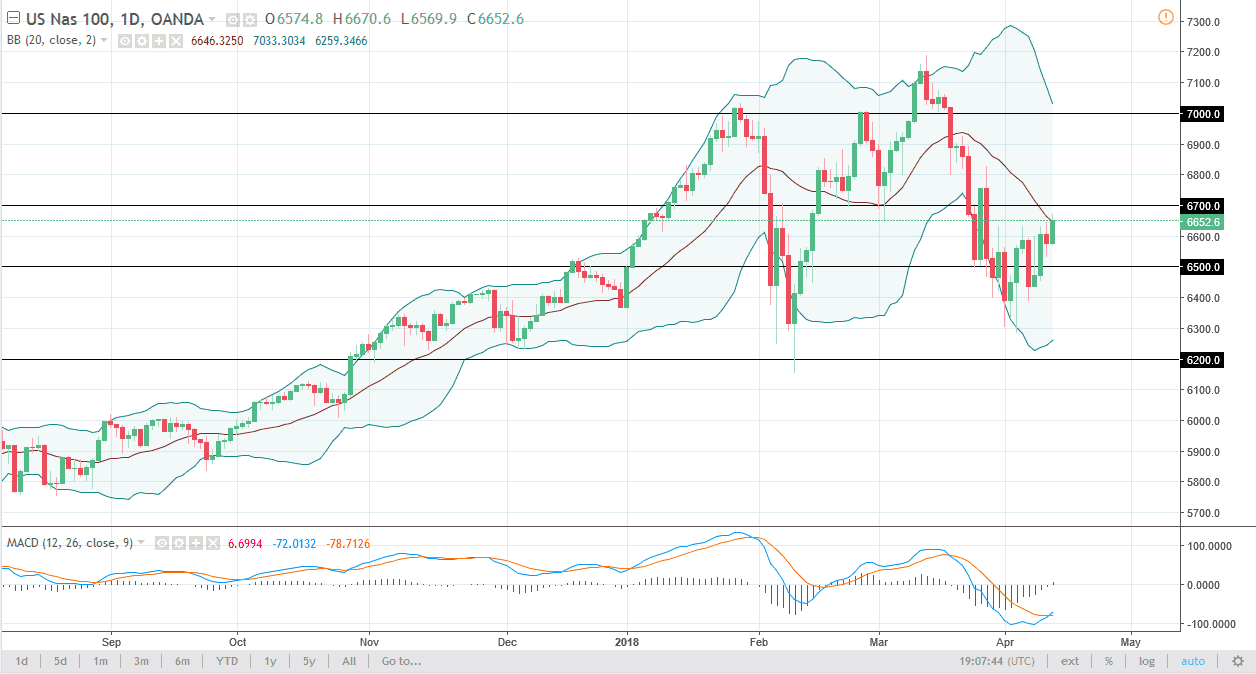

NASDAQ 100

The NASDAQ 100 broke higher during the trading session as well, reaching towards the 6650 handle. I think that the 6700 level is being targeted, and if we can break above that level it should send this market looking to the 6800 level, followed very closely by the 6900 level. I believe that we will eventually go to 7000 above, but it’s going to be choppy on the way up. We have been making “higher lows” recently, and we have been grinding away for some time, and I think that the market should continue to be difficult to deal with if you are highly leveraged. If you are not, and willing to take a longer-term approach, I think that the buyers are going to continue to defend this market, and the pullbacks will offer value. Expect noisy conditions, with a positive slant.