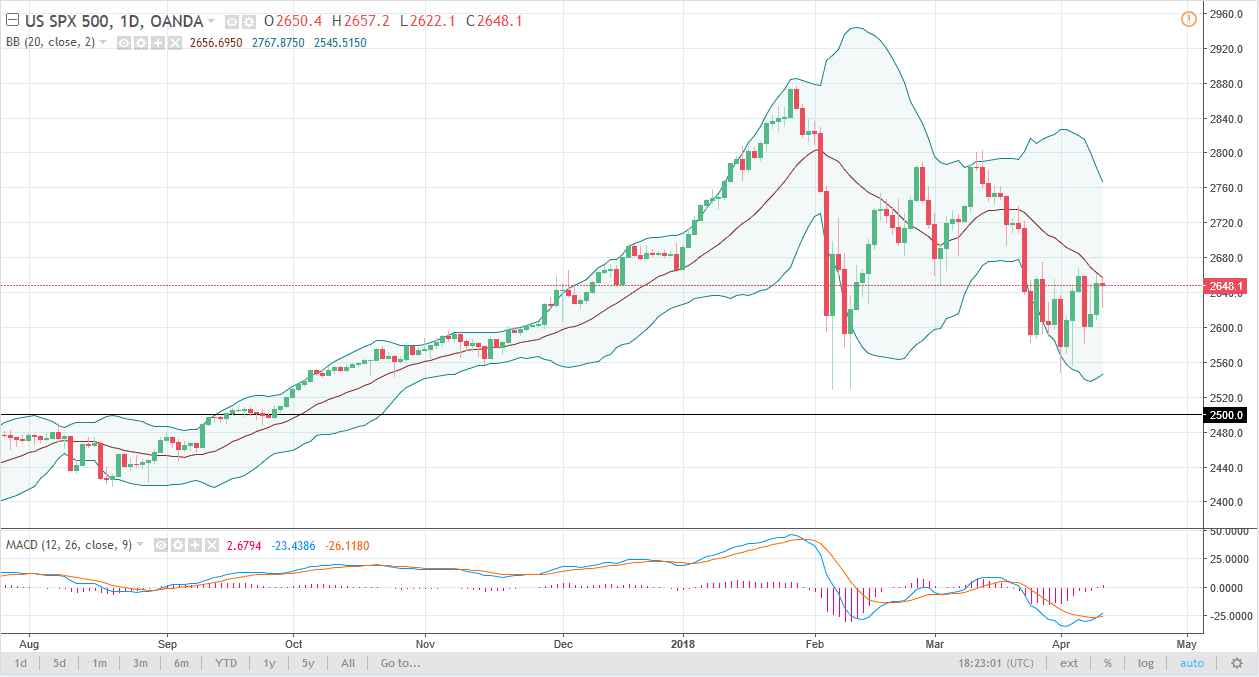

S&P 500

The S&P 500 initially fell during the trading session on Wednesday but turned around to bounce and form a nice-looking hammer. The hammer looks as if it is signaling that we are about to break out to the upside, perhaps clearing the 2680 level. Once we get above there, the market should continue to go towards the 2720 handle, and then perhaps the 2800 level. Ultimately, I think short-term pullback should be plenty of buying opportunities, and I also believe that the hammer that formed on the daily chart not only represents a signal to start going long, but if we break down below the hammer could send this market down to the 2600 level. I do believe that longer-term traders are starting to come in and take advantage of the fear that had entered the market previously.

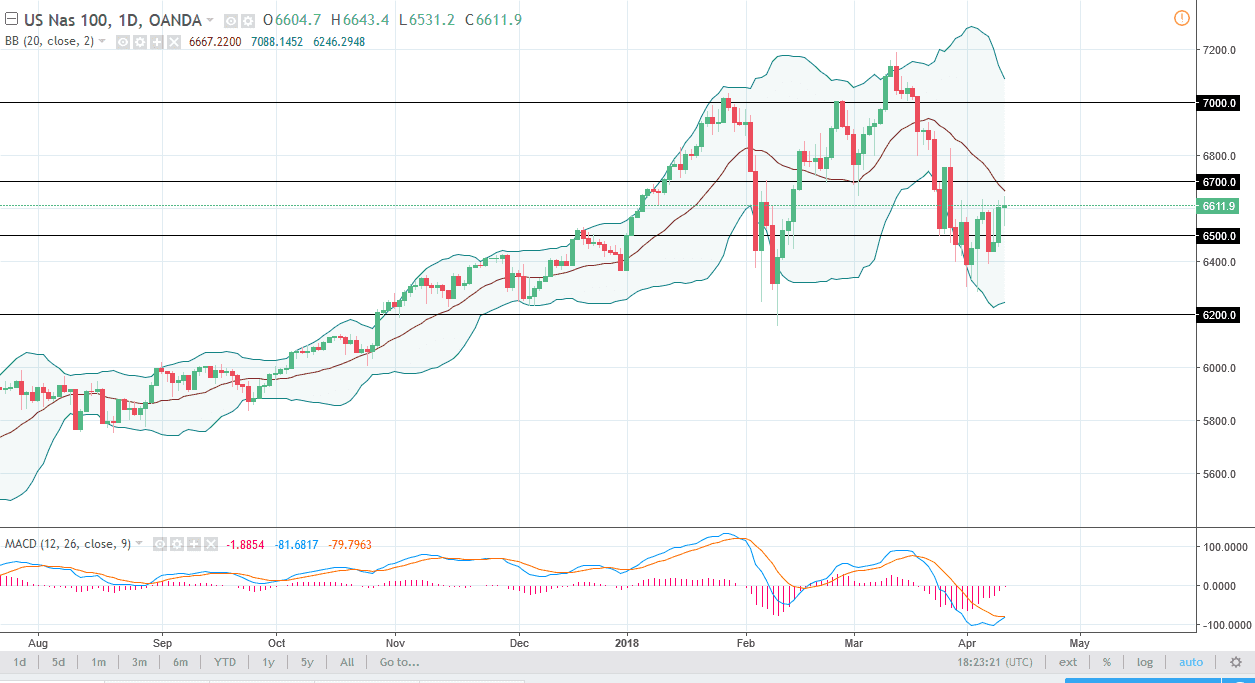

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session as well, but ultimately found enough buyers just above the 6500 level to turn things around and show signs of bullish pressure. If we can break above the top of the candle, we will test the 6700 level, and then perhaps break out to the 7000 level. Remember that this market is much like other stock markets around the world, reacting to the noise coming out of the US and Chinese officials’ mouths, about trade tariffs and the like. Ultimately, I believe that the market should continue to be noisy, but I think that the headlines will be the biggest driver of this market as technology was going to be targeted by a lot of what could have happened. I think that cooler heads are starting to prevail though, so I anticipate there’s more of a proclivity to go to the upside.