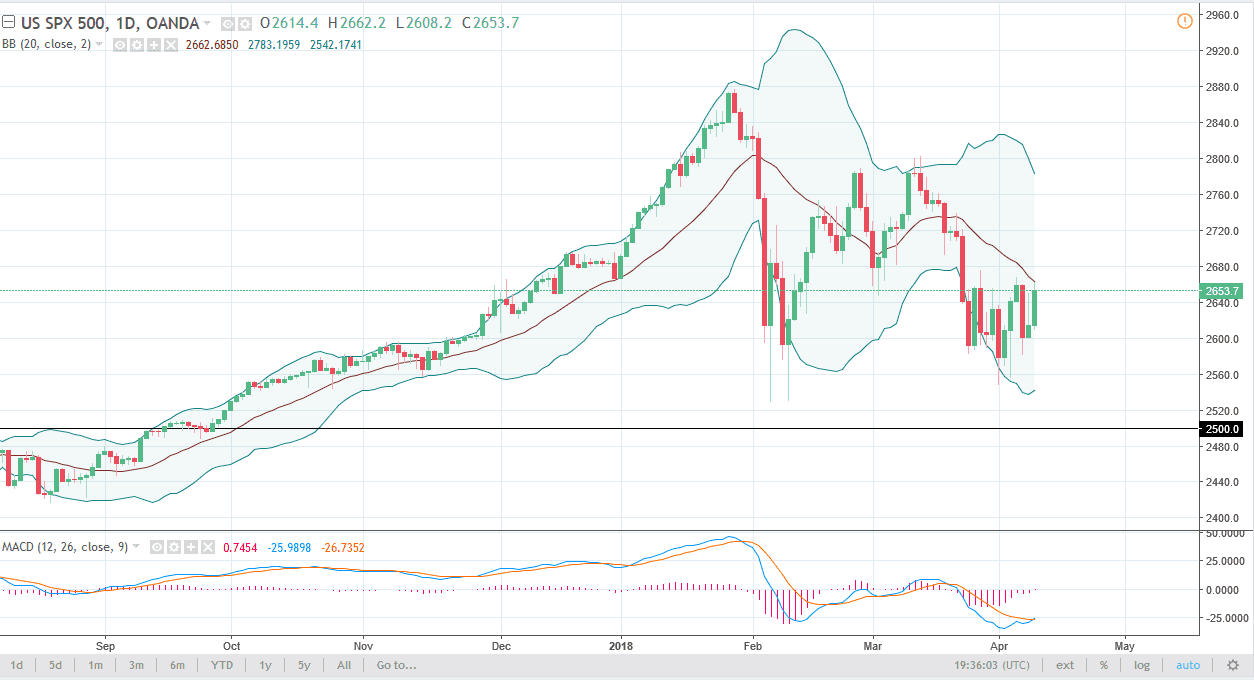

S&P 500

The S&P 500 rallied during the session on Tuesday, reaching towards the 2660 level, and the 20 SMA from the Bollinger Band indicator. The 2680 level above is resistance as well, and if we can break above that level I think that the market will probably go towards the 2800 level. That’s an area that’s resistance, but clearing that level allows the market to form a massive “W pattern.” I think that the bottom of the overall trend is closer to the 2500 level, and a breakdown below there would be very negative. Ultimately, I think that the market will remain very choppy, but there’s a lot of noise just below, that I think will keep this market somewhat afloat. This is clearly all about the US/China trade situation, and if we can continue to see a calm demeanor between the 2 economies, the market will probably continue to rally.

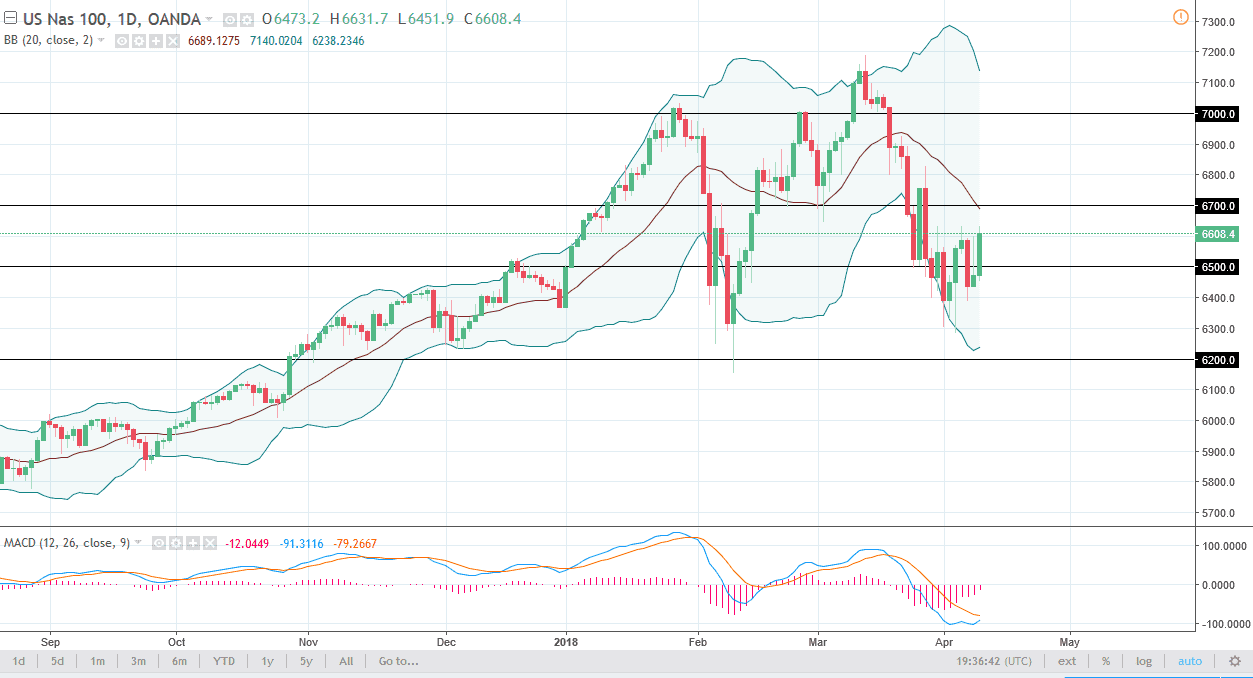

NASDAQ 100

The NASDAQ 100 rallied a bit during the trading session as well, gaining over 2%. The 6610 level being targeted yet again isn’t much of a surprise as we continue to bounce around. If we can break above that level, and I think we will eventually, will go to the 6700 level after that. I believe there is massive support near the 6400 level, so I am a buyer of dips as they occur. If we can continue to get conciliatory tones out of both the United States and China, the NASDAQ 100 will rally rather significantly as there was serious concern about tariffs against technology companies. The 6200 level looks to be the bottom of the overall uptrend right now. As long as we can stay above that level, I think that we will continue to have value hunters come back.