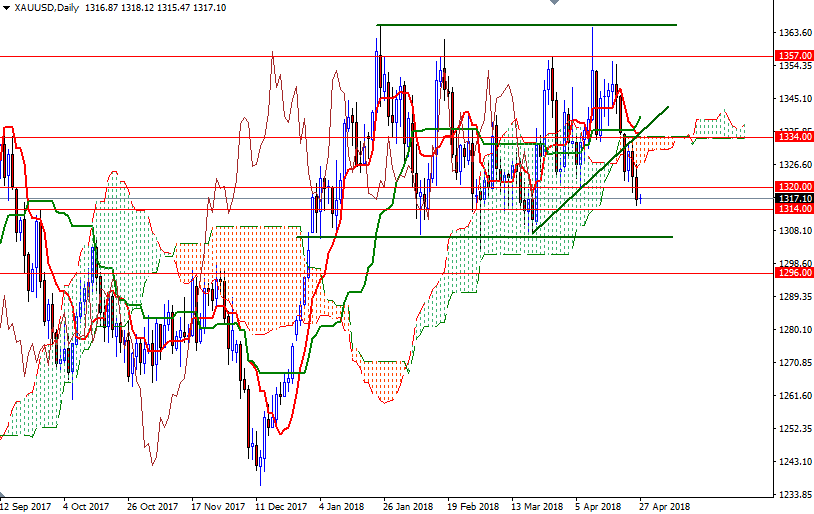

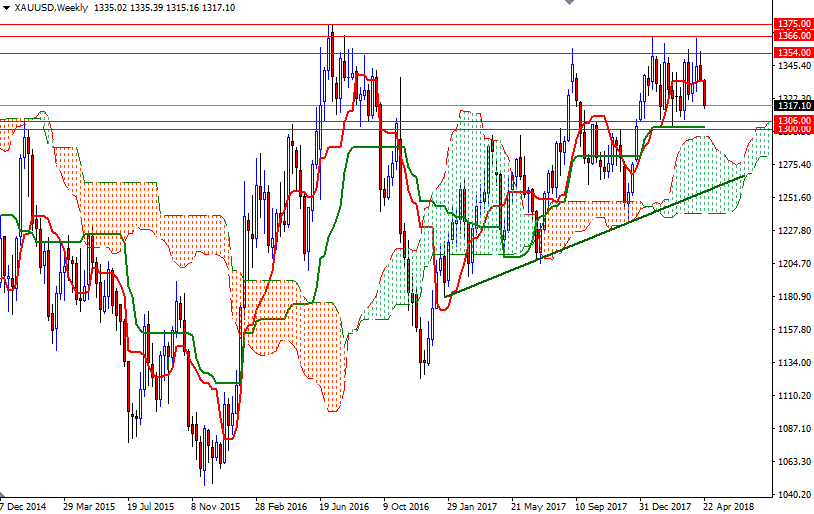

Gold prices slipped for a second straight session on Thursday as the U.S. dollar extended its rally and renewed risk appetite took some safe-haven demand away from gold. The dollar index rose after the euro was hampered by a dovish tone from the European Central Bank. U.S. stocks advanced, boosted by solid earnings results. XAU/USD tried to penetrate the daily Ichimoku cloud but the bulls run out of steam. Breaking below 1320 encouraged sellers and triggered a drop towards 1314 as expected.

The market is still trading below the Ichimoku clouds on both the daily and the 4-hourly charts. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are negatively aligned. While these suggest that the support at 1314 is still in danger, shorter-term charts point out the possibility of a bounce towards 1321/0. If the market gets back above 1321, the bulls may have a chance to test 1323.50, the bottom of the hourly cloud. A break above 1323.50 implies that the market will be targeting 1326.50-1325.60 next.

The bears, on the other hand, have to drag prices below 1314 to challenge the strategic support in the 1308/6 zone. If this key support is convincingly broken, then 1300-1296 will be the next port of call. Once we get below there, it is likely that prices will visit the 1292-1289 area.