Pairs in Focus This Week

The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 1st April 2018

In my previous piece last week, I saw the best possible trades for the coming week as long of the GBP/USD currency pair, and short of the USD/JPY currency pair. Both these trades were losing trades, with GBP/USD ending the week down by 0.76% while the USD/JPY rose by 1.48%, producing an average loss of 1.12%.

Last week saw a quieter, calmer market, at least in the stock market where the S&P 500 ranged above a supportive 200-day simple moving average. The steady fall in stock valuations has been halted. There was little news last week, but the major events are continuing tensions between Russia and NATO, and a better-than-expected U.S. Final GDP number, which supported the U.S. Dollar and may also have provided a floor for U.S. stocks.

The overall effect of these developments was to leave the U.S. Dollar up, while the Japanese Yen has fallen quite strongly. The market’s focus over the coming week should now move to the U.S. Non-Farm Payrolls data releases towards the end of the week.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, while sentiment is also aligned with the U.S. Dollar, partly due to the higher Final GDP data, and partly because there is a long-term trend against the U.S. Dollar which reinforces bearish sentiment. Sentiment is likely to remain unchanged until Wednesday’s ADP estimate of the Non-Farm Payrolls data, unless there are any new developments concerning U.S. / Chinese trade tariffs or the Russia / NATO tension.

Technical Analysis

U.S. Dollar Index

This index printed a bullish candlestick, which closed near its high, more than halfway up the body of the previous candle. This is not strongly bullish but coupled with the consolidative price action of the past 9 weeks, it suggests that the long-term bearish trend is weakening considerably and possibly coming to an end. The bearish trend is still in force and worth following, but it should be treated with increasing caution regarding its reliability. On the other hand, the fact that all the resistance levels which have formed during this downwards trend are still intact suggests continuing bearishness.

GBP/USD

This pair is in a long-term bullish trend. After consolidating over the past few weeks, it had begun to rise more strongly again. However, last week’s candlestick was undoubtedly bearish, with a fairly large upper wick rejecting an area of obvious resistance above. Sentiment now seems to be just as bearish on the Pound as on the Euro. There is still a bullish trend here, but the price looks weak.

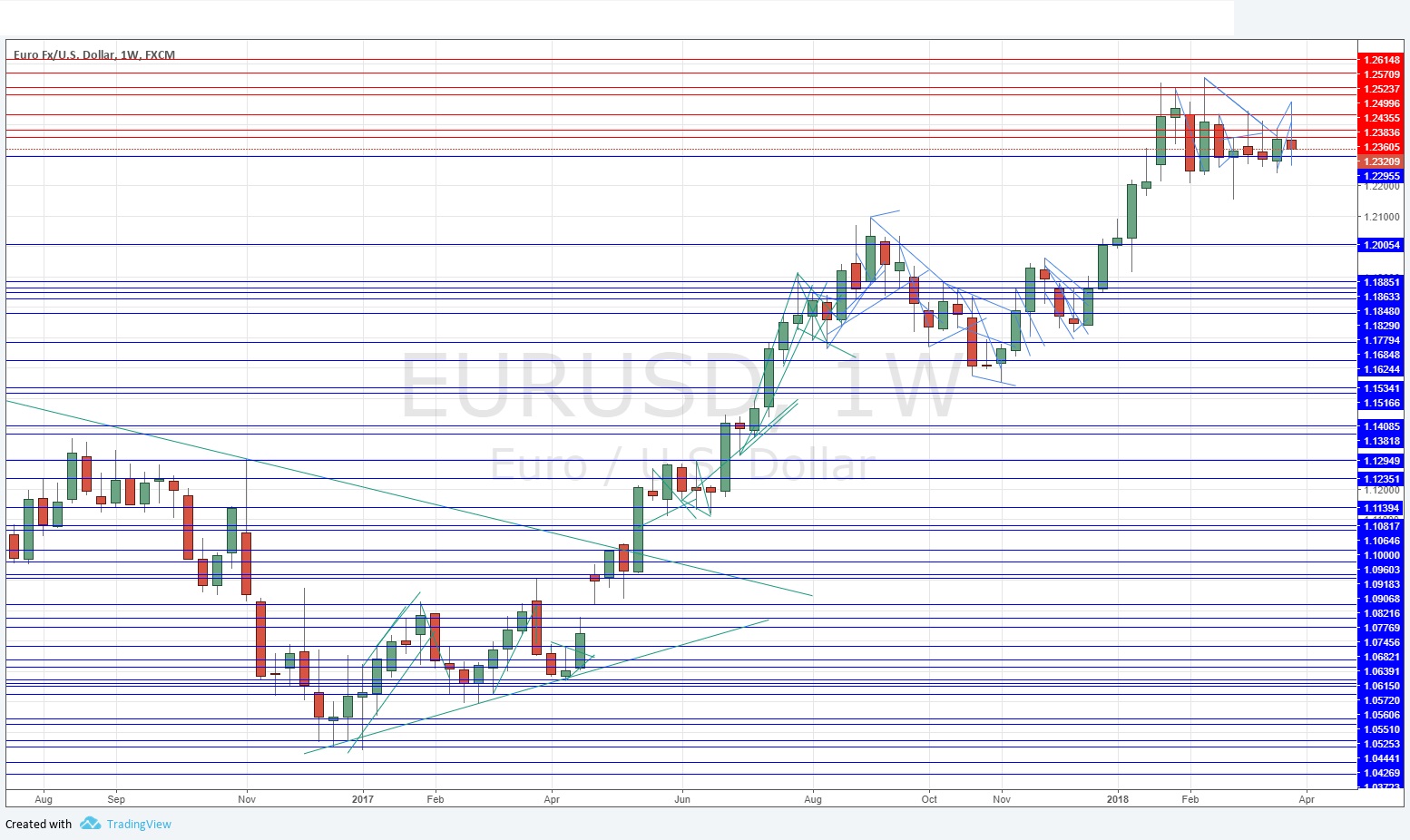

EUR/USD

It is the same story here as with the GBP/USD currency pair. The price consolidates below the psychologically key 1.2500 price area, looking increasingly bearish, or at best consolidative. The weekly candle is arguably even more bearish than that shown previously for the GBP/USD currency pair, being a pin candlestick.

S&P 500 Index

I just wanted to take a quick look at the U.S. stock market’s major index, so we can see that the stock market is looking dangerous and increasingly bearish. The moving average shown in the daily chart below is the 200-day simple moving average. However, last week’s price action was at least a little bullish, with the weekly candlestick being a bullish near-doji. However, the price remains heavy and close to the moving average, which should be worrying for bulls.

Conclusion

I cannot make any calls this week as the market looks very uncertain everywhere I look. The Non-Farm Payroll data cycle towards the end of the week may produce more directional clarity, so it may be a good idea to stand aside until at least Wednesday.