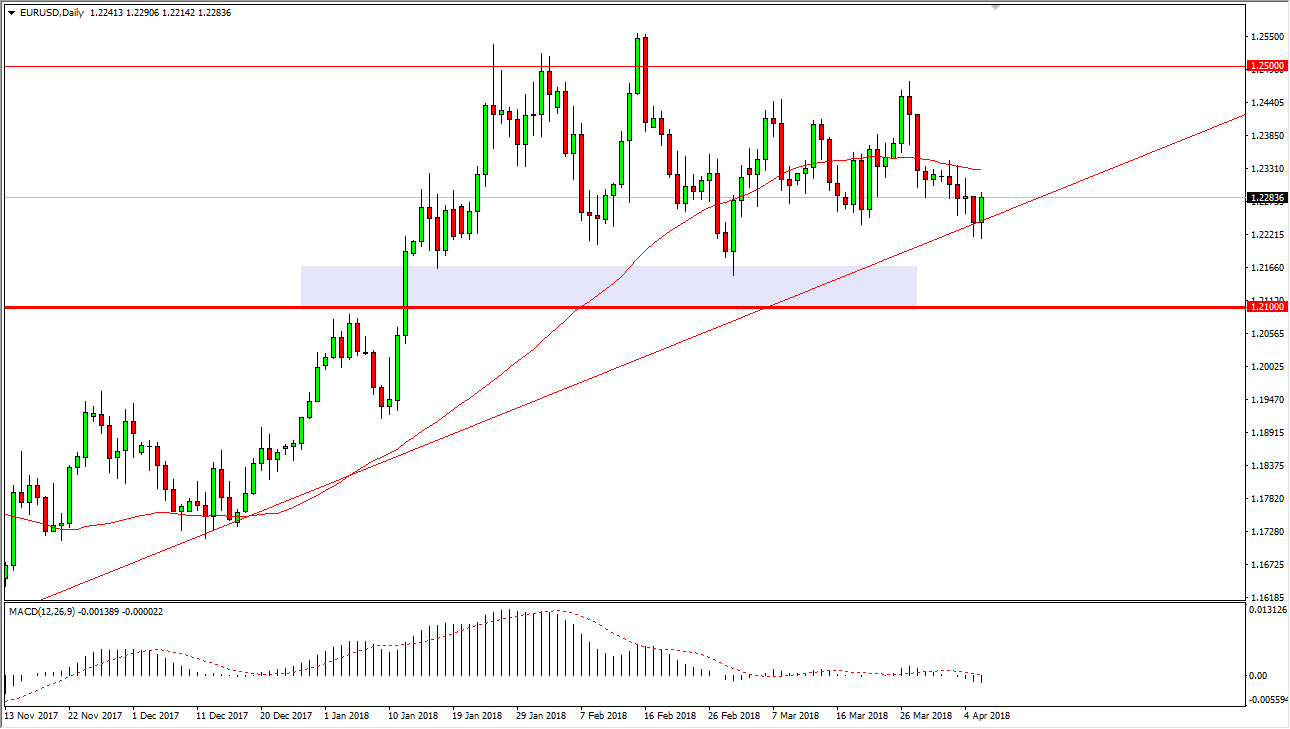

EUR/USD

The EUR/USD pair initially fell on Friday again, but found enough support based upon the daily uptrend line that we have been paying attention to for some time. I believe that the market should continue to go higher, and if the reaction on Friday is any indication, it’s likely that we will continue to see the market reach towards the 1.24 handle. The uptrend line being broken either to the downside or broken through would probably send this market into more consolidation, and I’m not interested in shorting this market until we get down below the 1.21 level. That’s an area being broken to the downside would send a lot of sellers into the market. However, it looks much more likely to see a continuation of the upward pressure, with the 1.25 level above being a target. If we can finally break above there, the market should then continue to go much higher.

GBP/USD

The British pound has rallied during the trading on Friday as well, showing signs of life at the 1.40 level and the 50-day EMA. I believe that the market should continue to reach towards the 1.43 level above, which is a major resistance barrier. Ultimately, the market has the uptrend still intact, and the British pound seems to be strengthening overall. Pullbacks of this point should be buying opportunities, and I think that the 1.38 level underneath should be a target if you break down. The uptrend line underneath should continue to keep this market going higher over the longer term, but I think that the buyers will be very aggressive underneath, and I think eventually breaking above the 1.43 level should send this market looking towards the next psychological barrier, the 1.45 handle.