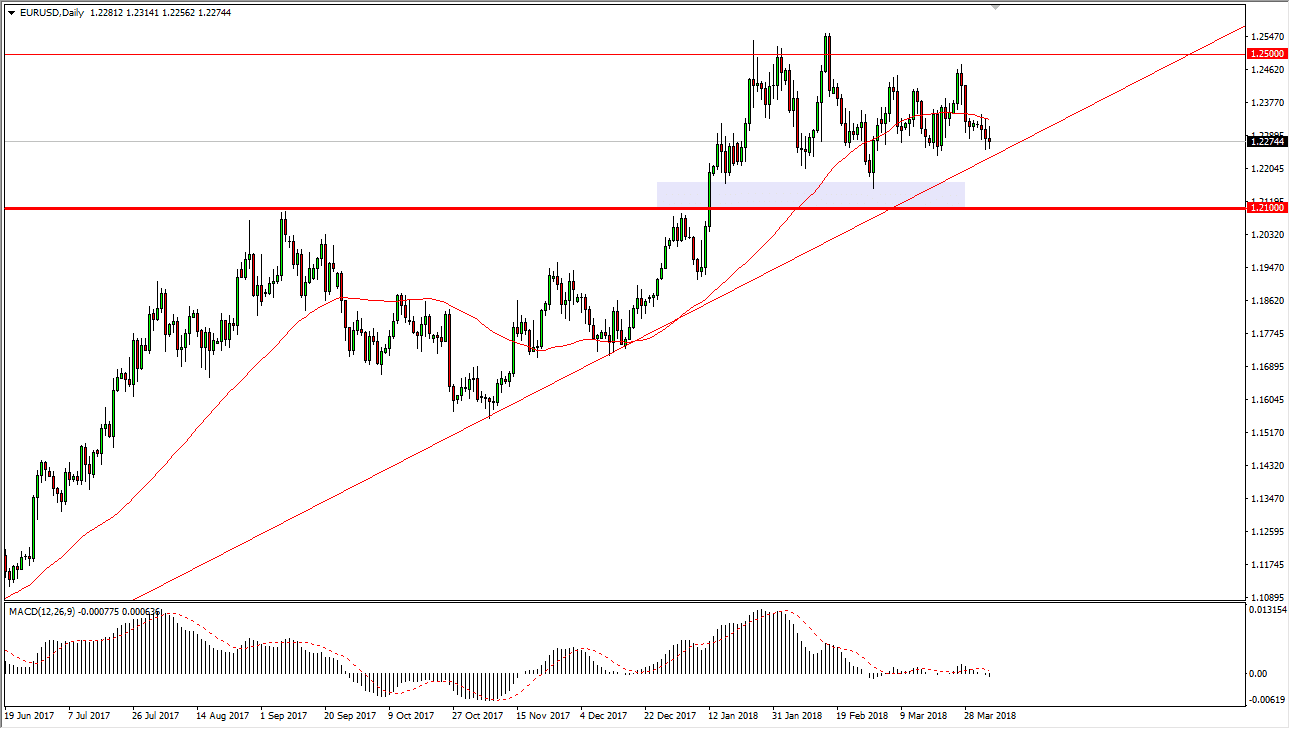

EUR/USD

The Euro went back and forth during the trading session on Wednesday, as we continue to be very noisy. The uptrend line is within reach now, and I think with the jobs number coming out tomorrow, it’s likely that we may get some type of decision as to where to go next. Because of this, I suspect that the Thursday trading session is going to be relatively uneventful, but I think that once we get the jobs number on Friday, we could see a significant move. If we break down below the uptrend line, the market could unwind to the 1.21 handle underneath. Otherwise, if we can break higher I think that we would eventually go to the 1.25 level over the longer term. I recognize that this market is very volatile, but we are still in an uptrend, regardless of what we’ve seen over the last couple of weeks.

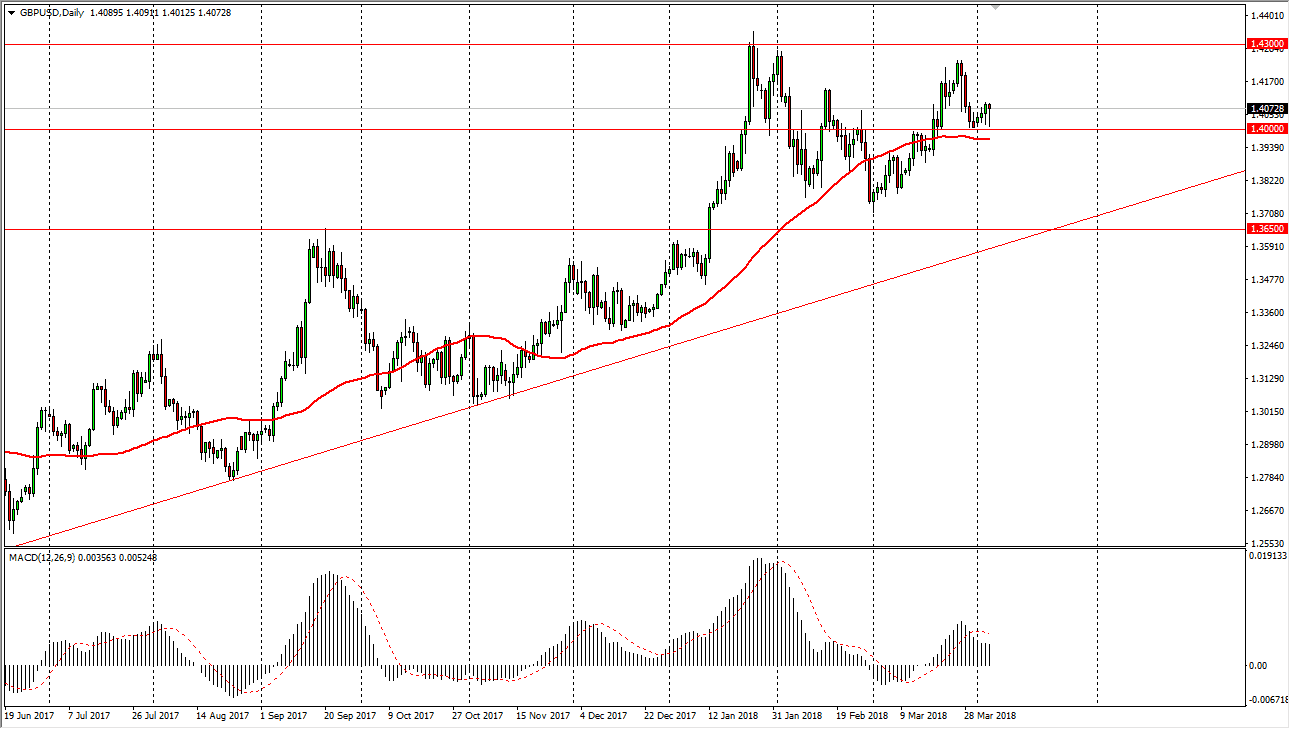

GBP/USD

The British pound initially fell during the trading session on Wednesday, reaching down to the 1.40 level. This is an area that is psychologically important, as well as structurally important. The 50 day EMA sitting just below there is very supportive as well. The fact that we are forming a hammer for the day on Wednesday is a very strong sign for Thursday, and I think that longer-term we will probably go aiming towards the 1.43 level. The alternate scenario of course is that we can break down below the 50 EMA, which of course would be negative as well. At that point, I would anticipate that the market could go down to the 1.38 level. I do believe that we are trying to build up the necessary momentum to finally have that major breakout that we’ve been waiting for.