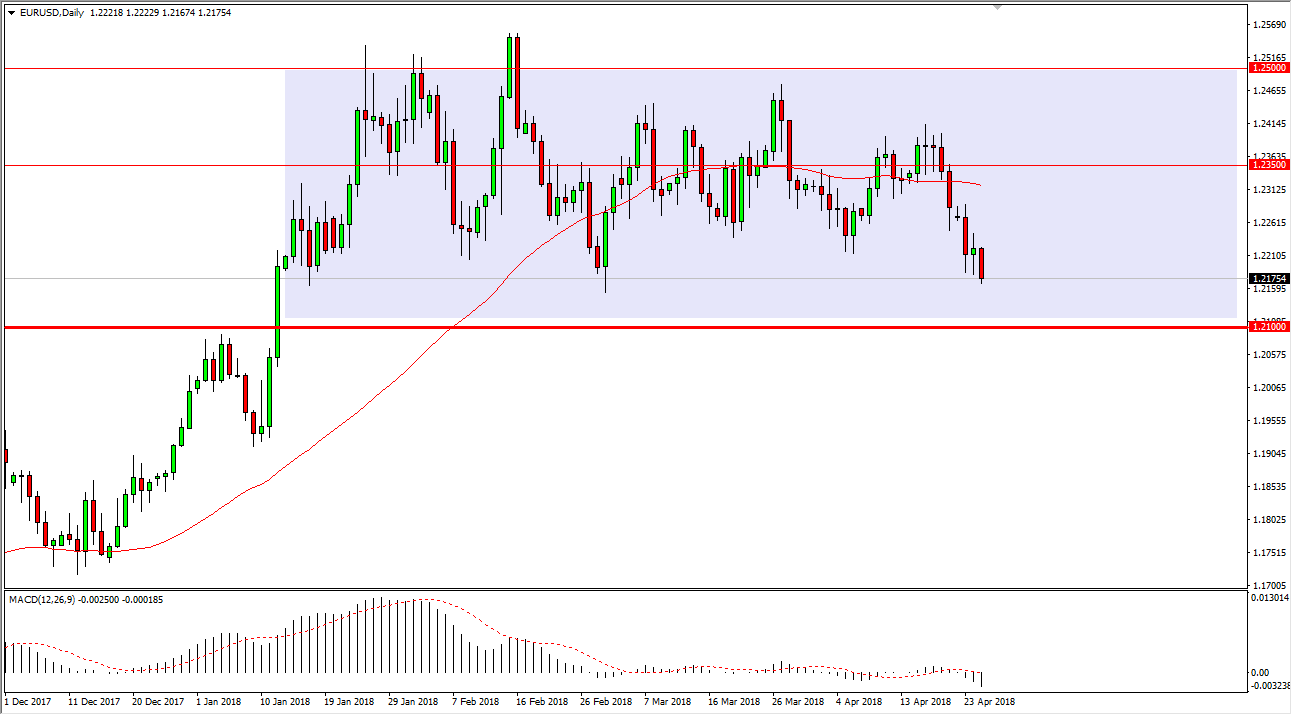

EUR/USD

The EUR/USD pair broke down during training on Wednesday, as we broke down below the bottom of the range for the session on Tuesday. It looks like we are going to try to continue to go lower, but I think there is a massive amount of support underneath extending down to the 1.21 level. That is an area that is previous resistance, and I think it should show plenty of support going forward. I think that we will find buyers looking to take advantage of this dip, but in the short term it makes sense that we will probably continue to see a bit of pressure. However, pay attention to the 10-year treasury market, as rising yields continue to make the dollar attractive in general. A breakdown below the 1.21 handle sends this market looking to much lower levels. Otherwise, we will probably stay in the consolidation that we have been in 4 months.

GBP/USD

The British pound fell during the trading session against the US dollar as well, and for many of the same reasons, namely higher interest rates in the US. However, this market has massive amounts of support underneath, especially with the daily uptrend line that you see on the chart. We are below the 50-day EMA, while the 200-day EMA underneath should offer support as it is near the uptrend line, showing a couple of reasons to get bullish in that area. I think that the 1.3650 level is the absolute “floor” overall, so if we were to break down below that level, this market would unwind rapidly. Otherwise, I think it’s only a matter of time before the buyers get involved. However, right now it does not look as if the market is ready to around. A supportive daily candle is needed to start putting money to work though.