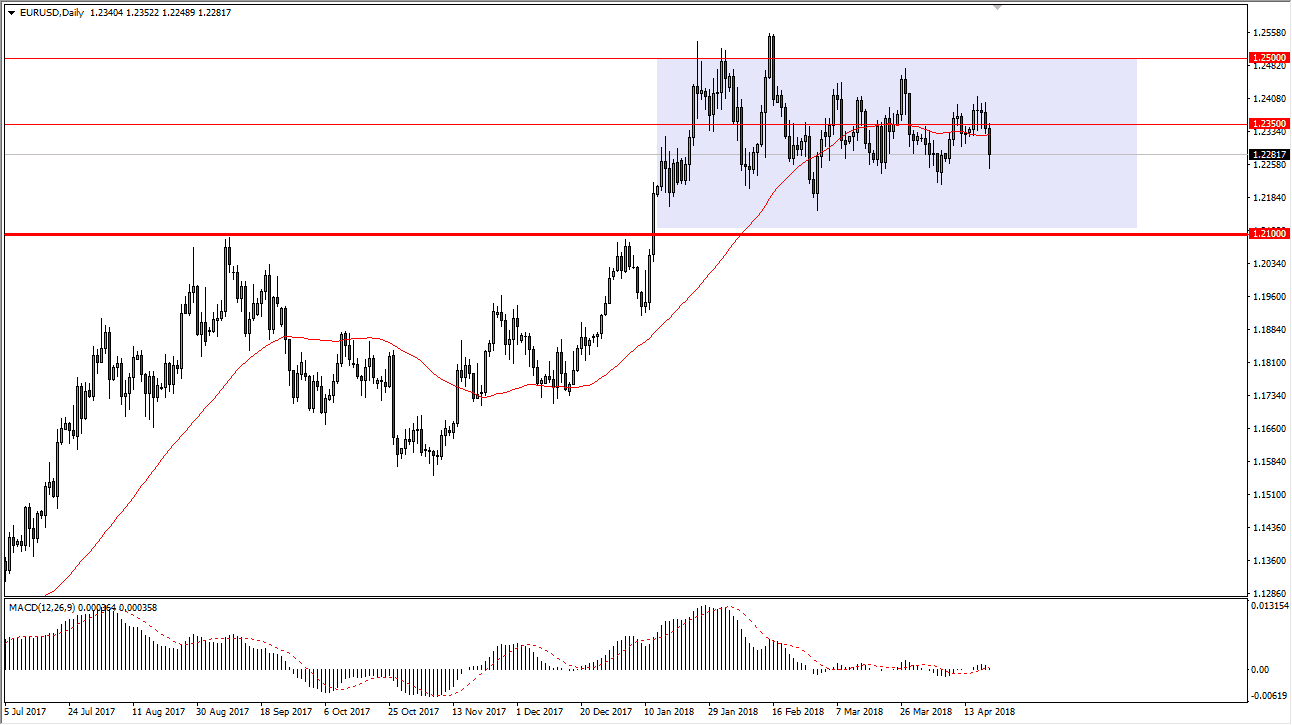

EUR/USD

The EUR/USD pair fell during the trading session on Friday, reaching down towards the 1.2250 level, before bouncing a bit at the end of the day. The market is in overall consolidation, and it just doesn’t show much in the way of breaking out or down from here. Beyond that, we have an even larger consolidation area that starts at the 1.21 handle underneath and extends to the 1.25 level above. If we can break above the 1.25 handle, the market is likely to go much higher, perhaps fulfilling the suggested move to 1.32 based upon the bullish flag that had been broken above on the weekly chart. In the meantime, I think we will continue to go back and forth with the 1.2350 level being a bit of a fulcrum for price. Short-term back and forth trading is probably about as good as this pair gets right now.

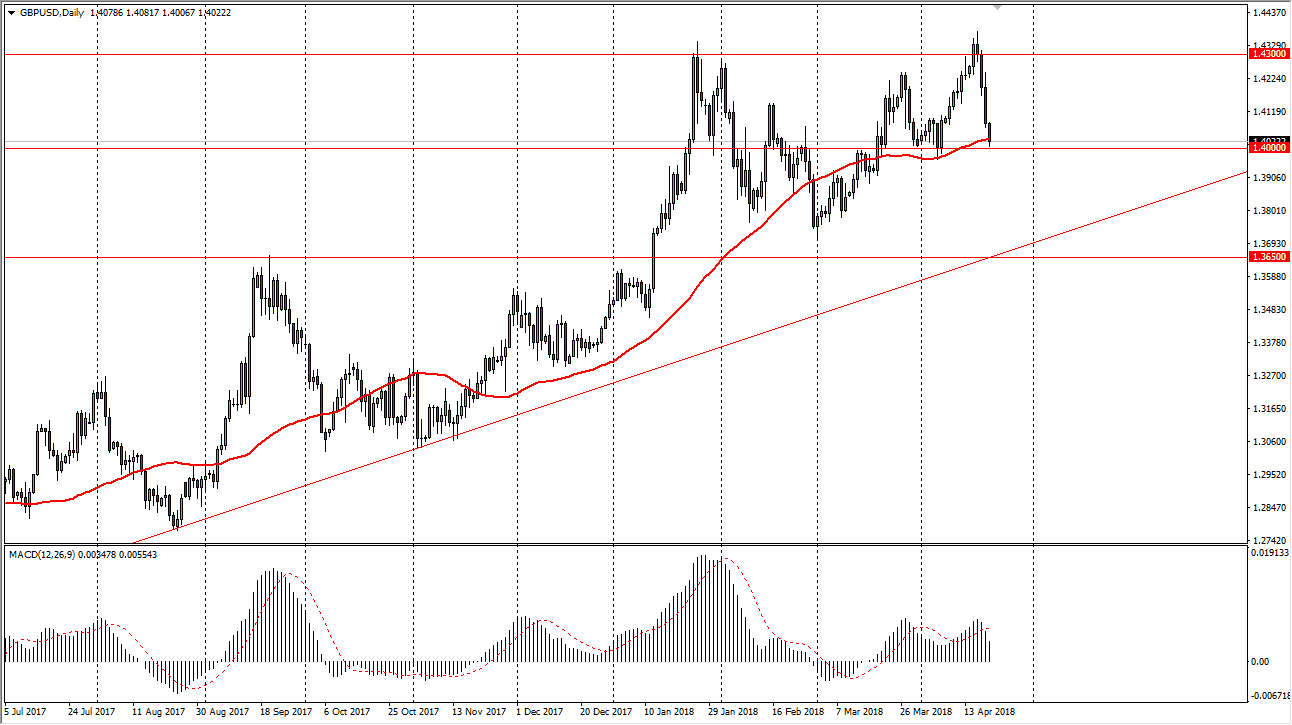

GBP/USD

The British pound fell during the day on Friday, breaking through the 50-day exponential moving average. We are testing the 1.40 level, an area that of course is not only psychologically important, but structurally important as we have seen over the last several sessions. If we were to break down below the 1.40 level, it’s likely that the market will go looking towards the 1.38 handle. We also have an uptrend line just below, so I think that the buyers will continue to get involved based upon value. In fact, I look at pullbacks as an opportunity to pick up the British pound “on the cheap”, and that the reaction to comments from Mark Carney were a bit overdone. However, I need to see some type of supportive candle or a bounce to start buying.