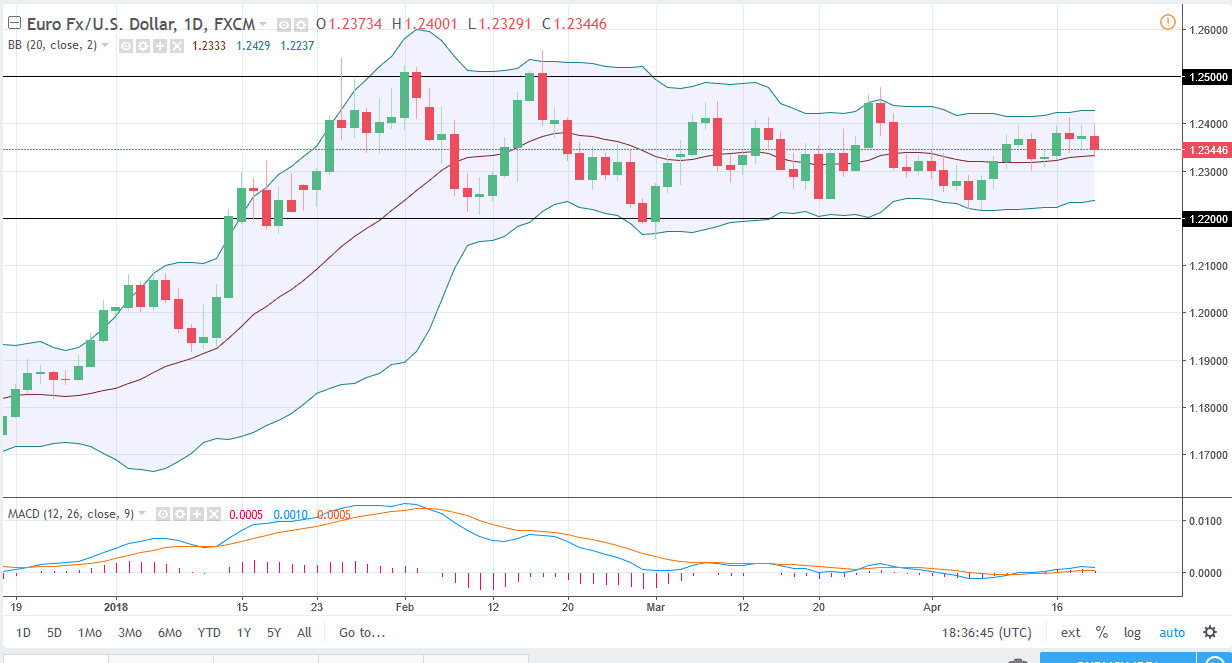

EUR/USD

The Euro initially rallied on Thursday but found the 1.24 level to be a bit too resistive again. The market also seems to have a certain amount of support at the 1.23 level, as we have been in a tight range over the last several sessions. I don’t see anything changing this in the short term, and beyond that, I see a larger consolidation area with the 1.22 level as support, and the 1.25 level as resistance. The market should continue to be very noisy, and essentially sideways more than anything else. I would not be too much money into the market, but I would look at it is a potential range bound system area, an area that you can take advantage of its clarity in borders. If we do breakout of the 300 pips range, that could lead to a much more significant move. In the meantime, I don’t expect much other than quick back and forth trades.

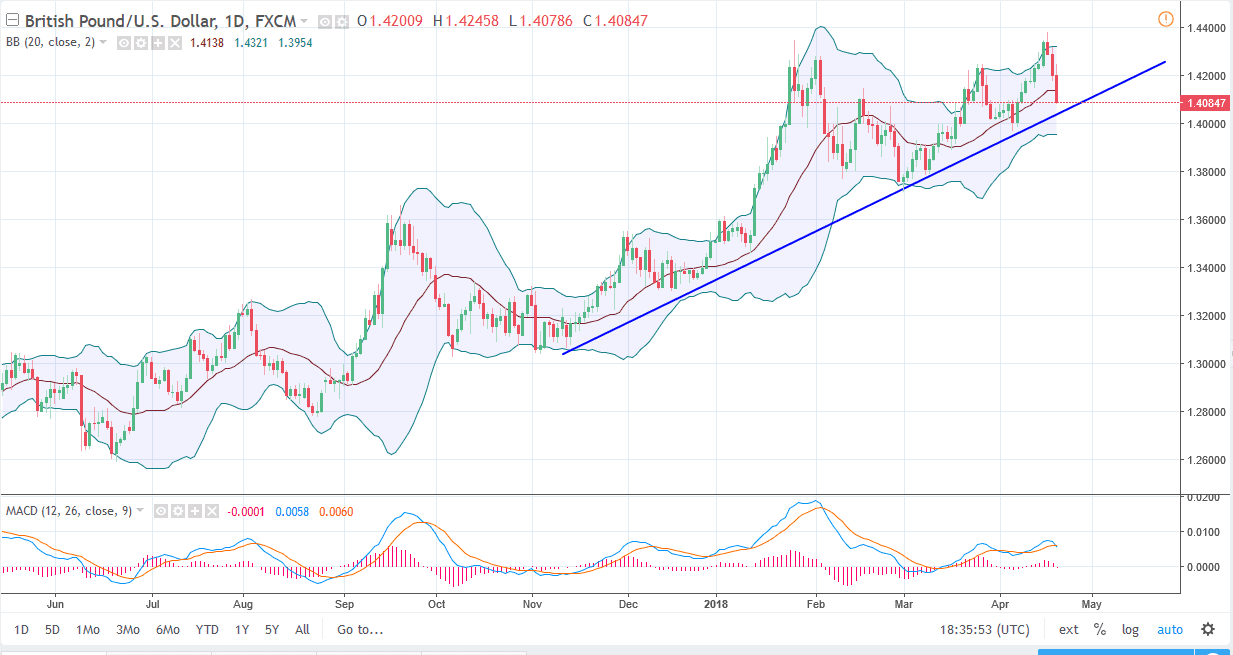

GBP/USD

The British pound was doing quite well but words coming out of the Bank of England today suggested that perhaps there were interest rate hikes coming but the timeframe for these interest rate hikes weren’t necessarily set in stone. In other words, the timing is going to be very difficult to gauge, and it’s possible that the market may gotten ahead of itself. Because of this, I’m now paying attention to the uptrend line just below, and I think that if we break down below it, we will probably drift a bit lower, perhaps to the 1.38 level before another uptrend line would come into play. I still believe that we go higher over the longer term, but certainly the market needs to catch his breath after the sudden panic on Thursday.