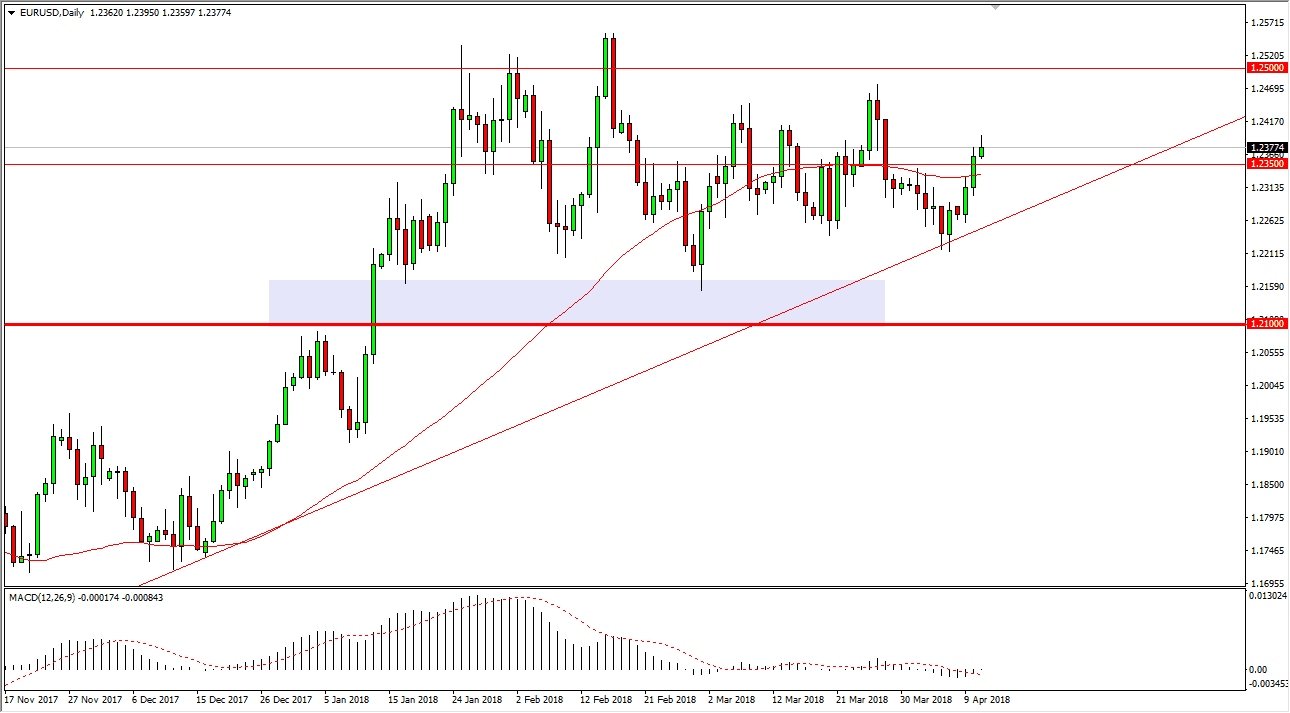

EUR/USD

The EUR/USD pair rallied initially during trading on Wednesday but found enough resistance above to roll over and form a bit of a shooting star. The shooting star slithers above the 1.2350 level, an area that has been both support and resistance recently. We also have the 50-day EMA just below, so that of course could have a bit of an effect on the market. Market participants continue to be rattled by talks of a trade war, but I think it’s unlikely to happen. However, the fact that we formed a shooting star suggests that we could get a pullback. I like the daily uptrend line just below though, as it shows signs of resiliency and it’s not until we break down below there that I would be a seller. If we can break above the top of the shooting star, that would be a very bullish sign, perhaps sending this market towards the 1.2450 level.

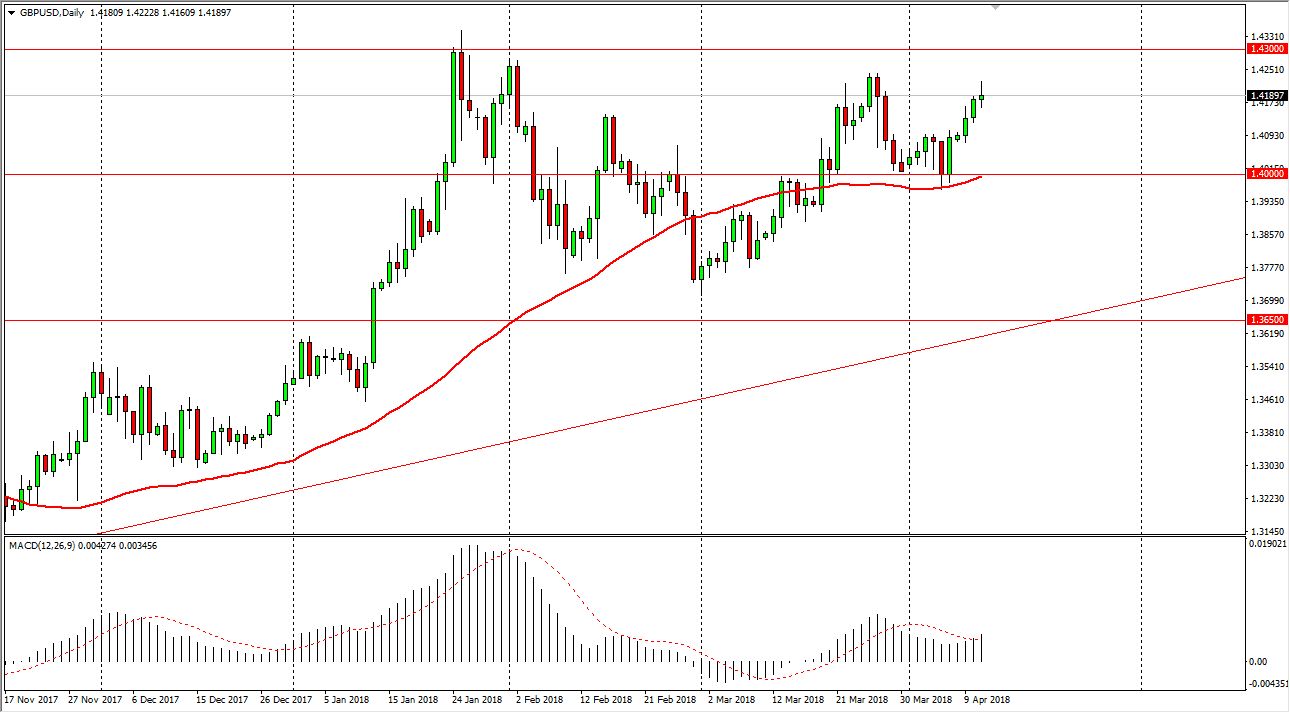

GBP/USD

The British pound has been noisy during trading on Wednesday as well, ultimately settling for a bit of a shooting star. It looks as if the 1.42 level is going to continue to offer resistance, but if we break down below the bottom of the shooting star for the Wednesday session, I’m not looking for a major pull back, I think that we will simply go looking for value underneath. I believe that the 1.40 level underneath is support, not only based upon the large round number, but the structural support that we have seen previously. We also have the 50-day EMA just below, so I think there are plenty of reasons to think that the 1.40 level will act as a “floor” in the short term. Longer-term, if we can break above the 1.43 level the market is likely to go to the 1.45 handle.