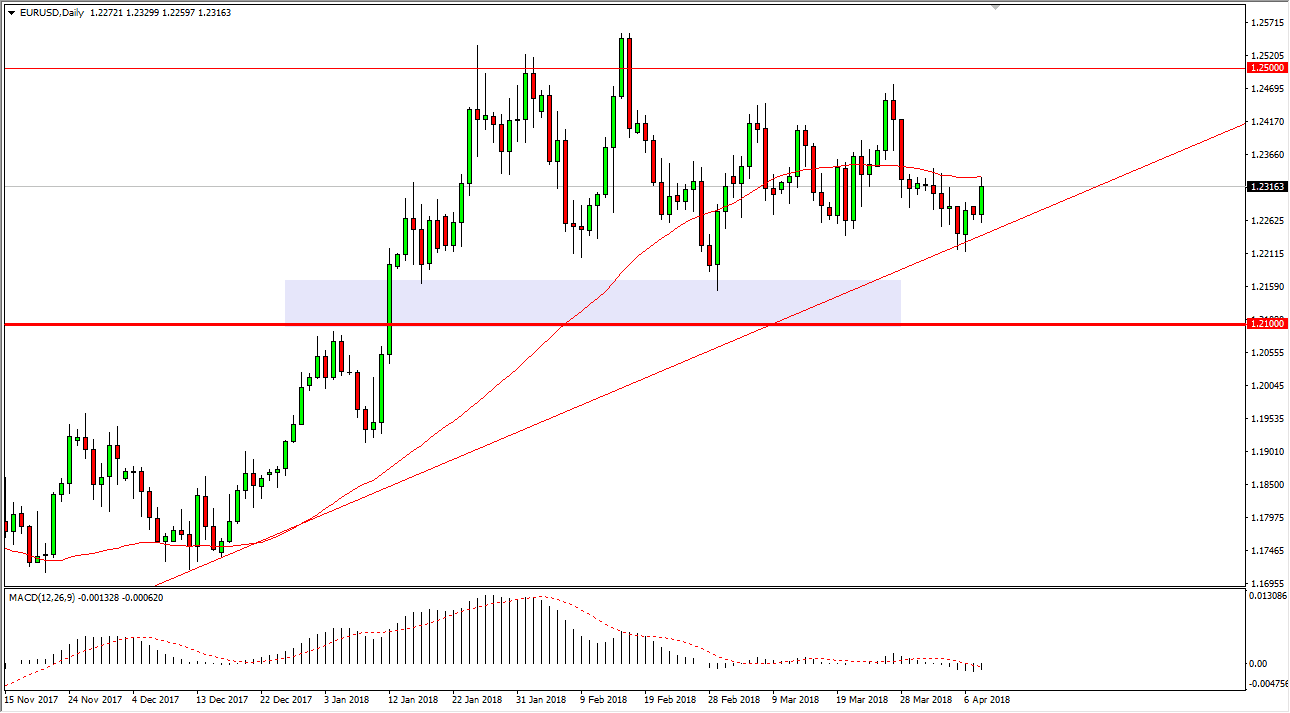

EUR/USD

The EUR/USD pair had a positive session on Monday as trade war fears had abated a bit, driving the stock markets higher and bringing out more risk appetite. That is generally good for this pair, and the daily uptrend line holding of course helps as well. The 50-day EMA is offering dynamic resistance, but I think if we can break above there, the market is likely to go looking towards the 1.2450 level. After that, we have a significant amount of resistance at the 1.25 level as well, which has proven itself important more than once. If we can break above there, then the market should go to the 1.32 level above. In the short term, I think that every time we pull back, there will be value hunters coming back into this market. The uptrend line has held, which is a very strong technical signal.

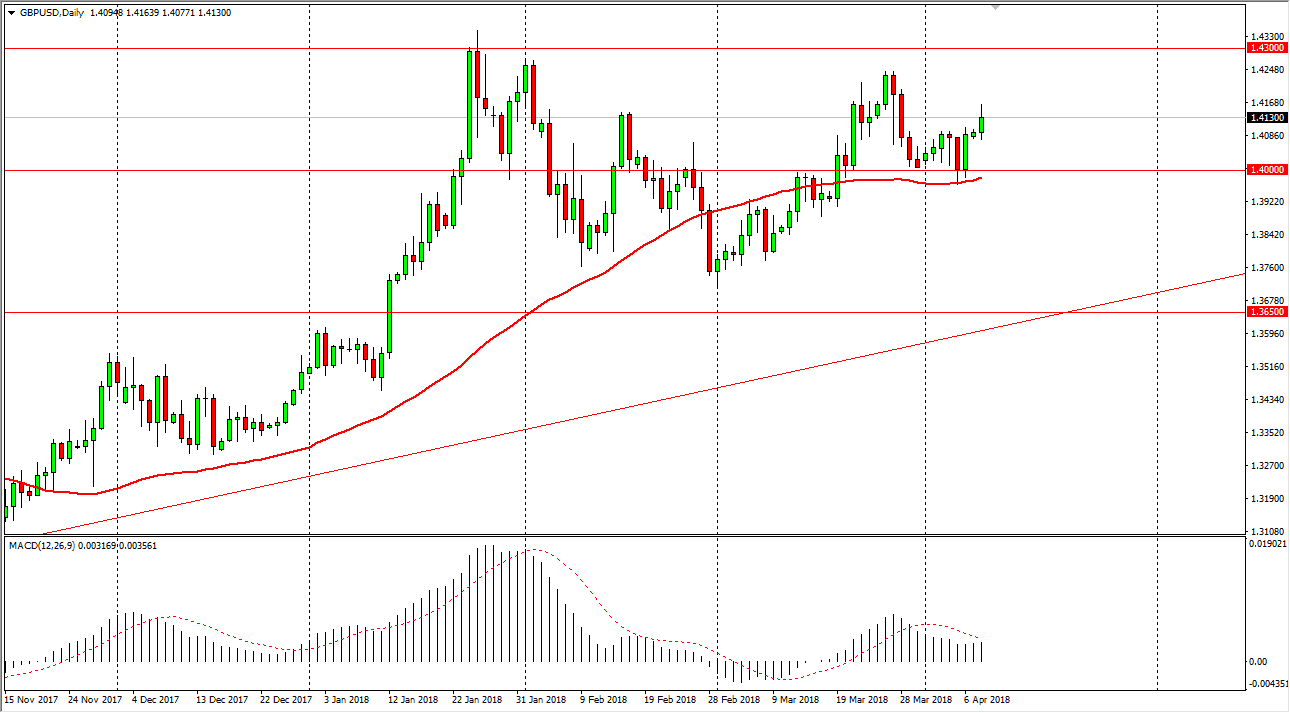

GBP/USD

The British pound rallied a bit during the trading session on Monday, breaking above the 1.4150 level at one point. The market should continue to go higher over the longer term, but I think that short-term pullbacks should offer buying opportunities, as the uptrend line is well below, and the 50-day EMA continues to sit just below recent pricing. I believe that the 1.43 level above is massive resistance, but I think the given enough time we will see buyers come into this market break above there, reaching towards the 1.45 level above that which is significant resistance. I believe that we will continue to have a “buy the dips” mentality in this market, especially when we have good headlines coming out of the potential of a trade war. This is a risk sensitive pair and will continue to go higher if stock markets also rally.