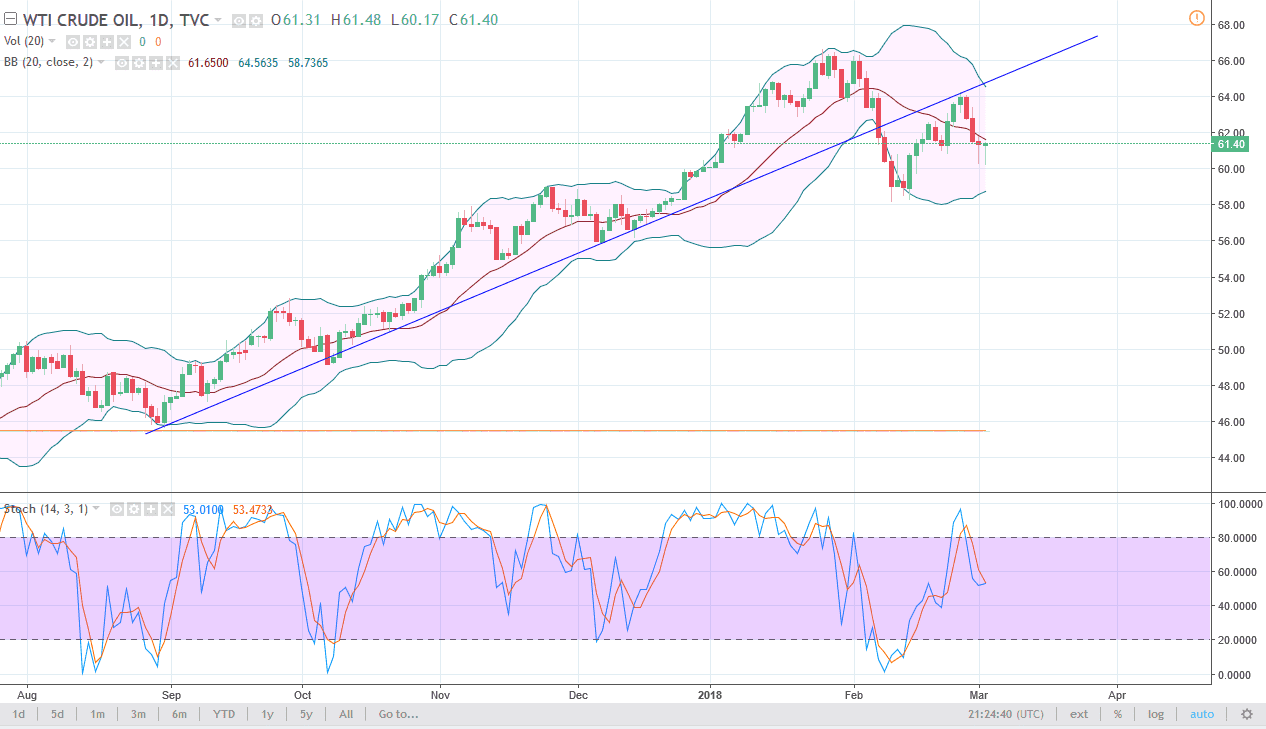

WTI Crude Oil

The WTI Crude Oil market initially fell on Friday, but just as we had seen on Thursday, buyers came in just above the $60 handle. While the market looks very negative at one point during the day, it obviously turned around as we close slightly higher. Ultimately, I think if we can break above the $62 level, the market could very well go looking towards the $64 level above. The previous uptrend line being broken to the downside is negative obviously, so it’s not until we break above that uptrend line that I would be bullish again. If we break down below the bottom of the hammer from both the Thursday and Friday session, the market will certainly unwind at that point, reaching down to at least the $58 level, if not lower levels.

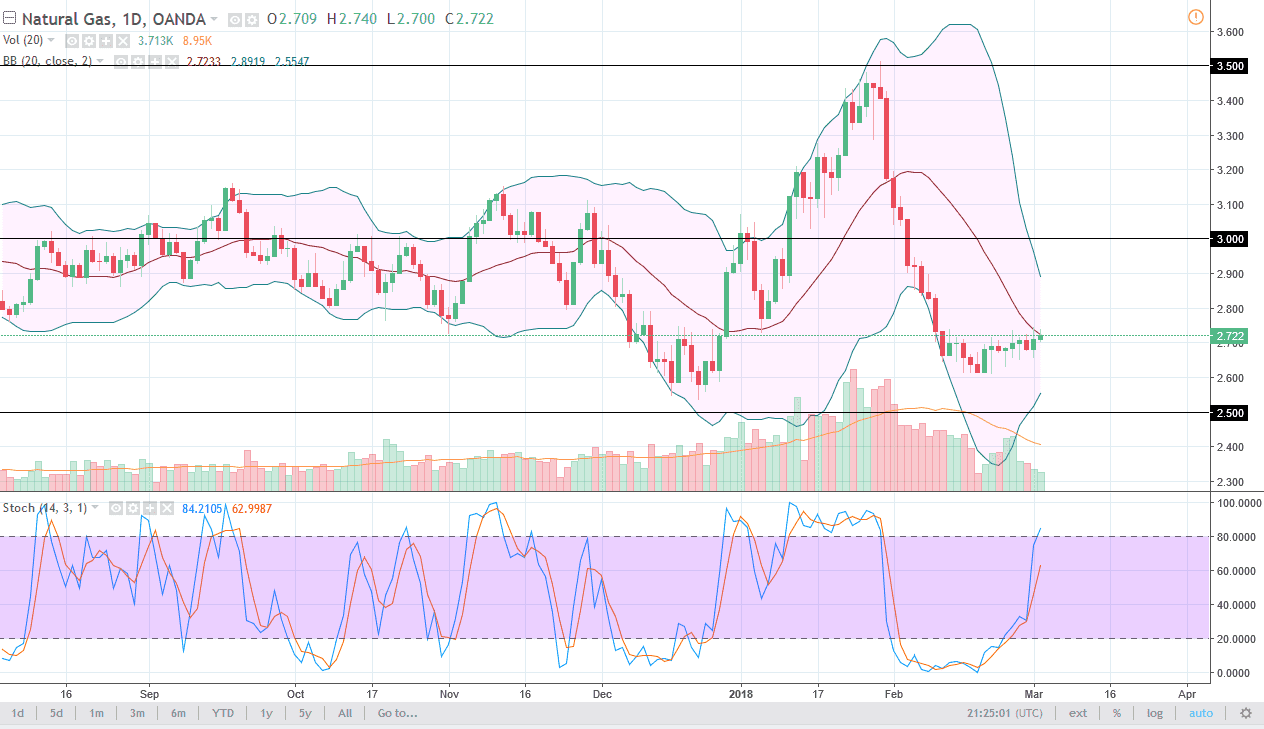

Natural Gas

The natural gas markets continue to do very little, grinding slightly higher by the end of the session. I believe that the market will eventually find a reason to rally, if nothing else because of a “short covering rally.” I believe that the market will eventually find reasons to sell off, not the least of which is going to be a massive oversupply of natural gas. I think that as we exit the coldest part of the year in the United States, demand will drop, thereby driving the price lower again. I look at rallies as selling opportunities, but also recognize that short-term traders may prefer to go back and forth in a scalping type of system, but for myself, I prefer to sell on rallies as it produces a larger move. The problem of course is being patient enough to see the market rally high enough for me to be a short seller.