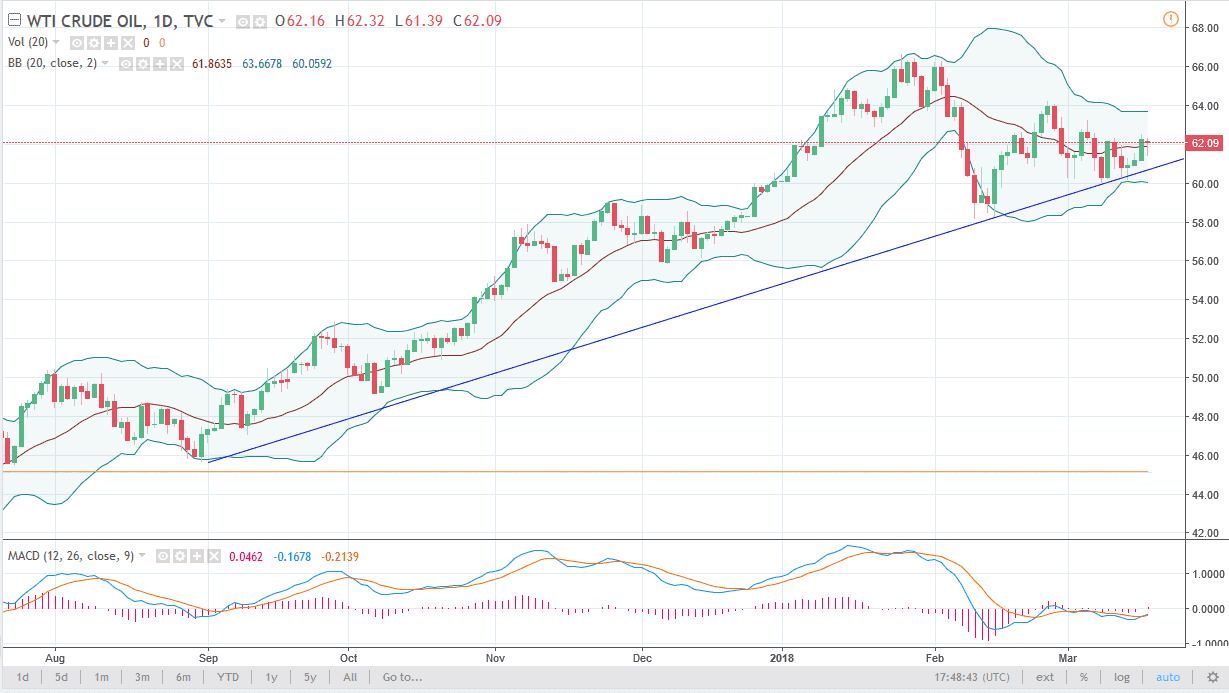

WTI Crude Oil

The WTI Crude Oil market was very noisy during trading on Monday, initially dipping lower, but as you can see we are found buyers. The daily candle is starting to form a significant hammer, and that of course is a bullish sign. I think that the $63 level will be targeted, and if we can break above there, then the market is free to go much higher. However, there’s also the uptrend line just below that continues to push the market higher as well. So, with this in mind, I’m a buyer on dips in short-term bursts, not much more than that. Longer-term, I think we do break down but it’s obviously going to take some work to do that. The next couple of weeks will be crucial in this market and could be influential going months into the future.

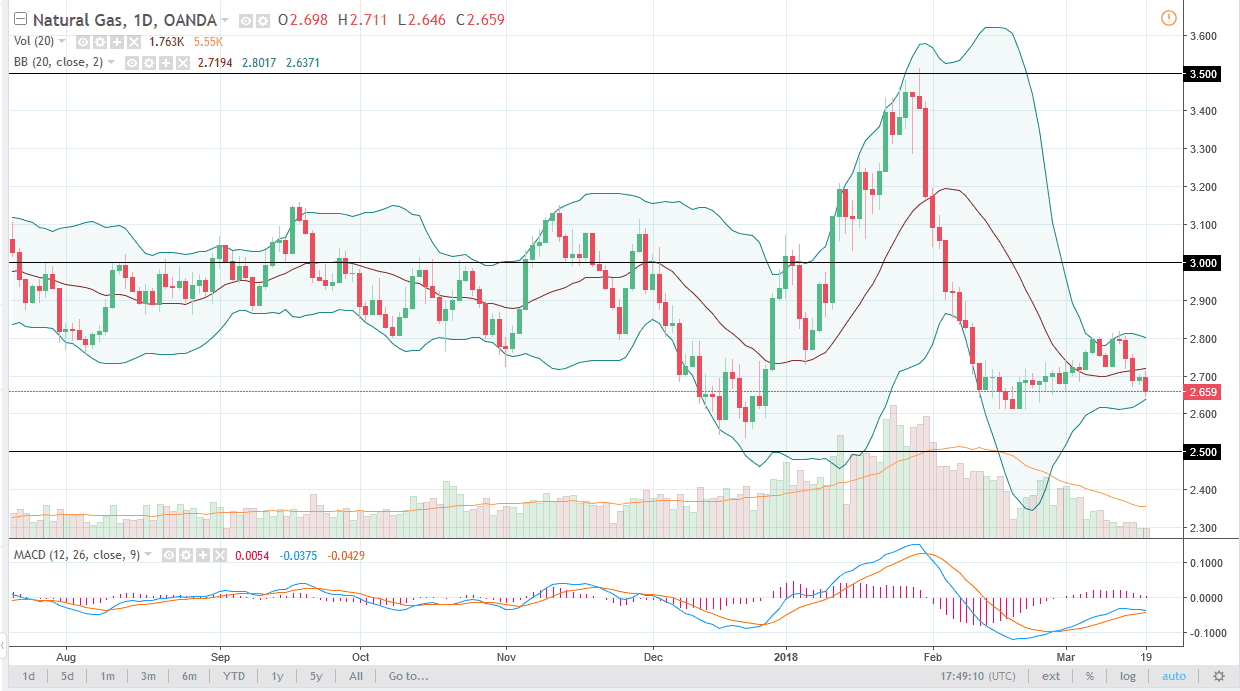

Natural Gas

Natural gas markets sold off significantly during Monday trading, and lost roughly 1.5%. The market continues to target the $2.60 level underneath, which is the beginning of significant support down to the $2.50 level. I think at this point it’s easier to sell rallies that it is to sell right now, as selling into support is a great way to lose money. I think that the $2.80 level has shown just how resistive it is, so a move towards that area for signs of exhaustion could be and I selling opportunity. Even if we broke above there, I’d be more than willing to sell near the $3.00 level above, which I think is going to be massive resistance. If we did breakdown below the $2.50 level, that would be extraordinarily bearish and probably send in fresh new sellers into this market. I have no interest in buying natural gas anytime soon.