WTI Crude Oil

The WTI Crude Oil market has gone back and forth during the session on Thursday, but most importantly, we have seen support just above the $60 level. The resulting candle is a bit of a hammer, and if we can break above the top of this hammer, the market could go to the $64 level above. I think that the $65 level above is even more resistive as it is where the previous uptrend line coincides with a price. I ultimately believe that the market will find sellers, especially considering that the Americans are pumping out so much supply. The US dollar strengthening will also work against the oil market if it continues. If we break down below the bottom of the hammer, that is a selling opportunity just below the $60 handle. If we get some type of rally and see exhaustion, that is a selling opportunity as well. However, I believe the next 24 hours could have the potential for a small rally.

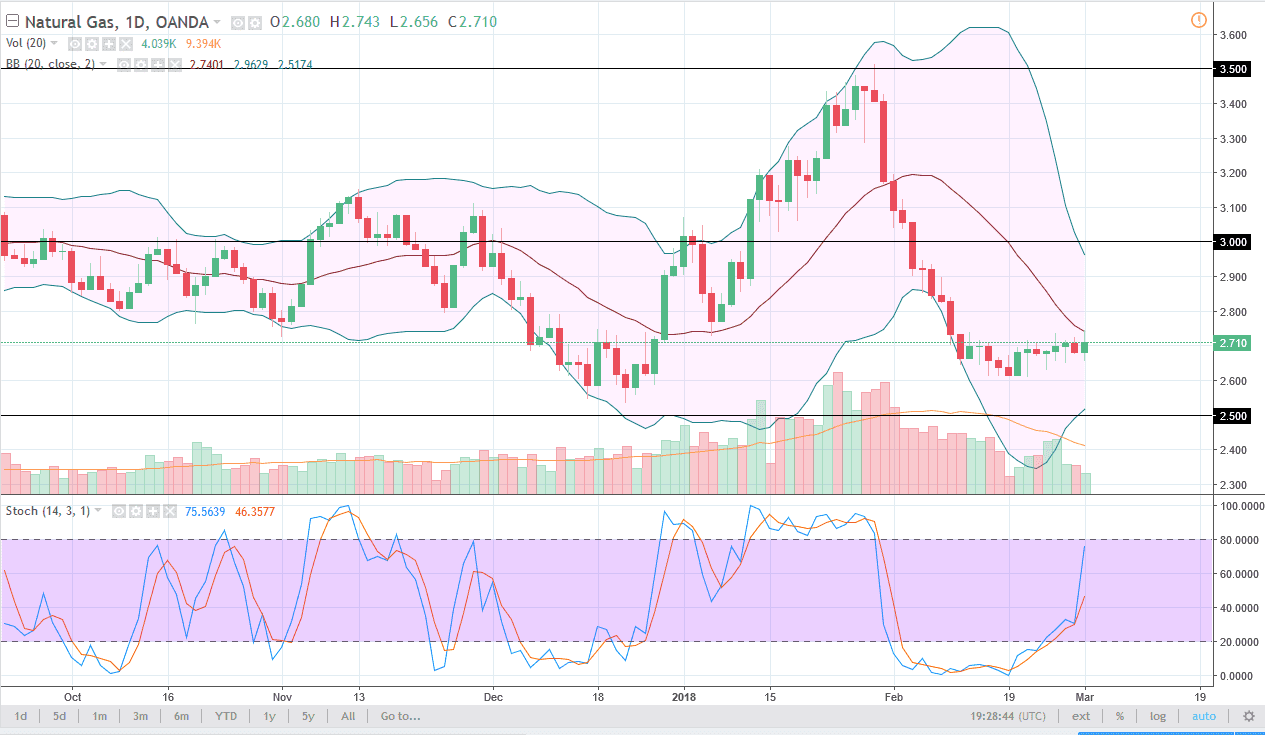

Natural Gas

natural gas markets went back and forth during the day as well, settling on a 1% gain. In a market that is beaten-down as natural gas is, it’s significant that we haven’t fallen any further. When you look at the last week or so, you can see that we have been hovering just below the $2.70 level. I think that we will eventually rally, if nothing else because of a “short covering rally”, reaching towards the $3 level. I think that the $3 level is an area where you should see a lot of selling. I’m looking for a rally that I can continue to short, as I believe that the oversupply of natural gas will continue to be a major issue, as the Americans have more than they know what to do with.