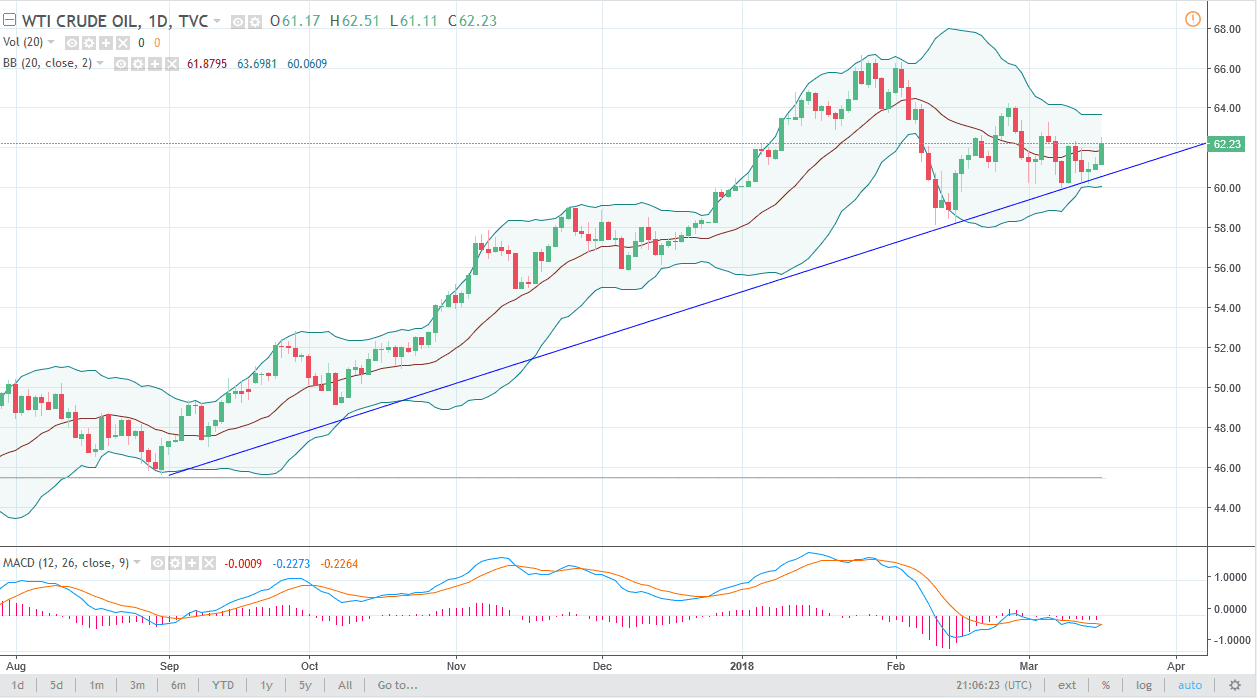

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Friday, gaining 1.77% by the time the futures markets closed. This shows that there is significant support based upon the trendline on the daily chart, and it has held true during Friday. It looks as if the market is going to try to break out to the upside, but I think the $63 level will offer resistance. Beyond that, the next target would be $64, and then $66. If we were to turn around and break down below the uptrend line, that would be very negative, and it could send this market lower. This would be especially true if we break down below the $60 level, because it would not only be a breakdown of an uptrend line but would also be a breakdown of horizontal support. This would open the door to $58 immediately.

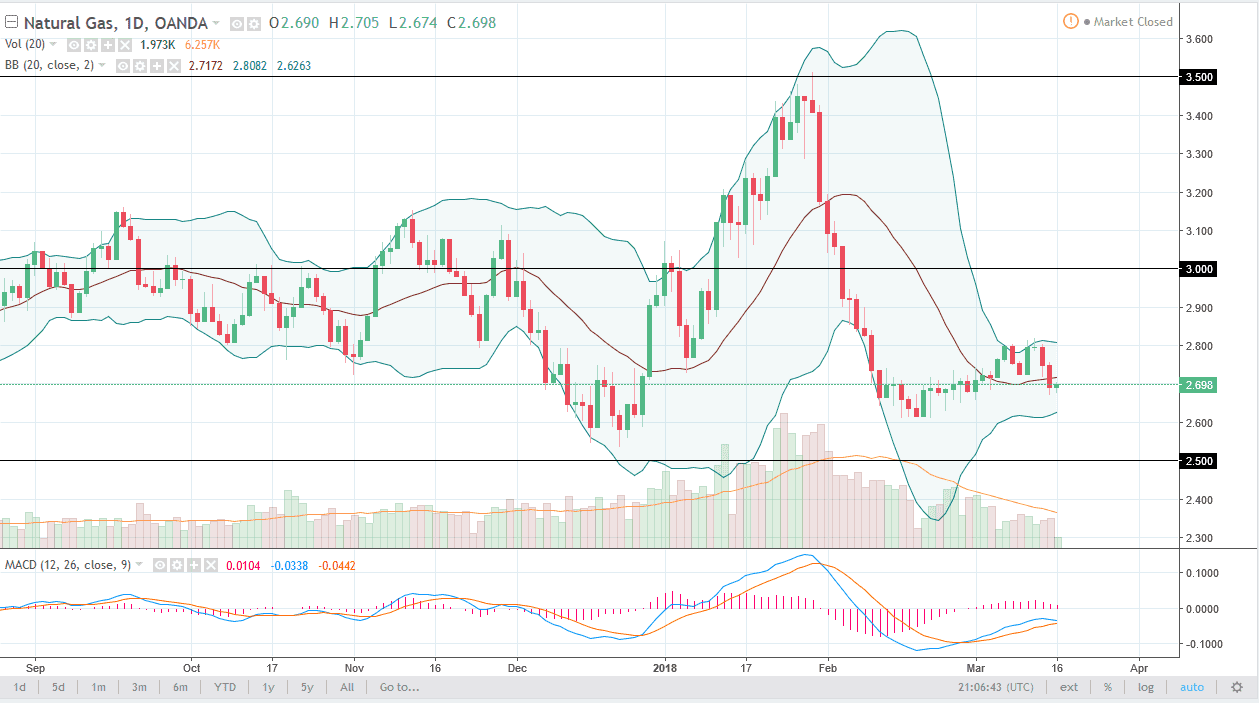

Natural Gas

Natural gas markets initially fell during trading on Friday but bounced enough to show signs of life again. Natural gas markets have been beaten down rather significantly over the last several weeks, so little bit of a bounce after a couple of days of selling isn’t a huge surprise. Because of that, I think that we could get a short bounce, but I think that there is plenty of resistance near the $2.80 level. Breaking above there could open the door to the $3.00 level, which is obviously a large, round, psychologically significant number. Alternately, if we break down below the lows of the Thursday session, I think it opens the door to the $2.60 level next. I recognize that there is a significant amount of support between $2.50 underneath, and the previously mentioned $2.60 level. Because of this, I am not expecting a massive breakdown.