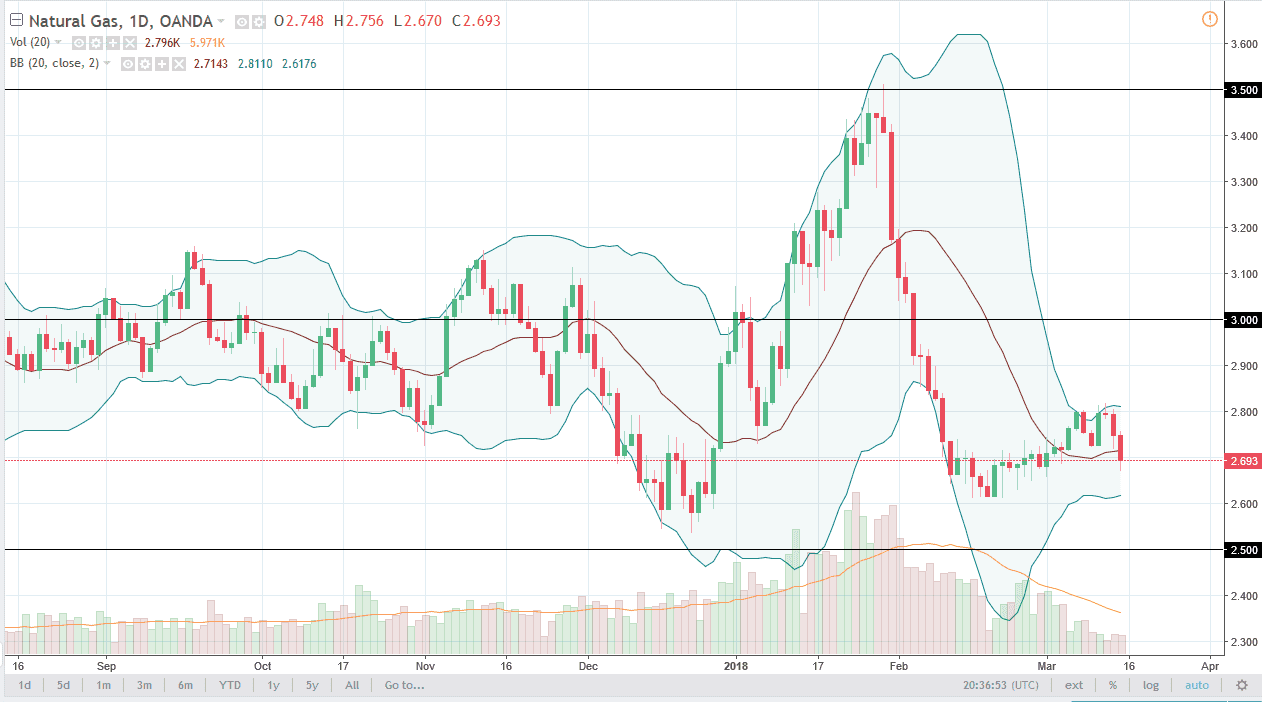

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Thursday but has rolled over a bit to show signs of lackluster behavior. I think that the uptrend line underneath it will continue to be supportive, and I also look at the $60 level underneath as being support also. If we break down through both of those levels, I think then we go lower, initially the $58 level, and then possibly even lower than that. Alternately, if we break above the $62 level, the market probably goes looking towards $64 next. We have been in an uptrend for some time, but I think things are starting to change. The next couple of sessions could be very difficult, so keep that in mind. I would not jump into this market to rapidly, waiting for a daily close either above or below those levels to take advantage of.

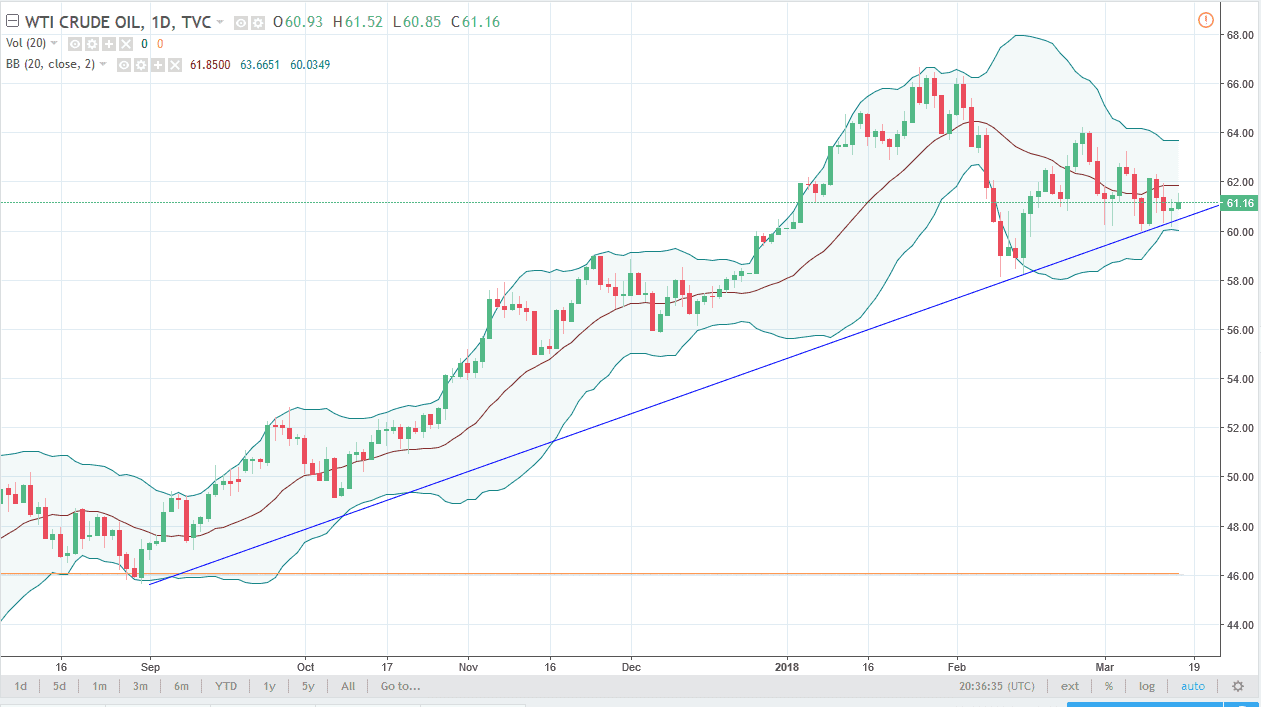

Natural Gas

Natural gas markets fell significantly during the trading session on Thursday, reaching down below the $2.70 level. There is a certain amount of noise underneath that could cause a bit of support, but I think the massive selloff and of course the less than bullish inventory numbers during the session, should continue to put bearish pressure on this market. At this point, I would anticipate that the market goes down to the $2.60 level, possibly even to the $2.50 level. The $2.80 level has offered a significant amount of resistance, as it was previous support. I believe that short-term sellers will continue to benefit from this marketplace, and as far as long-term trades are concerned, it’s going to be very difficult to deal with natural gas as we are very choppy, but most certainly negative.