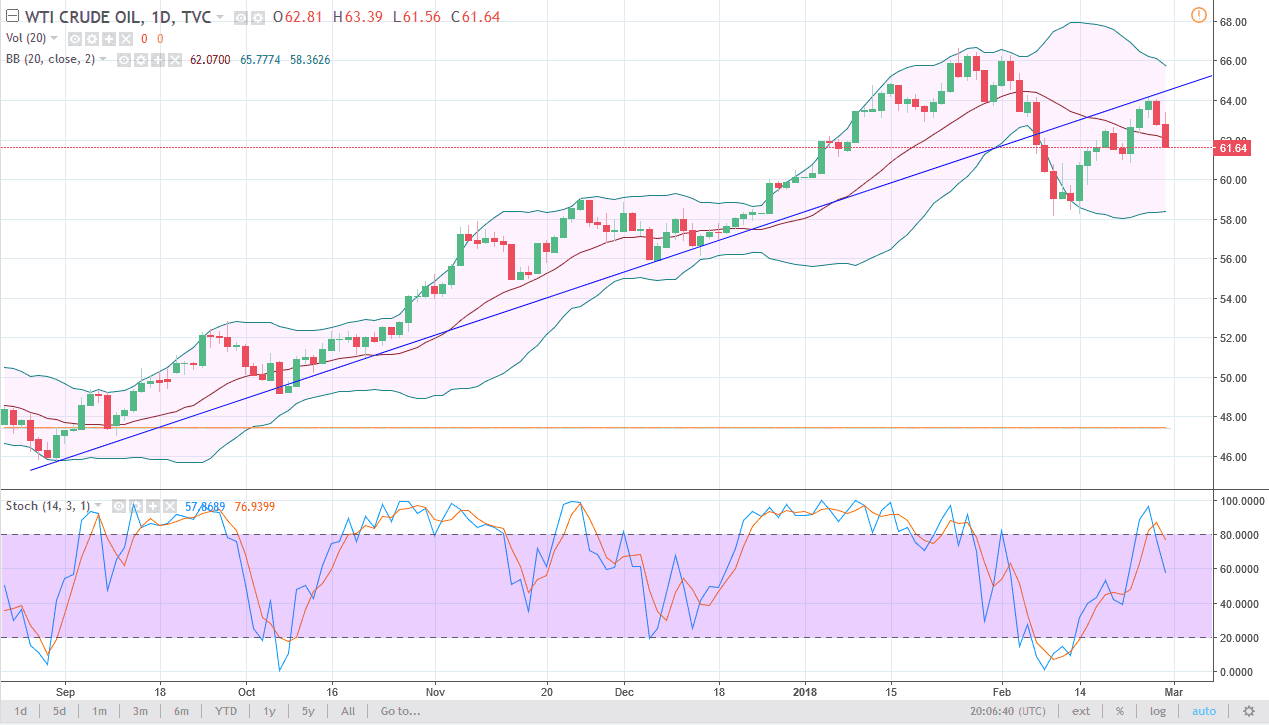

WTI Crude Oil

The WTI Crude Oil market has initially tried to rally during the day on Wednesday but rolled over rather significantly to break down below the $62 level. It looks as if there is a bit of support in the area though, so don’t be surprised if we get some type of bounce, but that bounce should be and I selling opportunity. Now that we have a rolled over from testing the bottom of the uptrend line from the previous trading, I think the market is eventually going lower. Given enough time, I think that the oil market will go down to the $60 level, perhaps even the $58 level. I have no interest in buying this market until we break above the $65 level and do so on a daily close. Until then, this market looks bearish to me.

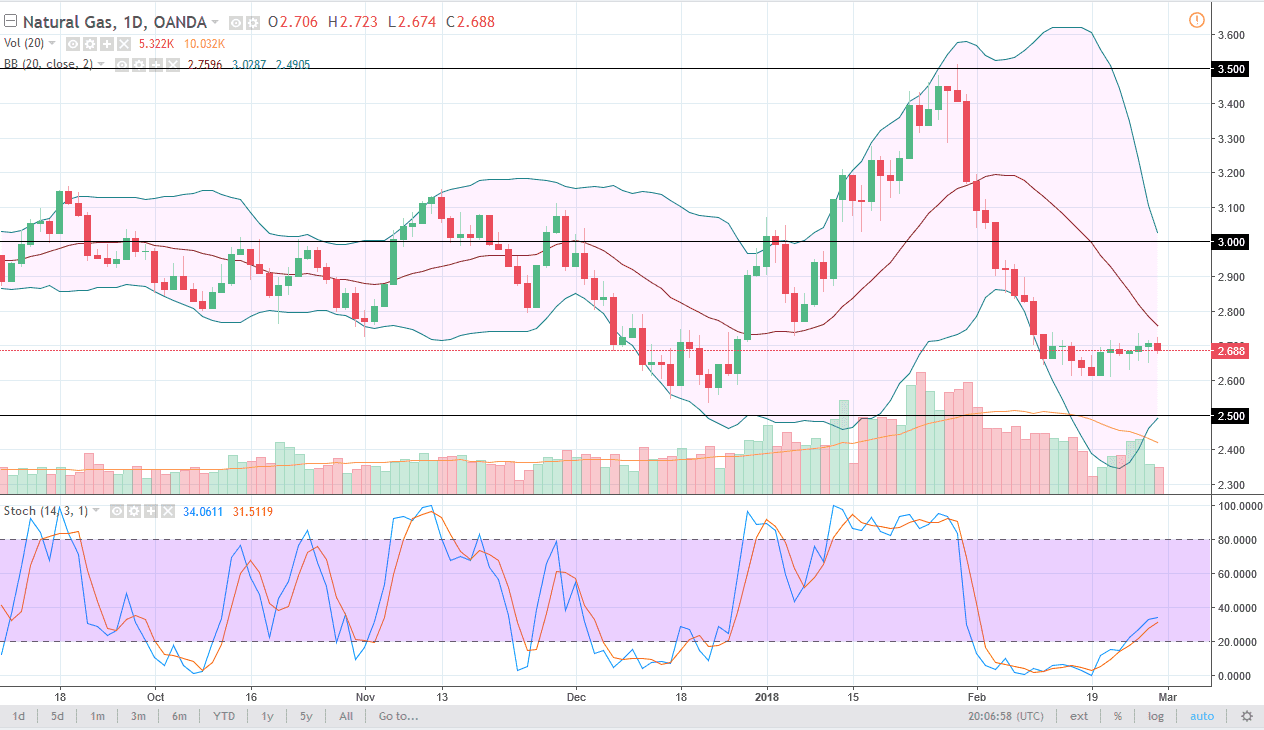

Natural Gas

Natural gas markets went nowhere during the trading session on Wednesday, as we continue to dance around the $2.68 level. I think that the market is overdue for a bounce, so it’s only a matter of time before we get some type of relief rally. Ultimately, this is a market that should continue to show bearish pressure, but I think that in the meantime we need to find a bit of a bounce to start selling. I certainly wouldn’t try to short here, I think we are oversold. The $3.00 level above should be a bit of a “ceiling”, so I’m waiting until we get closer to that level before I start selling. If we don’t get that moved, this could be a short-term trader’s type of market, perhaps scalping in both directions with the $2.60 level underneath offering the “bottom”, while the top of the range is probably closer to $2.75 just above.