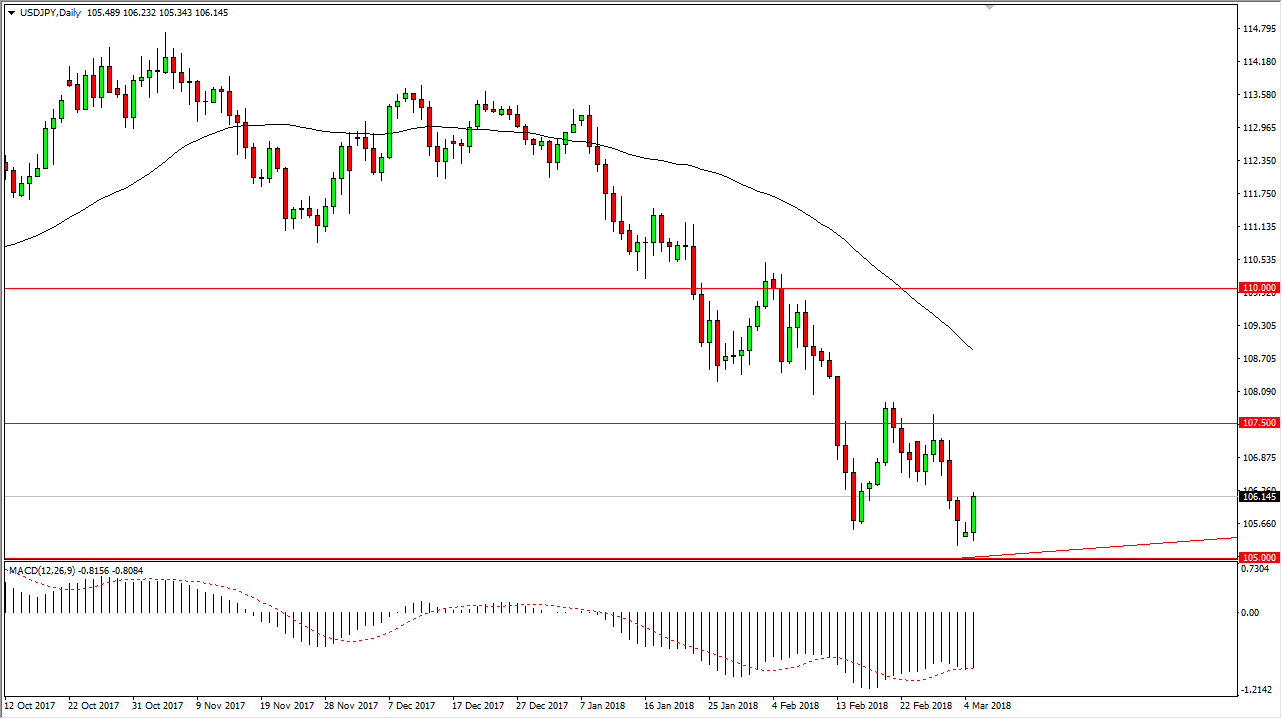

USD/JPY

The US dollar has initially pulled back a bit against the Japanese yen but turned around to show signs of strength and break above the 106 level. By breaking above there, the market looks as if it is ready to go towards the 107.50 level above, which is an area that we have seen a lot of resistance at, as well as support in the past. The market looks very likely to reach towards that area, and I think that short-term pullbacks are buying opportunities. The 105-level underneath should be massive support, and a breakdown below that level would of course be a very negative turn of events for the dollar. Currently, I think that the interest rates rising in the United States should eventually help this market.

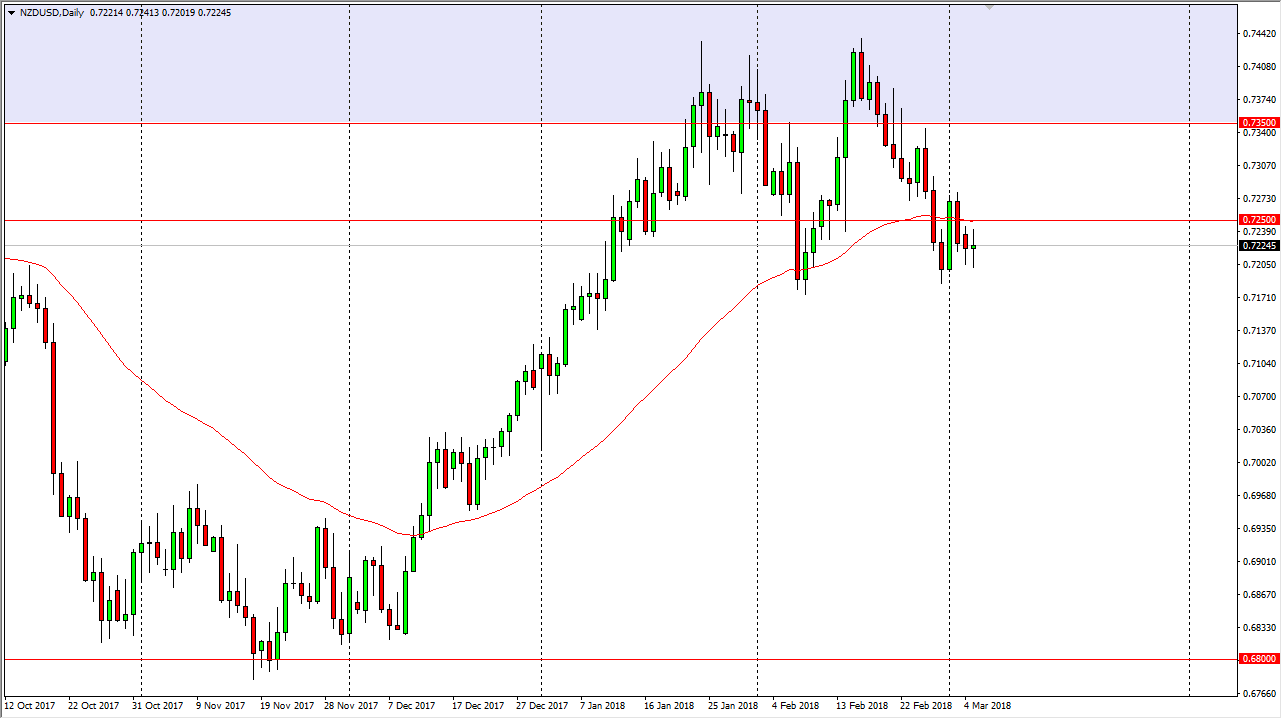

NZD/USD

The New Zealand dollar has gone back and forth quite a bit during the trading session on Monday, showing signs of exhaustion near the 0.7250 level. The 50-day EMA just above should continue to offer a bit of noise and resistance, but if we do clear that area, I think that the market could go to the 0.7350 level above. Alternately, the 0.72 level underneath should be massively supportive, and a breakdown below there could send the sellers into this market. I think at this point, it’s probably best to see which direction we break out of, and that could give us an opportunity to place a trade with a little bit of confidence. I think if we can break above the 0.7250 level, the market should probably go to the 0.7350 level. Alternately, the breakdown would probably have this market looking for the 0.70 level again. Ultimately, this is a very volatile pair, but it has set up a clear set of parameters from which to trade.