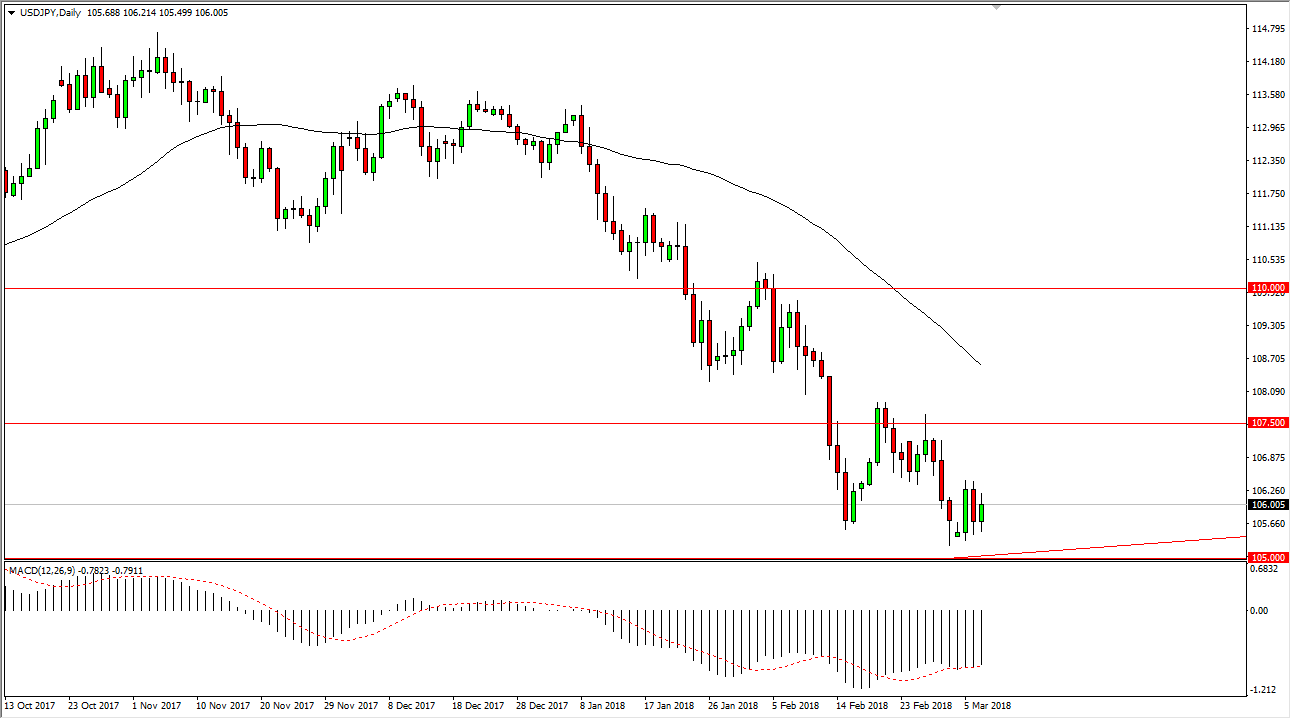

USD/JPY

The US dollar has rallied a bit during the trading session on Wednesday, as we continue to try to build up a bit of a base in this region. I believe that the 105.50 level underneath is continuing to offer buying pressure, and I think that value hunters are trying to get involved here. There is a nice uptrend line underneath, which extends near the 105 handle. If we break down below there, that would be a very negative sign, and of course could send this market much lower, perhaps down to the 100 handle. Overall, this is a market that I think will continue to be noisy, but if we can break above the 107.50 level, the market could extend gains towards the 110 handle above. Expect a lot of noise, because there are a lot of issues out there that could affect risk appetite in general.

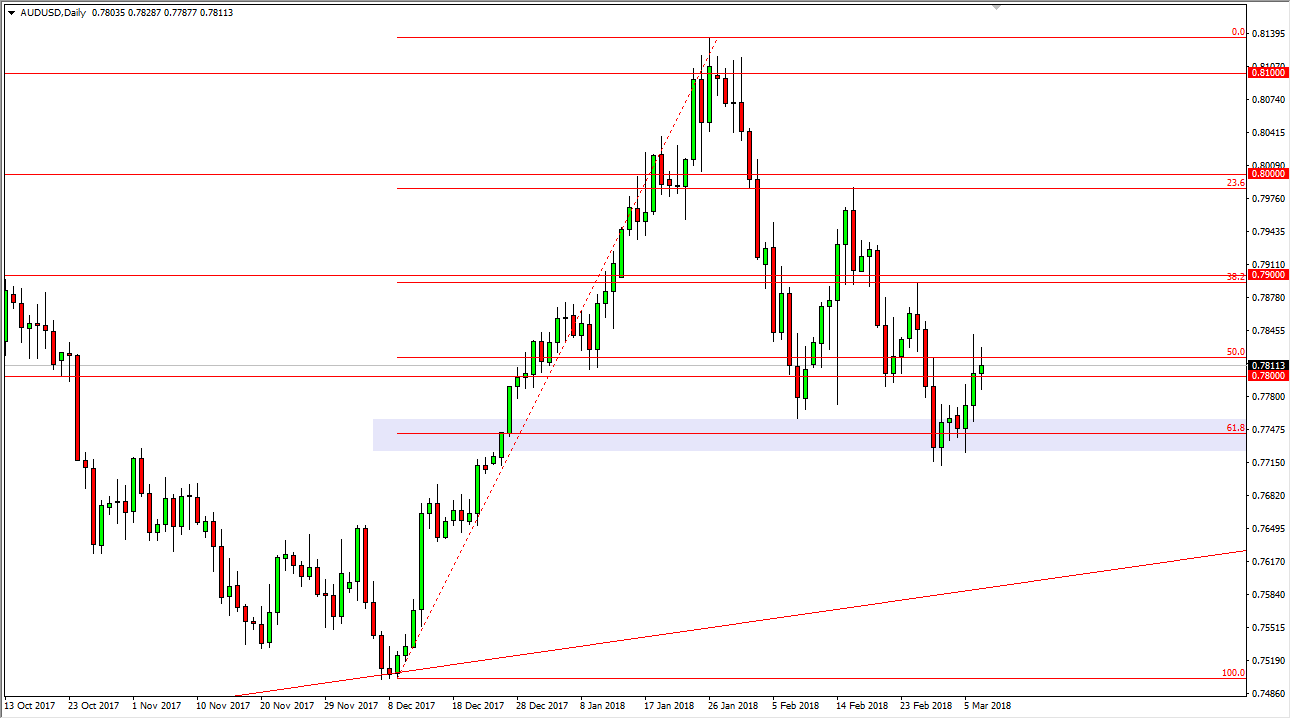

AUD/USD

The Australian dollar went back and forth during the course of the session as well, and as you can see that we had formed a neutral candle, and I think at this point the 0.78 level is a bit of a magnet for price for the short term, but I also believe that eventually we will continue to go higher, perhaps reaching towards the 0.79 level next. If we broke above there, then it would show a massive amount of bullish momentum, perhaps reaching towards the 0.80 level. Longer-term, I think that happens but in general I believe that the market will continue to be very noisy. The 61.8% Fibonacci retracement level underneath is a “floor” in the market, so if we were to turn around and break down below there, the market would fall rather drastically. If gold rallies though, that should continue to be good for the Aussie. In the meantime, you might be best on the sidelines.