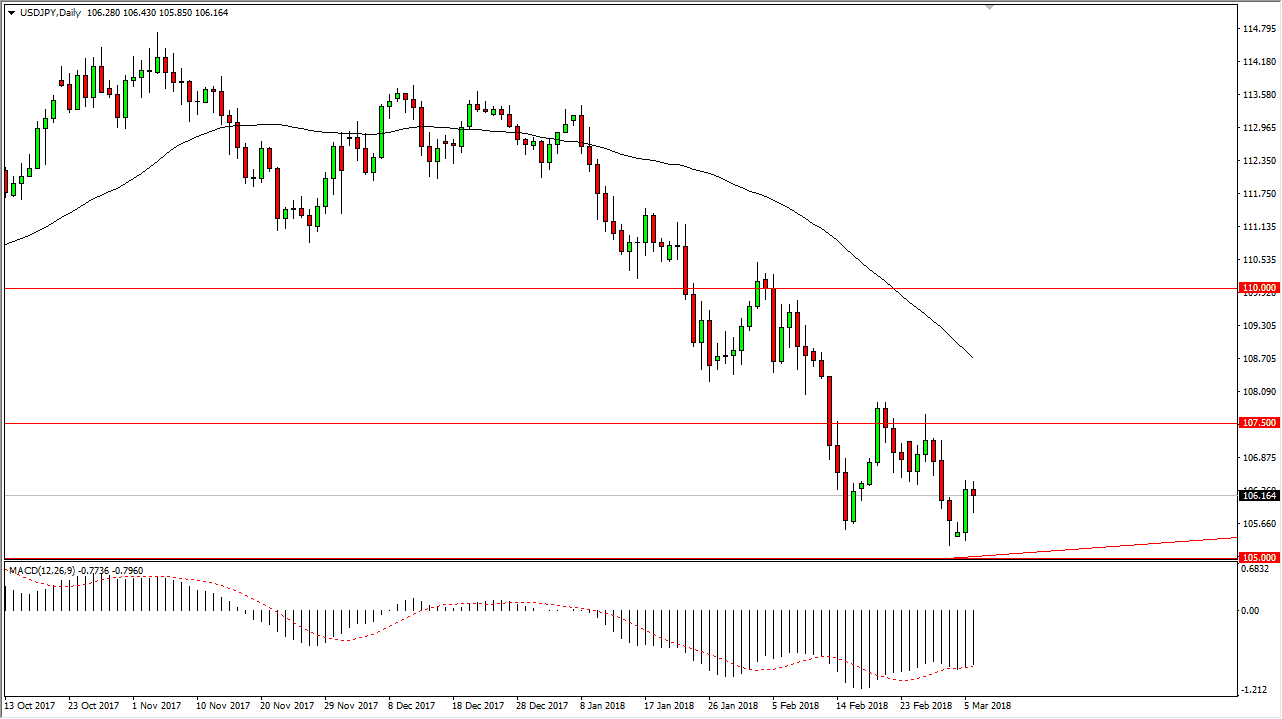

USD/JPY

The USD/JPY pair spent the initial part of the trading session on Tuesday following, but found enough support underneath the 106 level to turn around and form a bit of a hammer. This of course is a bullish sign and it looks as if we are trying to form a bit of a base just underneath, focusing on the 105.50 level. I also recognize that should be a certain amount of psychological support underneath that the 105 handle, and if the “risk on” attitude continues that we had seen during the trading session, I think we will eventually go higher. The 107.50 level is an area that I would anticipate seeing a bit of resistance, so it may take a couple of times to finally break through there. If we do, then we are free to go to the 108.50 region. Alternately, if we break down below the 105 level, the market will more than likely reach down towards the 100 level over the longer term.

AUD/USD

The Australian dollar pulled back initially during the day as well but found support yet again at the 61.8% Fibonacci retracement level to rally significantly, breaking above the 0.78 handle, extending to the 0.7850 level late in the day. We pulled back slightly, but nothing that I would be concerned about, and I believe at this point the buyers will be looking to pick up short-term pullbacks, assuming that we don’t see some type of escalation in the overall rhetoric about trade wars. A break above the high of the day should send this market looking for the 0.79 level. If we can remain above the lavender box on the chart, I believe that this is a “buy on the dips” scenario, but it will course be choppy as per usual.