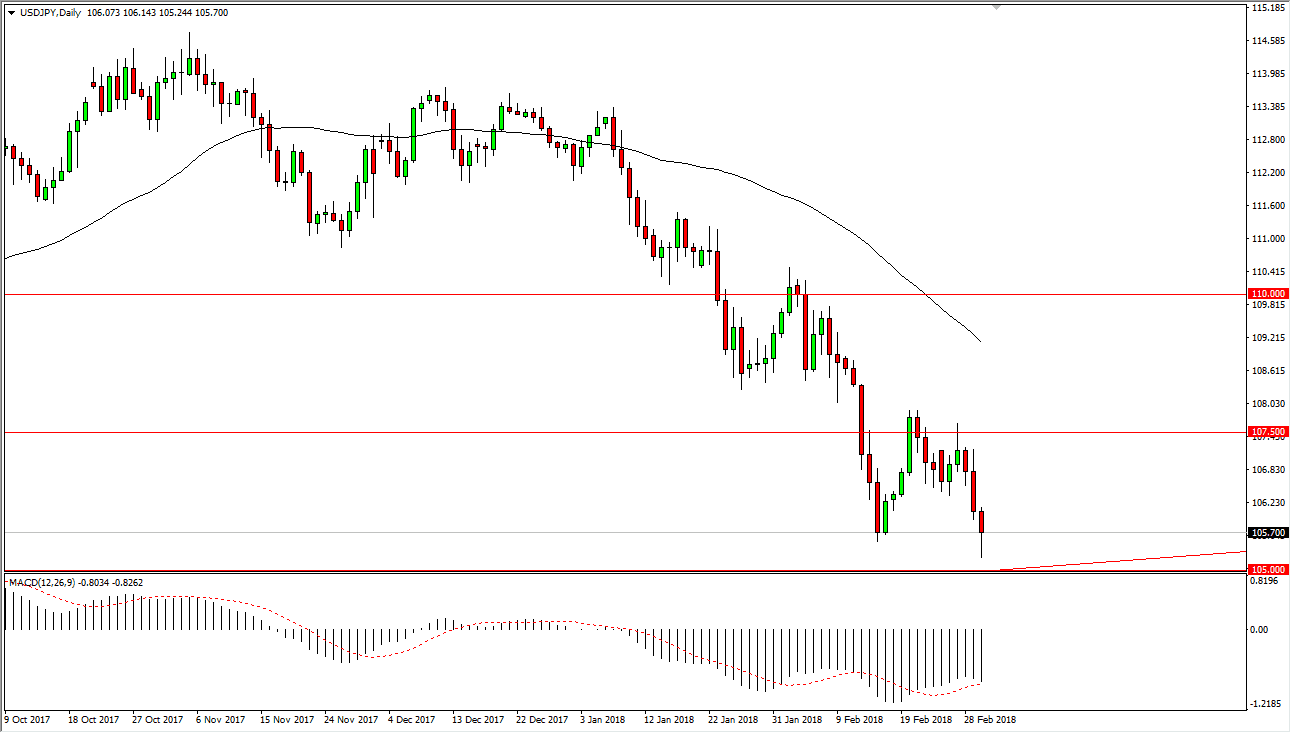

USD/JPY

The US dollar fell during most of the session on Friday, as traders continue to worry about tariffs coming out of the United States. However, we did bounce a bit towards the end of the day, forming a hammer by the time we closed. The hammer sits just above a massive uptrend line, so I think that the next couple of days will be crucial as to where we go next. Ultimately, I think that if we break above the top of the session for Friday, then I think the market probably goes looking towards the 107.50 level. Otherwise, if we break down below the 105 handle the market should continue to go much lower, perhaps reaching towards the 100 level. In general, I believe that we are about to see a lot of volatility in this pair regardless of which direction we go.

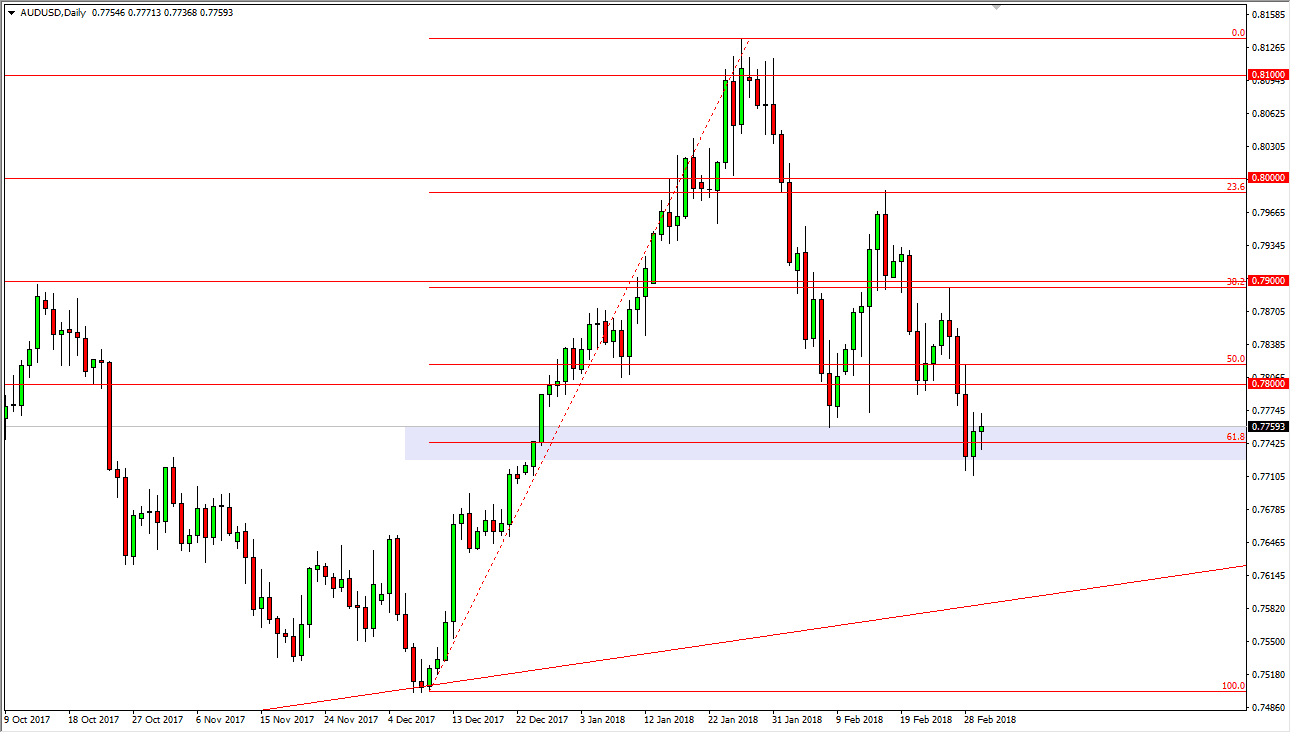

AUD/USD

The Australian dollar went back and forth during the session on Friday, as we continue to test the 61.8% Fibonacci retracement level from the recent move for support. The candle on Friday was somewhat encouraging, so if we can break above the highs from the Friday session, I believe the market will continue to go higher. Ultimately, I believe that the buyers will return, but the question remains whether it will be now or not. If we break down below the lows of Friday, we probably go lower, looking for the uptrend line underneath. I believe that gold markets will have their usual influence, and therefore it could be a scenario which offers an opportunity to pick up value in this area as gold has sold off recently. Gold could get a bit of a bid because of global concerns, so that might be reason enough to send the Aussie higher as well.