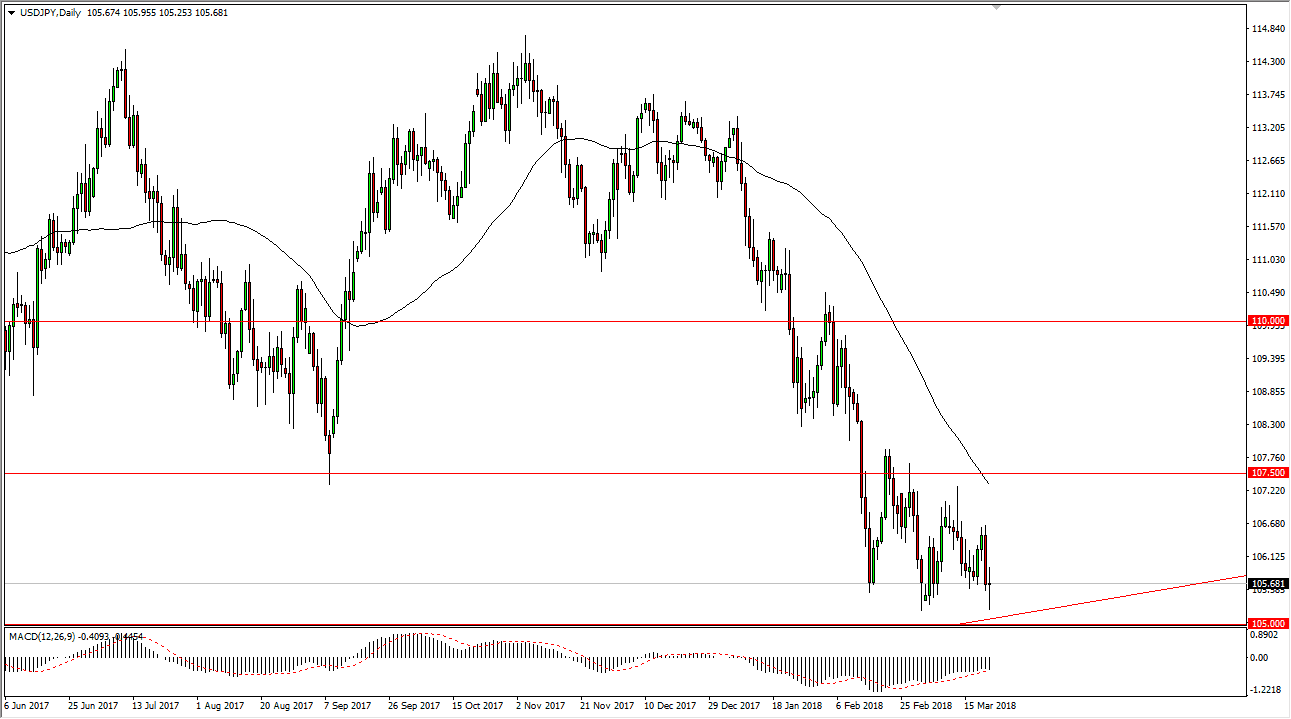

USD/JPY

The US dollar was very noisy during the trading session on Thursday, as the world awaits the results of trade tariffs being levied on China from the United States. This could start a potential trade war, so obviously people were very cautious. The USD/JPY pair is very sensitive to risk appetite, and because of this we had seen a lot of noise. Currently, it looks as if the Chinese are weighing their options, but it’s ultimately that response that will move the market next. Ultimately, this market has a significant amount of support just below at the 105.50 level, that extends down to the 105 handle. If we were to break down below the 105 level, the market will almost undoubtedly unwind towards the 100 level over the next several sessions. I believe this would be in reaction to some type of Chinese retaliation that was stringent. Right now, it looks as if they are ready to consider their options.

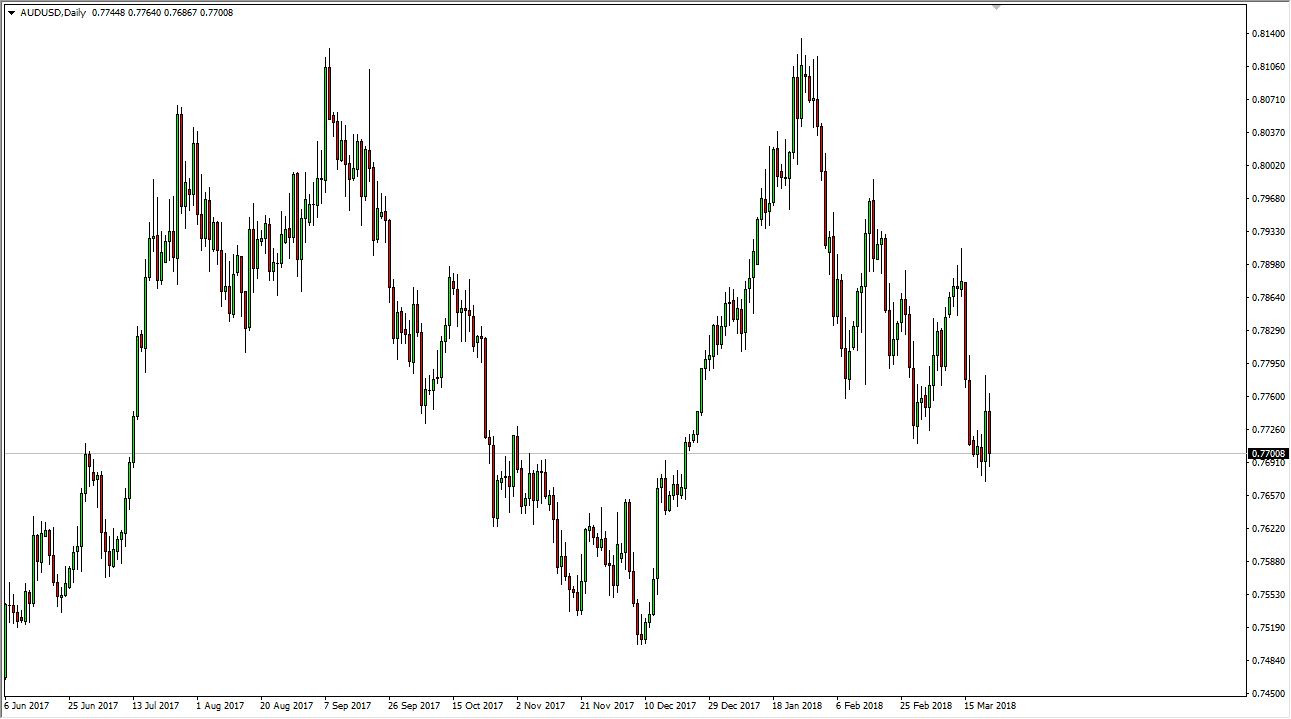

AUD/USD

The Australian dollar initially tried to rally during the session but rolled over significantly to reach towards the 0.77 level. It’s at this point that I think most traders are starting to look for value, and it’s possible that they may find it. However, if we break down to a fresh, new low, then I think the market goes down to the 0.76 level, an area that is essentially the uptrend line of the longer-term uptrend channel. I think that the next couple of sessions will be crucial, and you should probably pay attention to gold markets as they could lead the way for Australian dollar traders as well. If we do rally, it’s going to be a very messy affair.