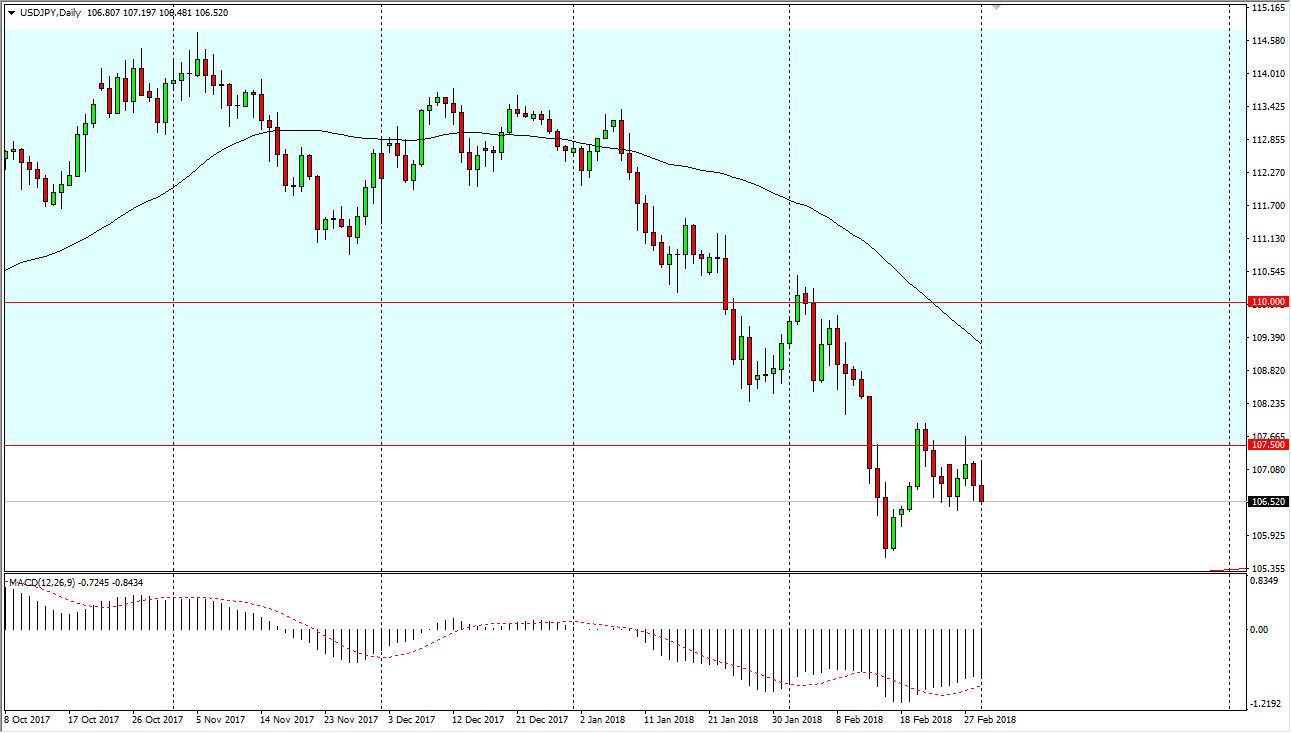

USD/JPY

The US dollar initially tried to rally during the day on Thursday but turned around and fell against the Japanese yen. The 106.50 level should be an area that attracts a lot of attention, and as I record this video it looks as if we are trying to break through that support. If that happens, the market should continue to go lower, perhaps reaching towards the 105.50 level. The 107.50 level above is resistance and is not until we break above that level on a daily close that I’m willing to start buying now. This may have been predicated by tariffs being applied by the United States in the steel sector, which has the market a bit concerned. I think that the 105-level underneath is massive support as well, and I think at that point we may reset and perhaps try to find buyers.

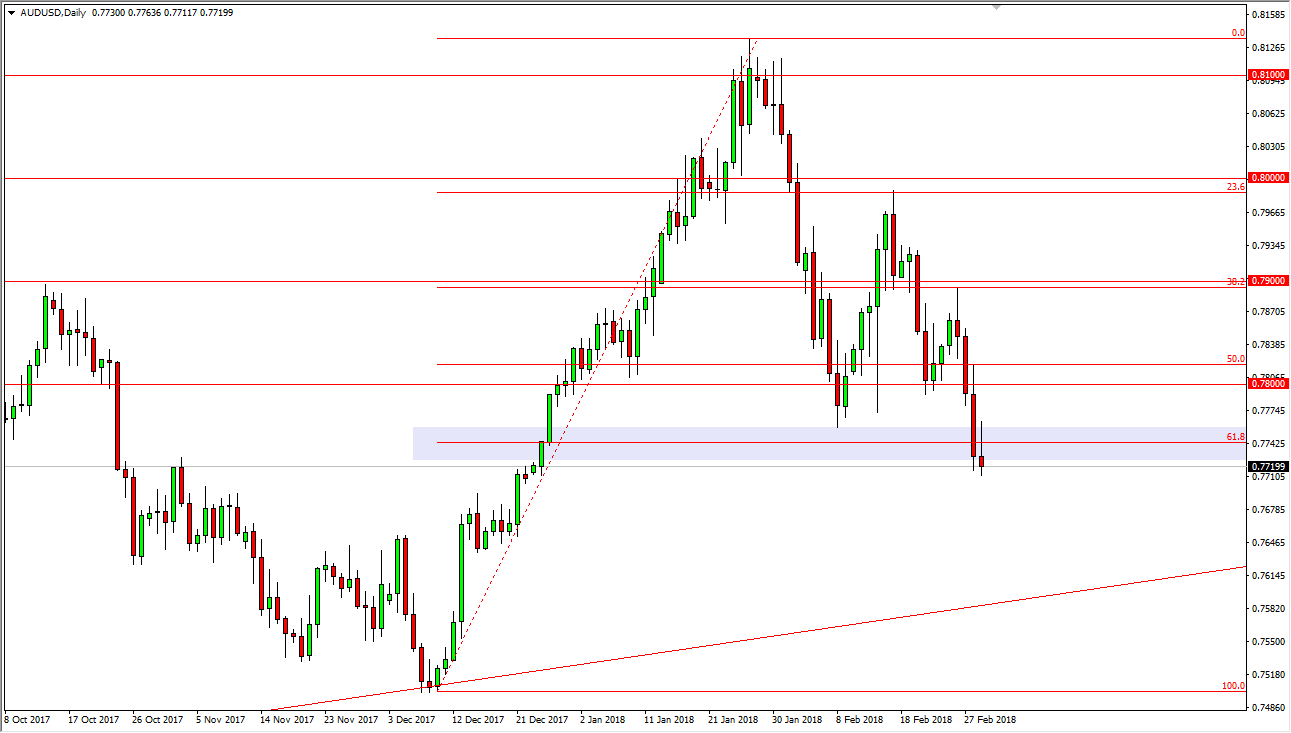

AUD/USD

The Australian dollar initially tried to rally during the trading session on Thursday but found enough resistance above the 0.7750 level to turn around and form a shooting star like candle. This tells me that we will probably see more downward pressure, so on a break below the bottom of the daily range, I think we will probably wipe out the move, as we are below the 61.8% Fibonacci retracement level. If we break down below there, the market probably goes down to the 100% Fibonacci retracement level. The alternate scenario is that we break above the top of the shooting star for the day, and that of course would be an extraordinarily bullish sign. Pay attention to the gold markets, because they of course will lead the way for the Aussie dollar, but right now it looks as if the US dollar is strengthening in general, and therefore I suspect that downward pressure continues.