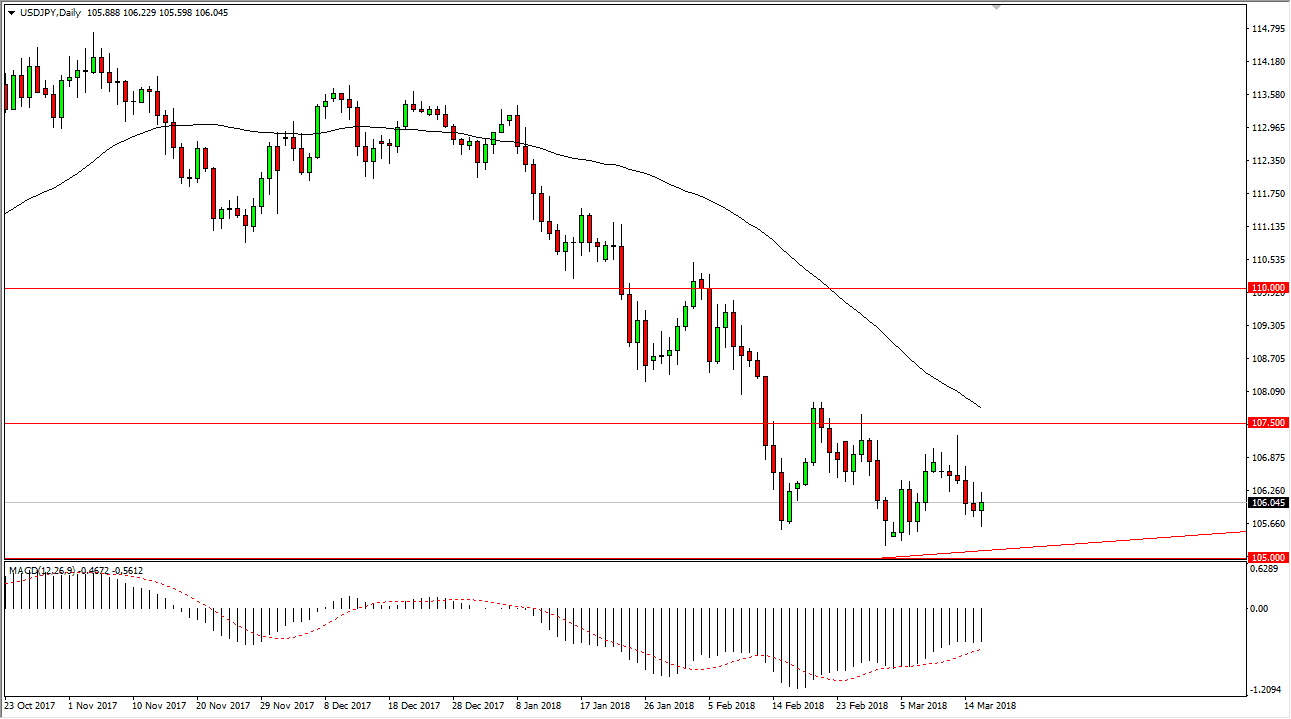

USD/JPY

The US dollar has been very noisy against the Japanese yen during the trading on Friday, as traders went back and forth. We are hovering around the 106 handle, and I think that underneath we have massive amounts of support that should continue to influence this market. The 105.50 level underneath is support, and it extends down to the 105 handle. Beyond that, we have the uptrend line that should continue to offer buying opportunities as well. However, if we are going to break down below the 105 level, then I think the markets should dropped towards the 100 level. Remember, this is a currency pair that is highly sensitive to risk appetite, so pay attention to the overall attitude of stock market traders. We did close well, so that helps, but at this point I think we are going to go back and forth more than anything else. Expect a lot of short-term volatility, and perhaps a lot of back and forth trading today.

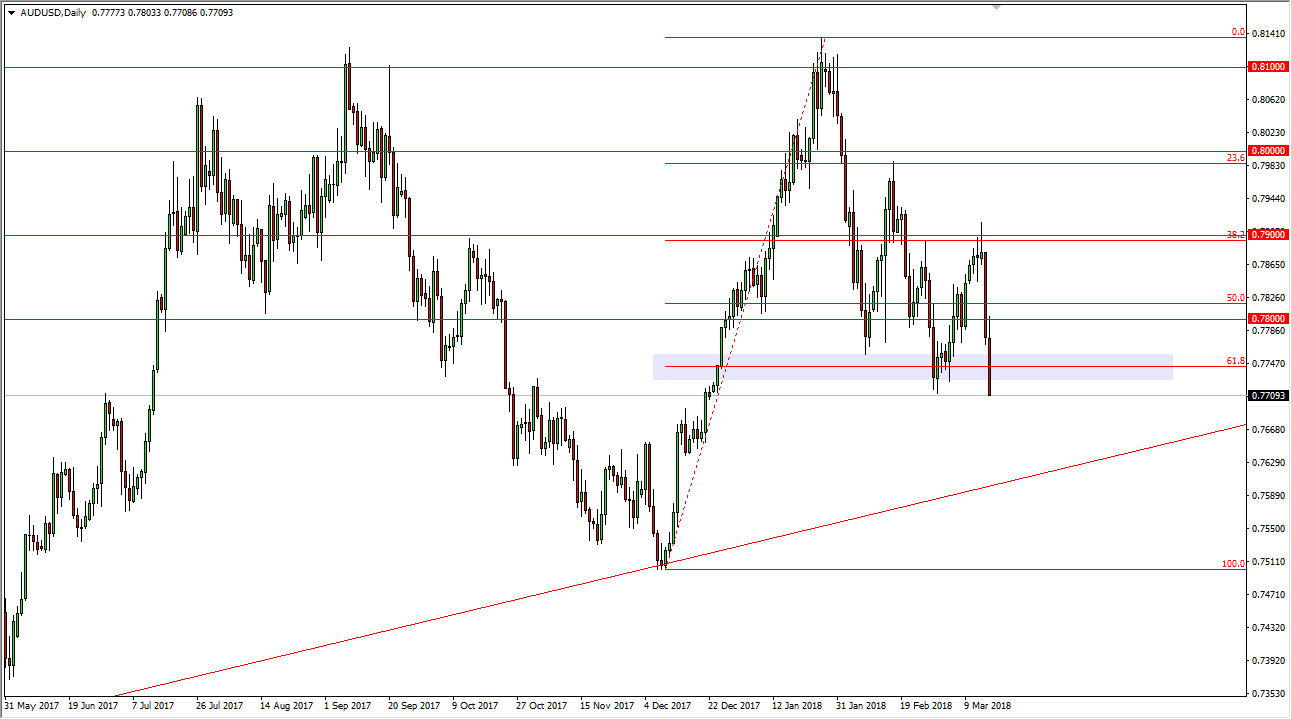

AUD/USD

The Australian dollar broke down towards the 0.77 handle, an area that has been supportive recently. If we can break down below the 0.77 level, then I think the Aussie dollar continues to fall. This has been a brutal selloff over the last 48 hours, so I think it’s likely that we do continue to see selling pressure. However, somewhere near the 0.76 level, we have an uptrend line that has been the bottom of an up-trending channel, and that could bring in the buyers. If we were to break down below this uptrend line, then it’s almost a certainty that we go down to the 0.75 handle. I expect Monday to be negative, at least initially for the Aussie dollar, although I’m not expecting some type of wiped out.