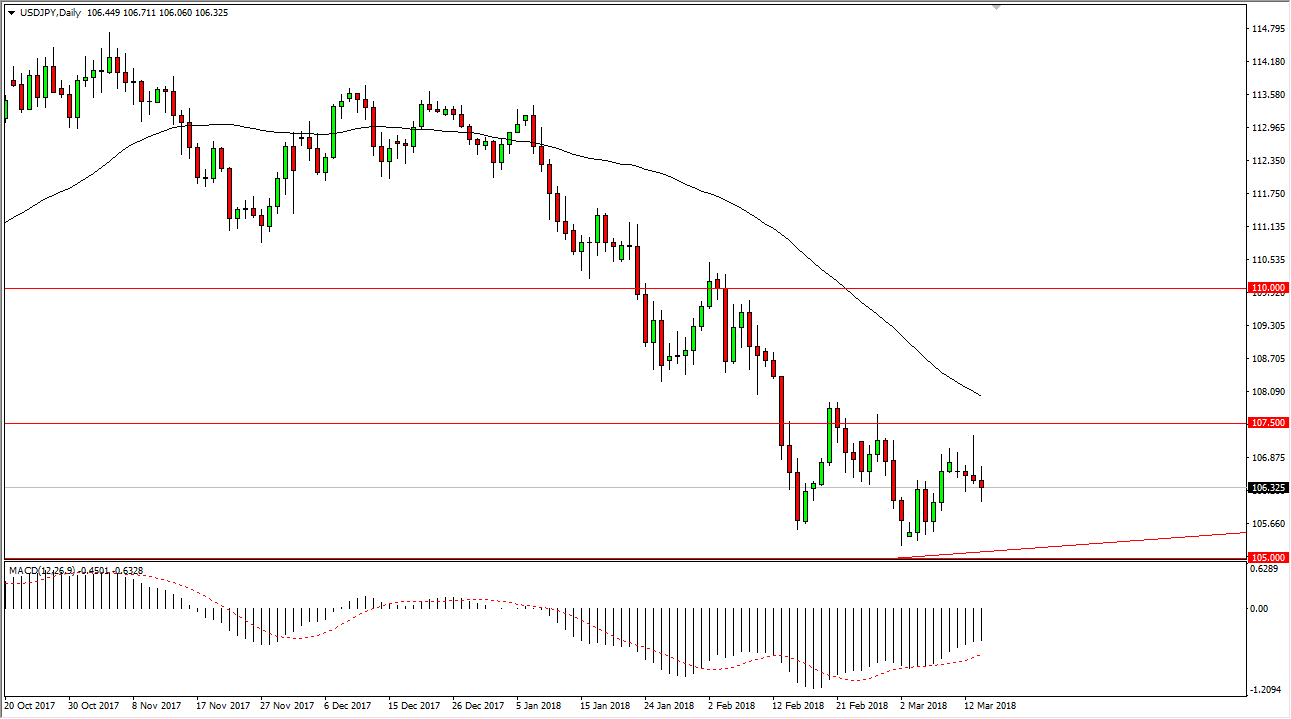

USD/JPY

The US dollar has been very noisy during the trading session on Wednesday, going back and forth against the Japanese yen as we have seen a lot of noise in the US stock markets. That tends to have a major influence on this market, so it makes sense that we would see the same action in this pair. I think it’s likely that we will continue to respect the uptrend line just below, especially near the 105 level, as it is a large, round, psychologically significant number, and an area where we have bounce from drastically. Ultimately, I think that we will find buyers every time we bounce, but if we can break above the 108 level the market will be free to go to the 110 handle. If we can break down below the 105 level, the market could drop down to the 100 level, which is even more supportive.

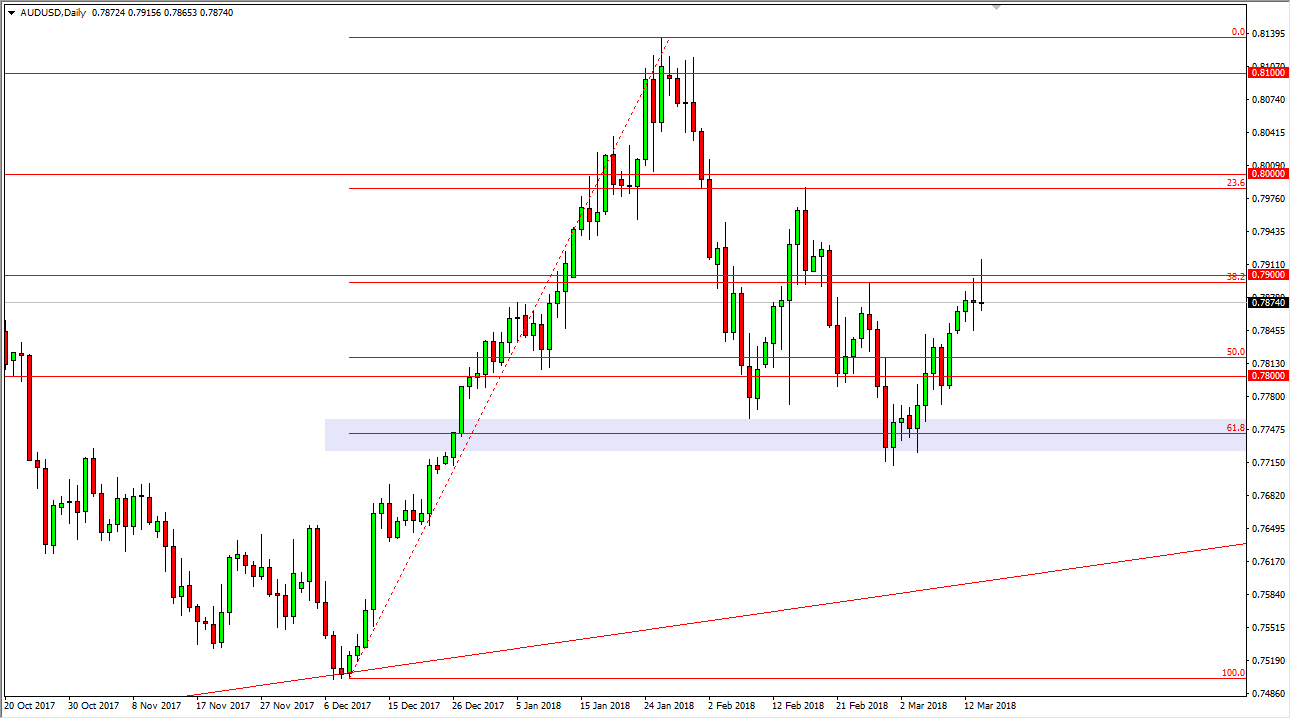

AUD/USD

The Australian dollar initially broke out to the upside during the trading session on Wednesday but found enough resistance above the 0.79 level to turn around and form a shooting star. The shooting star shows signs of exhaustion, so I think that if we break down below that candle, the market probably drops to find support underneath. Otherwise, if we can break above the top of the shooting star, the market should continue to go towards the 0.80 level. Pay attention to the gold markets, because they could give us an opportunity to follow, and that gives us an opportunity to get a bit of a fundamental reason to trade the Aussie, either higher or lower. I think the one thing you can probably count on is a lot of choppiness.