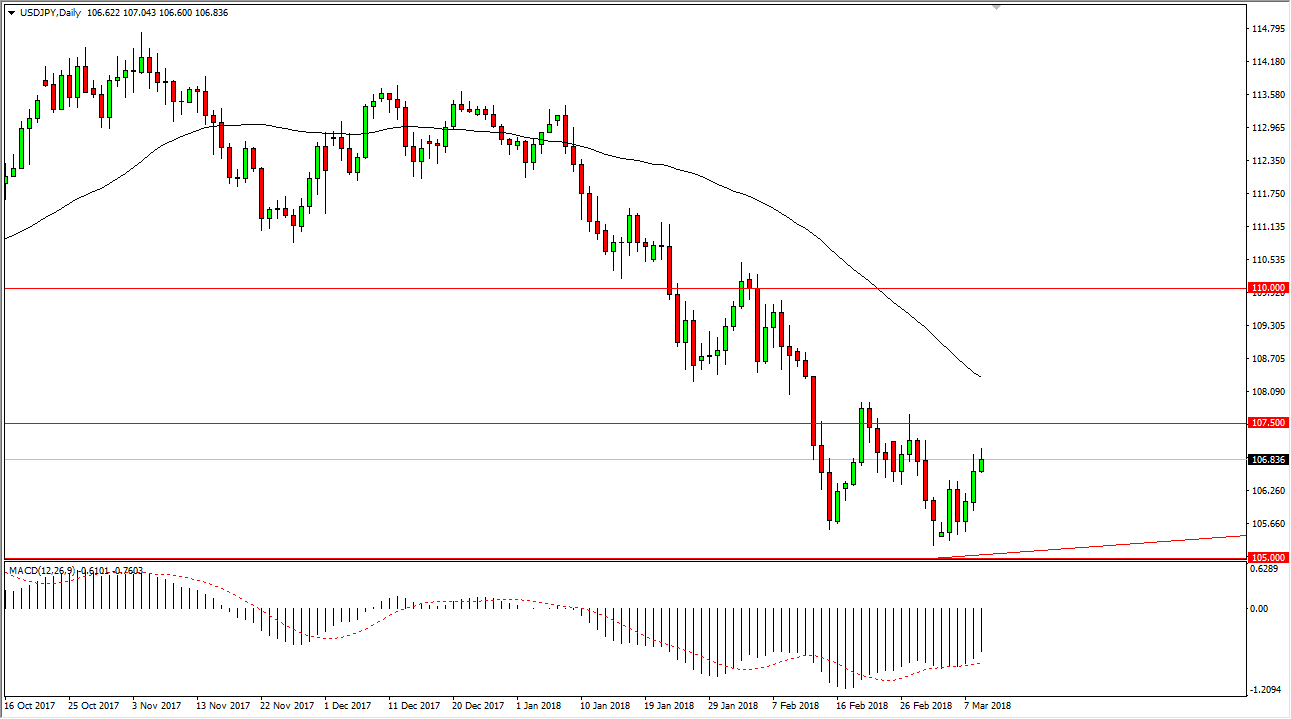

USD/JPY

The US dollar has rallied a bit during the trading session on Friday, breaking towards the 107 level. However, we turned around to form a bit of an exhaustive candle, so I think that the market may roll over a bit from here, perhaps looking to build more of a base. The 105-level underneath has been massively supportive on longer-term charts and is also interesting because there is a nice uptrend line that should keep this market afloat. Keep in mind that the market tends to be moved by risk appetite, so ultimately, I think the stock markets and of course commodity markets could have a massive effect on this market. I think a pullback is probably necessary to continue to build a base, but I do think that eventually we will break out to the upside.

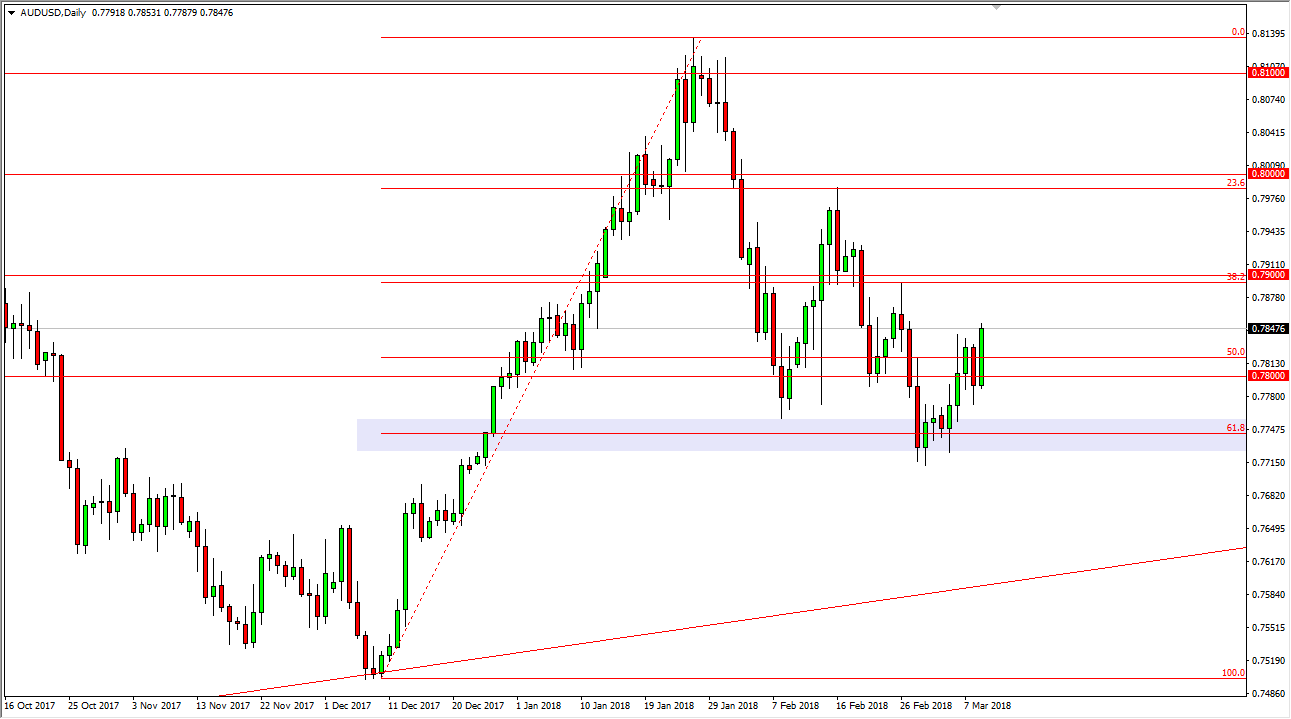

AUD/USD

The Australian dollar exploded to the upside during the trading session on Friday, breaking above the 0.7850 level. I think ultimately, it’s a matter of buying dips, as it looks like we are ready to continue to reach towards the 0.79 level above. The market will course be very noisy and influenced by what happens in the gold pets, as per usual. The market looks likely to be very noisy, with the 61.8% Fibonacci retracement level underneath being supportive. The 0.7750 level should be the “floor” in the market, so if we can stay above there I feel that the market will continue to find buyers. If we were to break down below the 0.77 handle, the market will then probably break down significantly at that point. Ultimately, I think that we are trying to form a base for a continuation of the uptrend in channel that we have seen over the last couple of years.