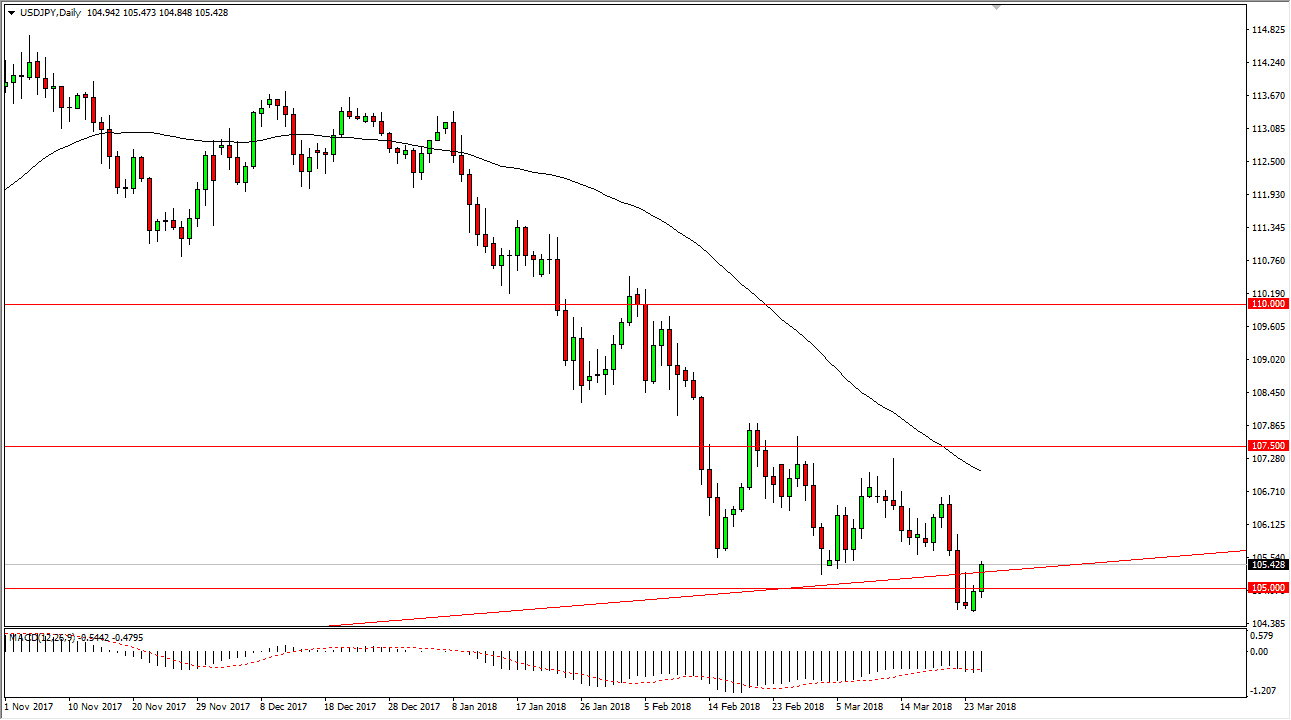

USD/JPY

The US dollar has rallied against the Japanese yen on Monday, breaking above the top of the shooting star from the Friday session. It appears that there are talks between the United States and China going to happen, and that will hopefully avert some type of trade war. This has a lot of traders thinking that it is more of a “risk on” environment, as stock markets in America exploded to the upside. With that, we have more of a risk on environment in the Forex markets as well. That doesn’t mean that we are going to go straight out, but it looks as if we are going to make a fight to form some type of floor in this vital area. If we made a fresh, new low, then we will break down and reach towards the 100 handle. On the upside, the 107.50 level is resistance.

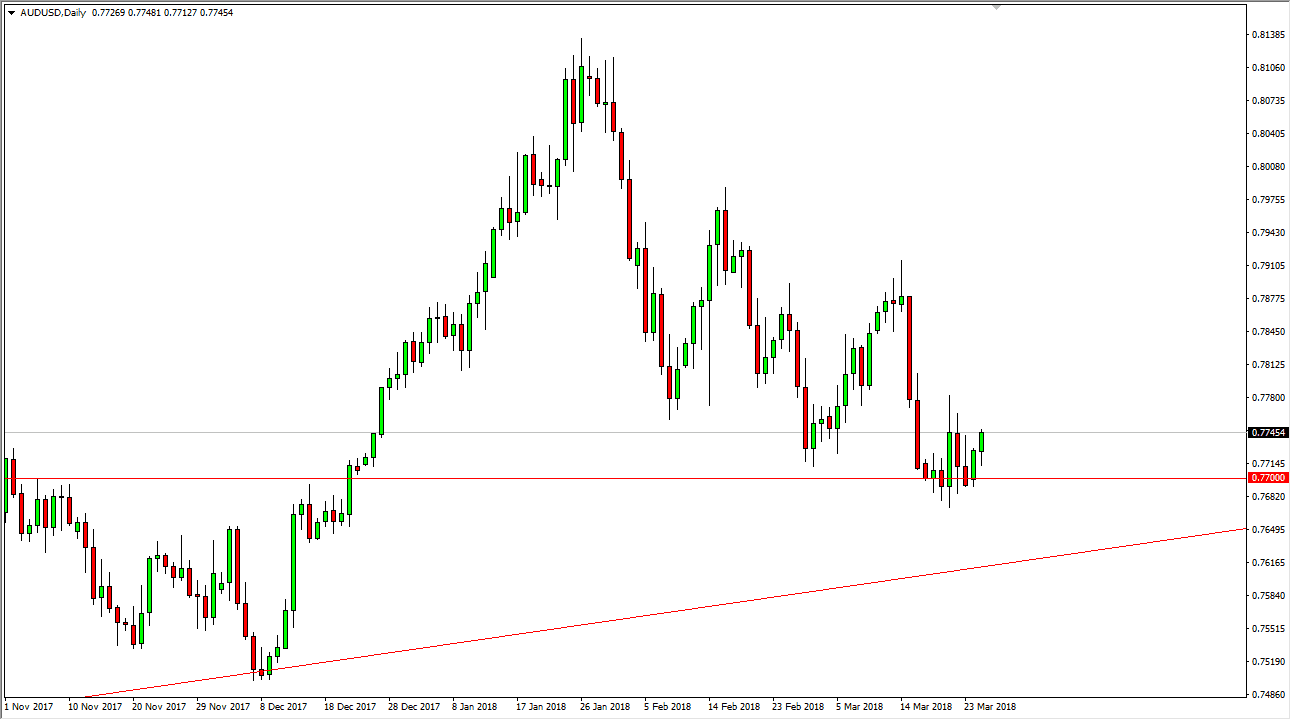

AUD/USD

The Australian dollar initially dipped during Monday but turned around and rallied significantly. Gold has had a good day, but we also have the sum of a “knock on effect” due to the trade war fears abating, and of course the Australian dollar is a proxy for China as Australia supplies a much in the way of commodities for the company country. The 0.77 level underneath is massive support, and I think that we also have support underneath that the 0.76 level. There is an uptrend line near that area as well, so I think that ultimately the buyers should continue to jump into this market.

When I look at the longer-term charts, the 0.80 level is a major pivot point for traders going back decades, so I think that we will eventually try to find that area. In the meantime, I expect a lot of choppiness.