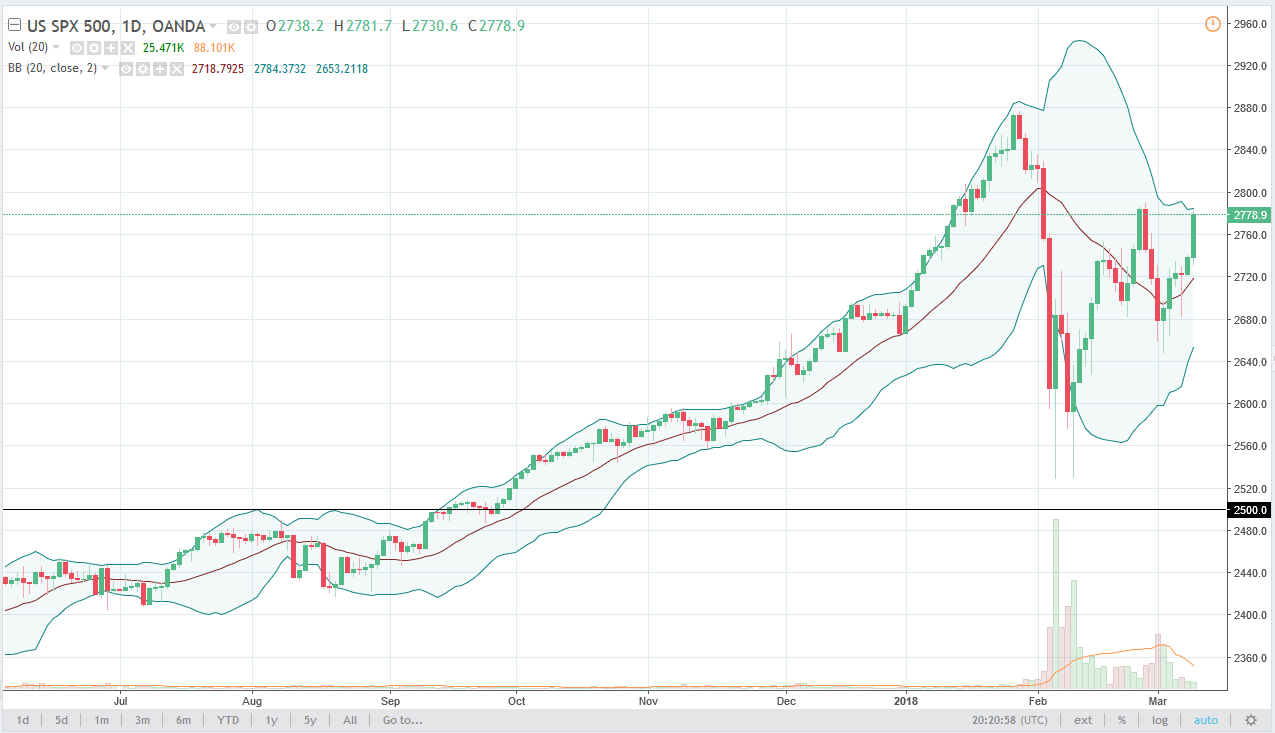

S&P 500

The S&P 500 rallied significantly during the trading session on Friday, gaining 1.5% as the jobs number from February came out much stronger than anticipated. Ultimately, the market looks likely to find buyers on dips, but we are approaching a significant resistance barrier in the form of 2800. I think you will have value hunters come back into play, and a break above the 2800 level should free this market to go looking towards the 2880 level. Ultimately, I have no interest in shorting this market after this jobs number, but I also recognize that a pullback is probably needed as we are getting a little bit to the overbought side.

NASDAQ 100

The NASDAQ 100 also rallied during the day, gaining a little over 1.5%. Importantly, we have broken above the vital 7000 level as we have made a fresh, new high and it looks as if the NASDAQ 100 will probably lead the way for the other US indices. I like buying dips, and I would anticipate that the 7000 level should be support going forward as it was such strenuous resistance in the past. I like the look of this market, and I believe that we will probably go to 7500 given enough time, perhaps even 8000 which is my longer-term target. It’s not until we break down below the 6700 level that I would consider selling this market, something that looks very unlikely to happen after this most recent move and of course the economic numbers on Friday. Expect volatility, but most importantly, I would expect a lot of bullish volatility.