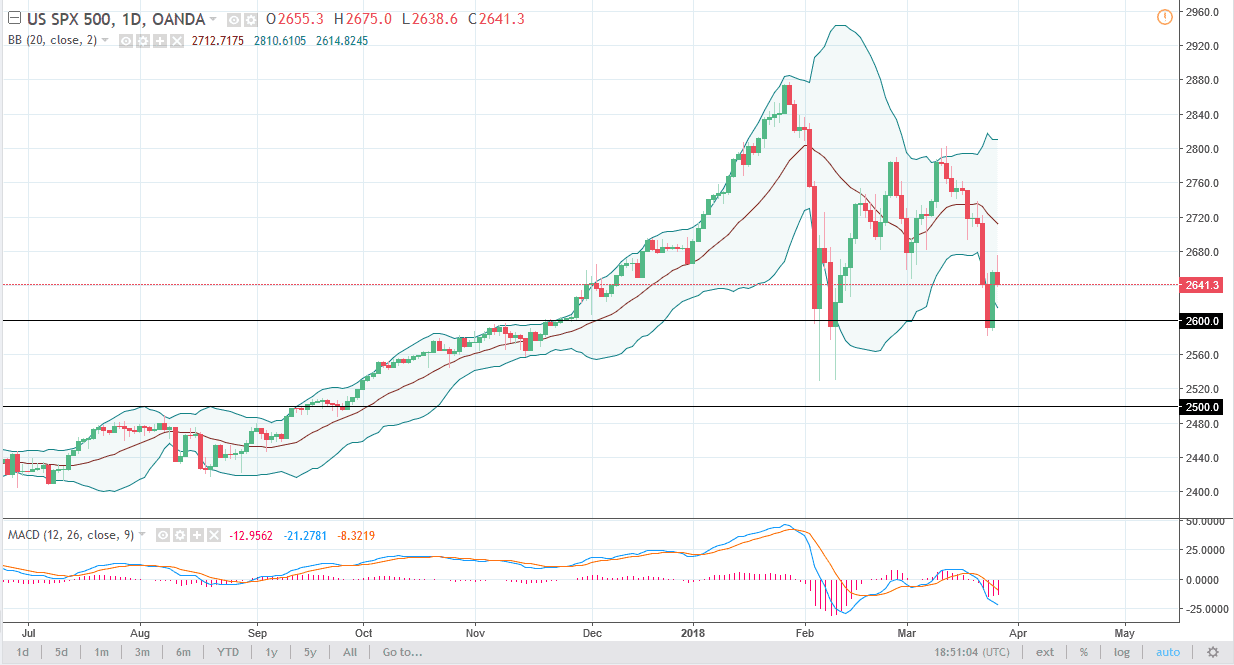

S&P 500

The S&P 500 initially rallied a bit during the trading session on Tuesday but rolled over at the 2680 handle. The market looks very soft, and it looks as if we will go back down towards the 2600 level. I think that the market continues to see a lot of volatility based upon various issues, and the fact that we cannot hold the gains for the session is not a good sign. Because of this, I think that the market will probably need to several days of consolidation with a slight upward bend to continue to go higher. I believe that there is even more support at the 2500 level, but what this uptrend needs now is a bit of stability. Staying out of this market might be the best trait of all, as there so much noise.

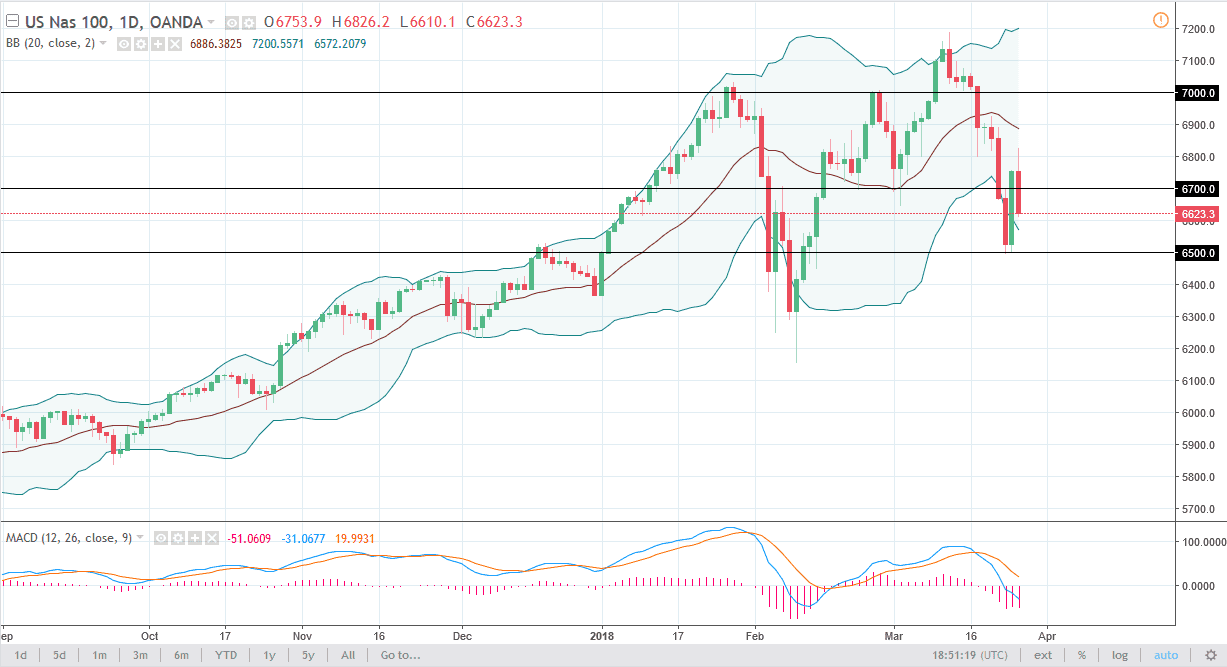

NASDAQ 100

The NASDAQ 100 initially rally during the day, and broke above the 6800 level, but that was short-lived. In fact, we broke down so significantly that I think we are going to continue to bounce around. I think that the 6500 level below will be supportive, and that should be an area that will attract a lot of attention. If we break down below there, the market should then go down to the 6300 level. That’s an area that is massively supportive, so it’s likely that we would find buyers there as well. In general, though, I think that this market will probably continue to be very noisy, so I believe that although value hunters will return, it’s probably best to trade in small pieces as the market is a very dangerous as of late. However, if we break down below the 6300 level, this market probably falls apart completely.