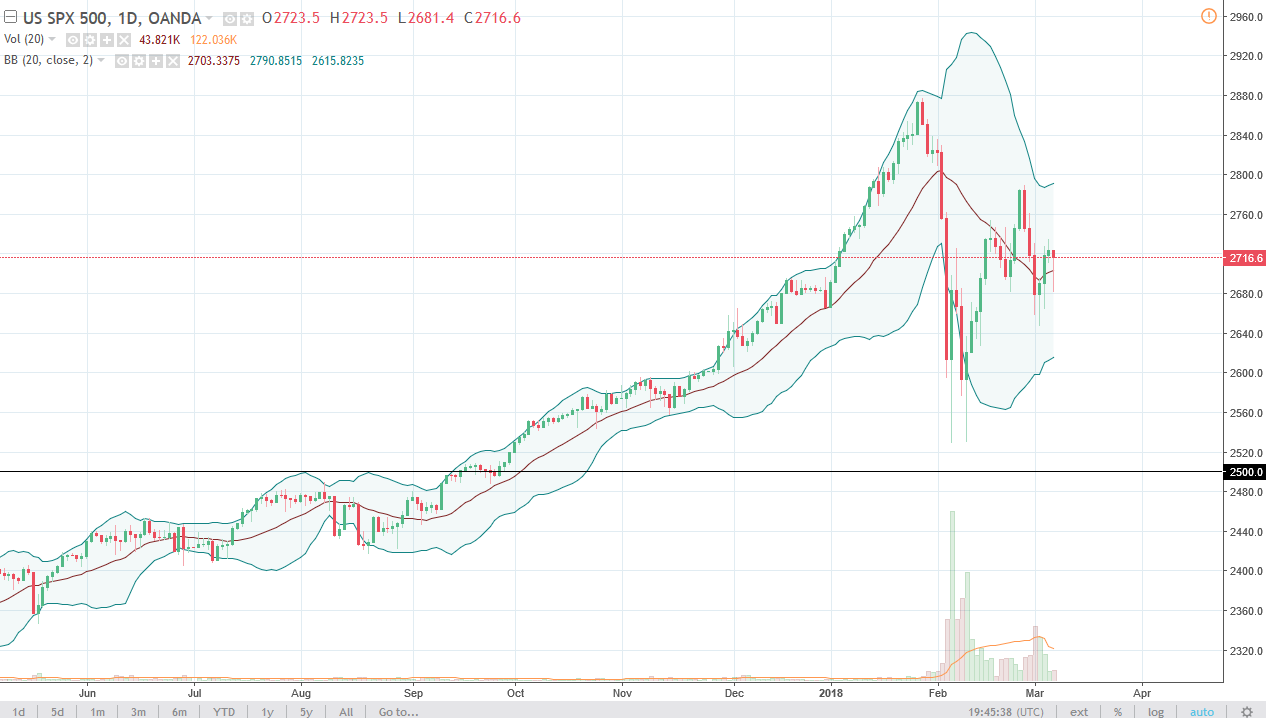

S&P 500

The S&P 500 sold off rather significantly during the trading session on Wednesday but turned around to form a massive hammer as the 2680 level has offered support. The hammer is a strong sign, if we can break above the 2800 level, the market is very likely to continue to go much higher. At that point, I would anticipate that the market is going to go to the 2880 level next. Keep in mind that there are a lot of concerns about a trade war, but it seems at this point that value hunters are willing to step in and start picking this market up every time it falls. Overall, I believe that we will continue to see a lot of volatility in the marketplace, so keep your position size small.

NASDAQ 100

The NASDAQ 100 has had a very wild day during Wednesday, falling down to the 6800 level, but then turning around to form a massive hammer. The hammer is a very bullish sign, and it now looks as if we are going to go to the 7000 level above. By breaking above the 7000 level, the market will offer more of a “buy-and-hold” scenario. If that’s the case, the market will then go to the 7200-level next, and then eventually the 7500 level longer term. Otherwise, if we pull back from here I think there should be plenty of support near the 6700 level to start buyers jumping back into the marketplace as well. If we do break down below 6700, the market then has 6500 under need to offer massive support. Ultimately, I think that the market will remain in an uptrend if we can stay above the 6500 level. A breakdown below there would be very negative.