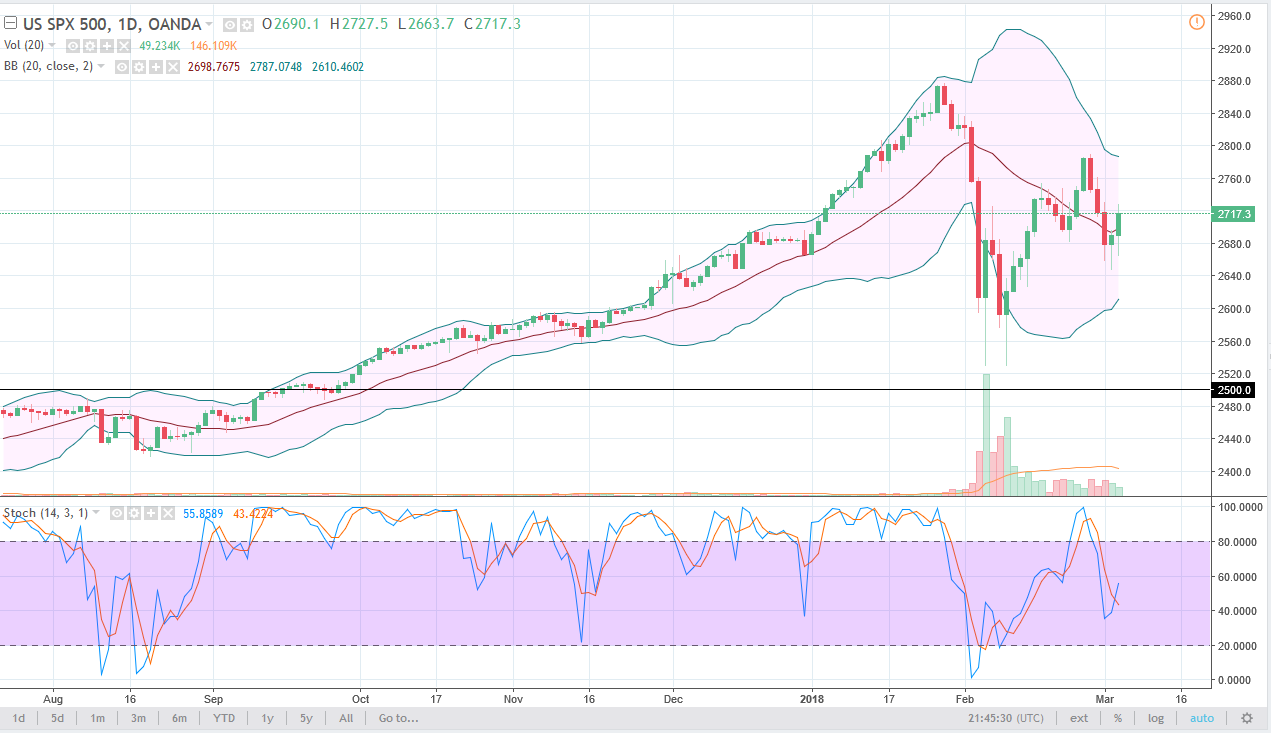

S&P 500

The S&P 500 initially fell during trading on Monday, but as we had formed a nice-looking hammer on Friday, it was obvious that the buyers were ready to come back. The pullback offered value the traders were willing to take advantage of, and therefore pushed the market higher by 1%, reaching towards the 2720 level. Ultimately, it looks as if the buyers are trying to make some type of stand just below, especially near the 2650 handle, and if we can stay above there think we will eventually reach the highest from last week. If we can break that, then I think the market goes much higher. I still have a longer-term target of 3000, and if we can stay above 2650, I see no reason to be concerned with the uptrend that we have seen. However, if we were to reach down towards the 2500 level, that would be the uptrend dying off.

NASDAQ 100

The NASDAQ 100 also pulled back initially during the trading session on Monday, but continues to find support at the 20 SMA, which is the middle band of the Bollinger Band indicator. The 6700 level has also offered a lot of support, and I think that we will then go to the 7000 handle above. That’s an area that has been massive resistance, but I think it’s only a matter of time before we break out above there. Once we do, the market will be more of a “buy-and-hold” scenario, sending this market to fresh, new highs towards the 7250 handle. Otherwise, if we break down below the lows of the Friday session, I think the market will then go looking towards 6500 below, which sees even more support be informed based upon previous noise.