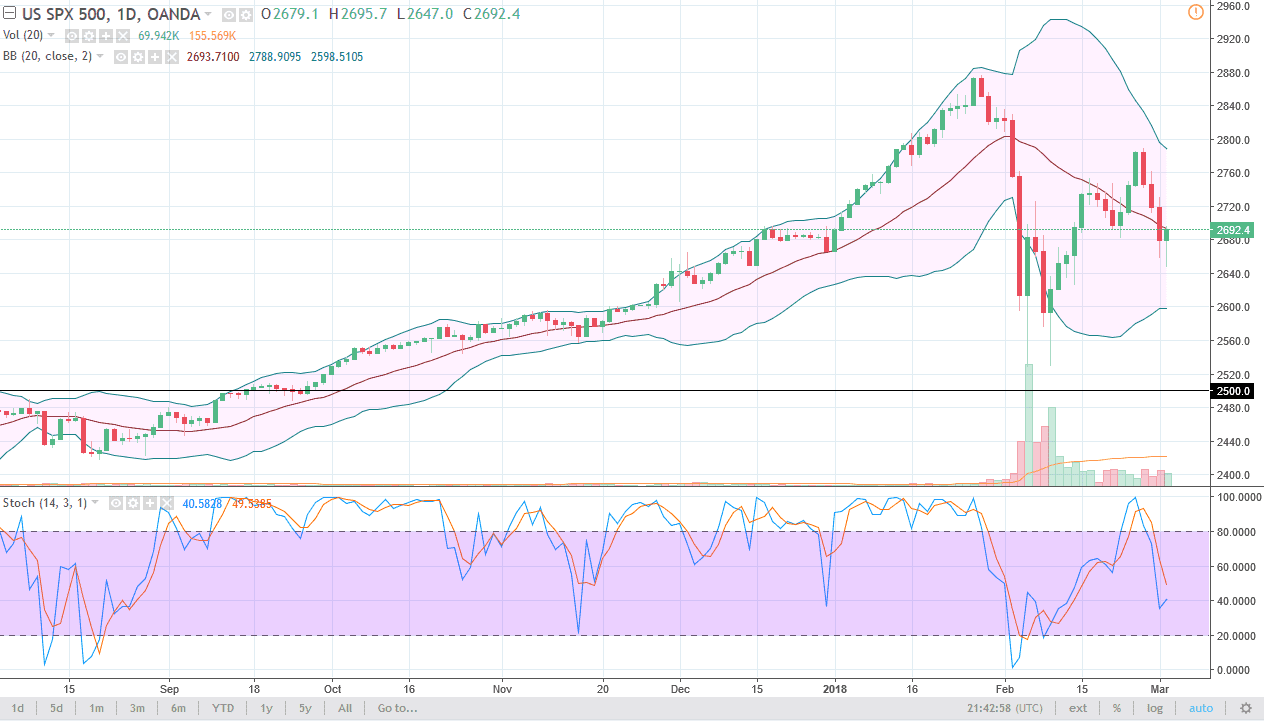

S&P 500

The S&P 500 has initially fallen during the day on Friday, reaching down towards the 2650 level before bouncing. By the end of the day, we ended up forming a nice-looking hammer, and that is of course a good sign that we are going to continue to find buyers in this market. If we can break above the top of the candle for Friday, the market should continue to go higher, perhaps reaching towards the 2800 level. While the markets are jittery after the talk of tariffs coming out of the United States, it looks as if people are starting to jump into this market to pick up value. However, a breakdown below the bottom of the candle for the session on Friday would be negative, perhaps sending the S&P 500 down to 2600.

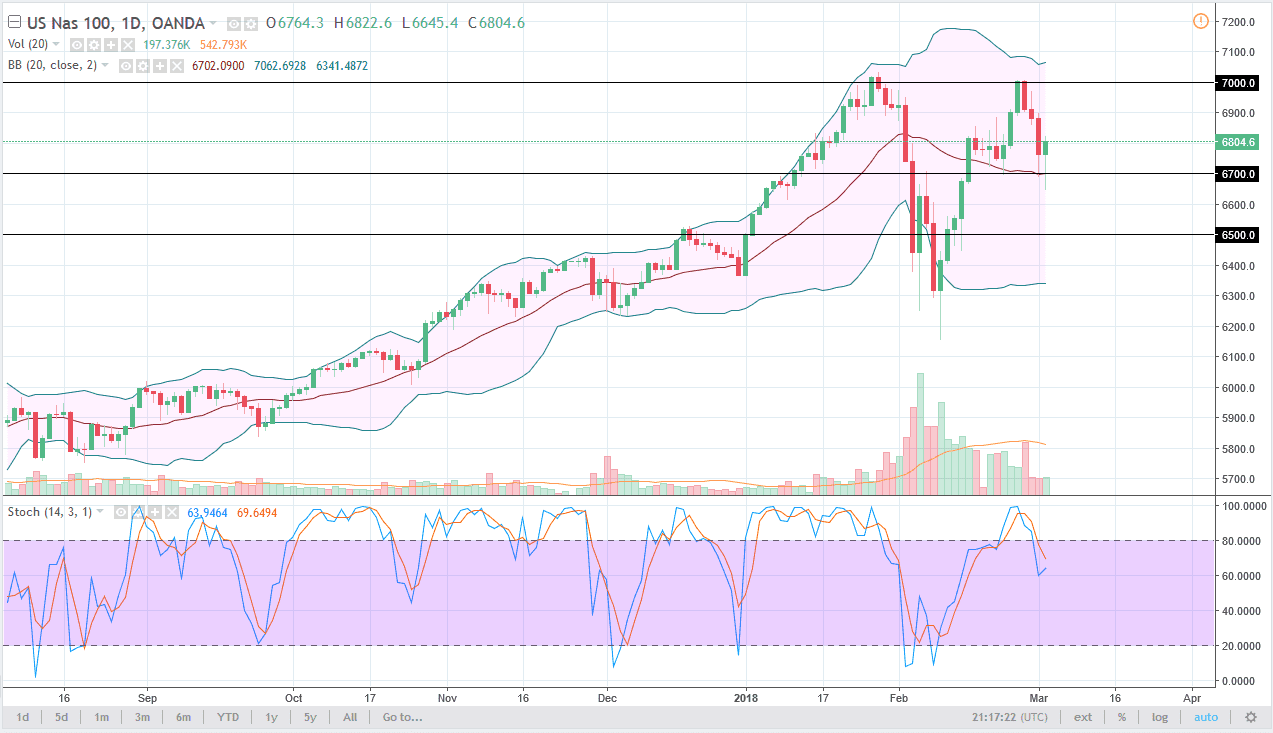

NASDAQ 100

The NASDAQ 100 did the same thing during the day, initially falling rather significantly, but found enough support just below the 20 SMA and the 6700 level to turn things around and form a nice-looking hammer by the end of the day. It looks as if the buyers are ready to step in and pick up value when we dip, which has been the case for a while. I think ultimately the market will try to get to the 7000 handle, which has been massively resistive. A break above there becomes more of a “buy-and-hold” scenario. On the other hand, if we break down below the bottom of the range for the session on Friday, the market more than likely unwinds down to the 6600 level first, and then the 6500 level after that. Either way, I think it’s easier to buy dips in this market than it is to sell the market.