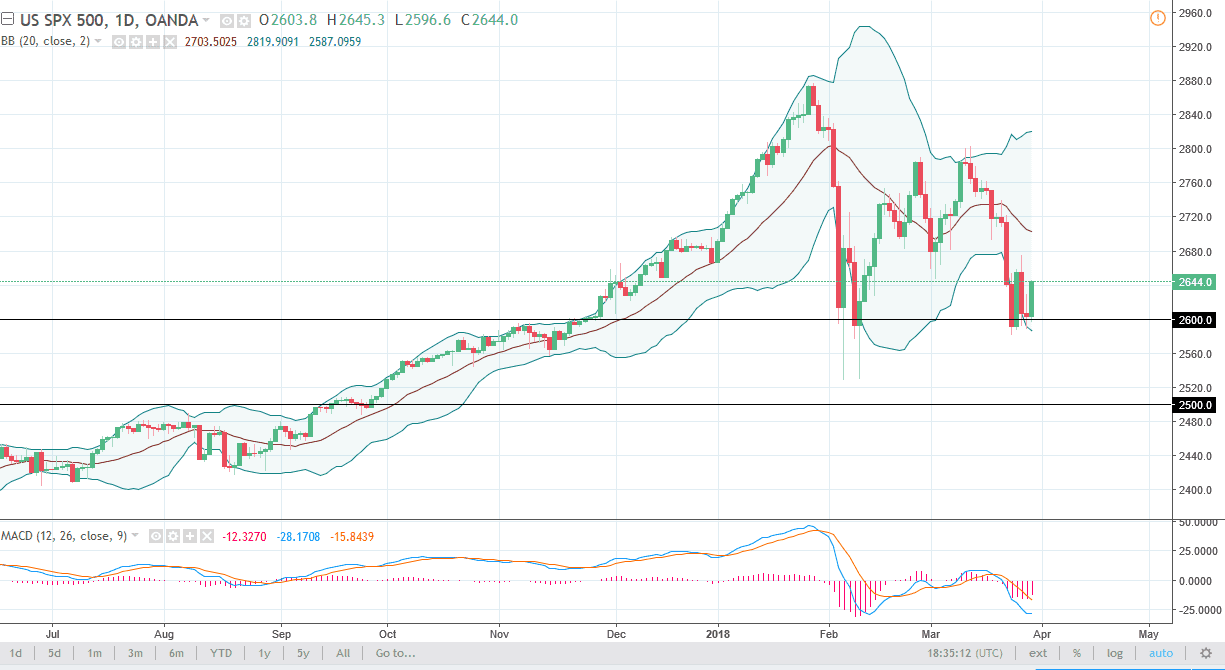

S&P 500

The S&P 500 rallied a bit during the trading session on Thursday, bouncing from the 2600 level. By rallying the way, we have, it looks as if were going to test the 2680 handle. I think at this point, we will find buyers eventually, and the pullback should offer value. The 2600 level is crucial, and I think it begins a significant amount of support down to the 2500 level. I think that we are trying to build a bit of confidence in this area so that we can go higher, as we have seen so much in the way of massive volatility. The alternate scenario of course is that we break down below 2500, and that would be very negative in general, and could send the sellers into overdrive. Pay attention to rhetoric involving the trade war, as it will certainly move the market.

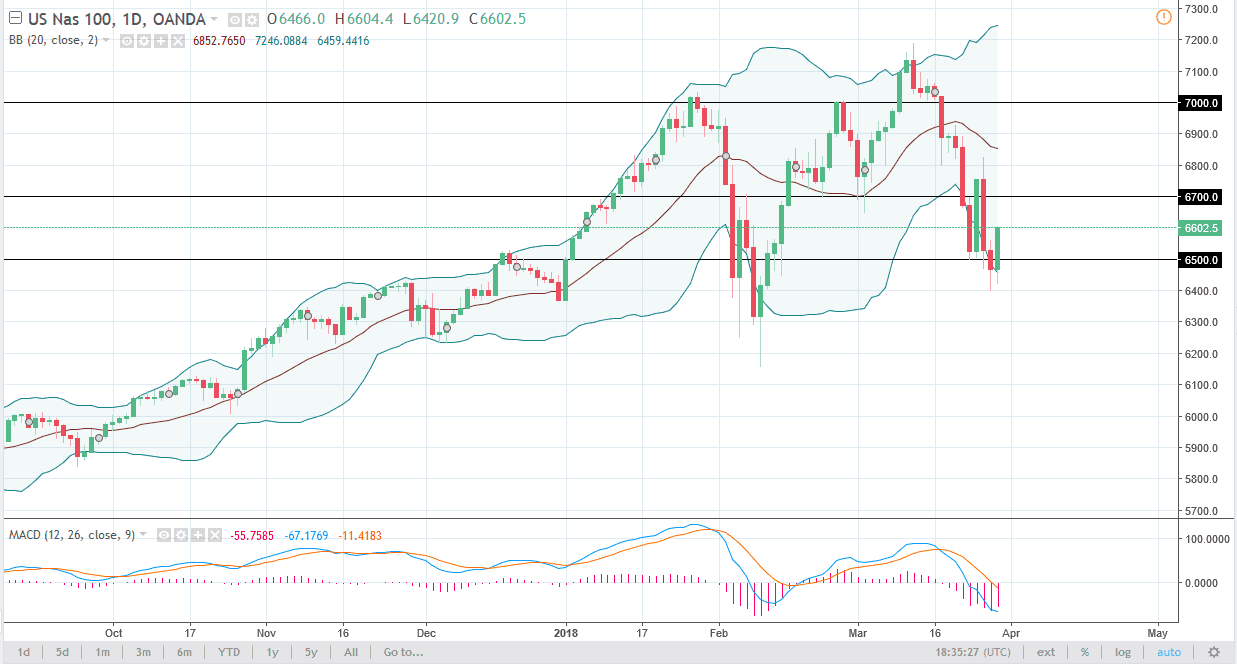

NASDAQ 100

NASDAQ 100 traders initially saw this market fall, but then turned around and rallied significantly above the 6500 level. The 6600 level was targeted, and I think that we will probably break above there and continue to go towards the 6700 level. I like the idea of the 6400 level as support, and I think that we will eventually find reason enough to go higher, especially if the trade war rhetoric abates. I look at this market is one that is starting to see more volatility, so this will create more of a trading environment and less of an investment environment.

The market will continue to be very noisy, but that’s to be expected as there has been such a massive shakeup. I believe that the 6300-level underneath would be the gateway to much lower pricing, but I anticipate that we will continue to find value hunters.