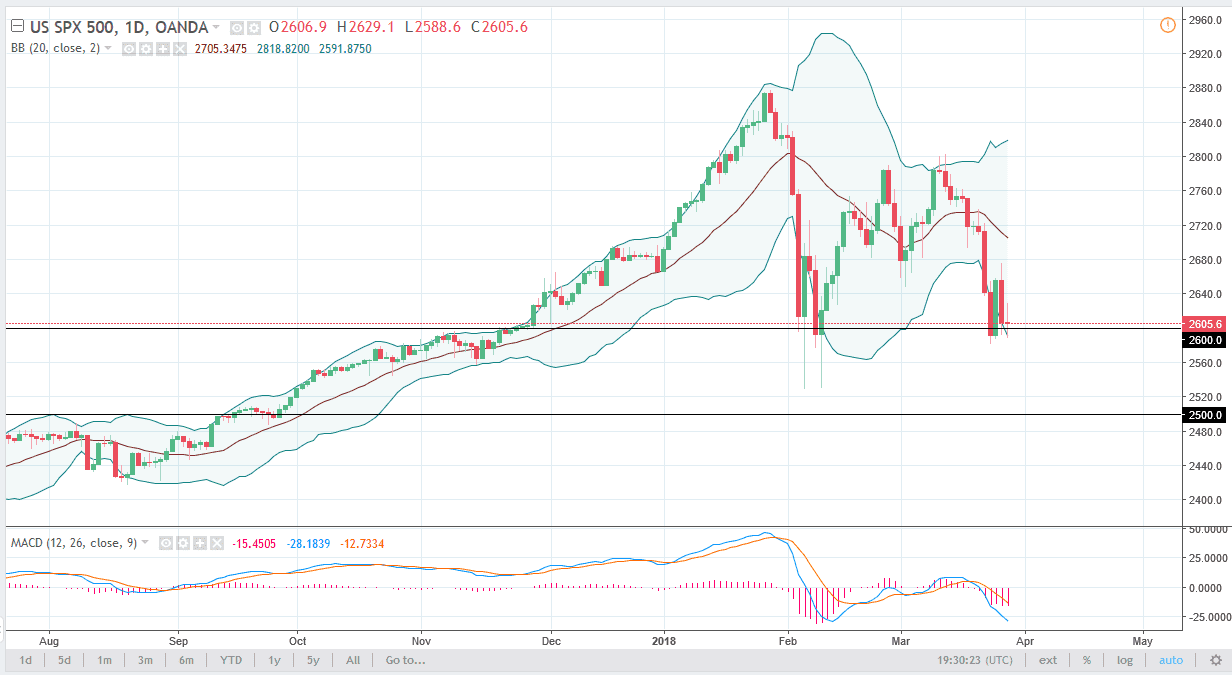

S&P 500

The S&P 500 went back and forth during the session on Wednesday, as we respected the 2600 level as support. This is an area that seems to be attracting a lot of attention, so I believe that if we can stay above there, the market will try to reach towards the 2700 level, perhaps even the 2800 level. If we break down below the 2600 level, we could have plenty of support show up somewhere near the 2500 level, as it is an area that has been important more than once. However, what I find the most interesting about this chart is that we have sat still at this area, showing that perhaps the market is finally calming down. I believe that the longer we go sideways, the better off this market’s going to be and potentially we could go higher as a result. I believe that this market will also move based upon talks about a potential trade war. If we break above the 2680 handle, the market should continue to reach much higher.

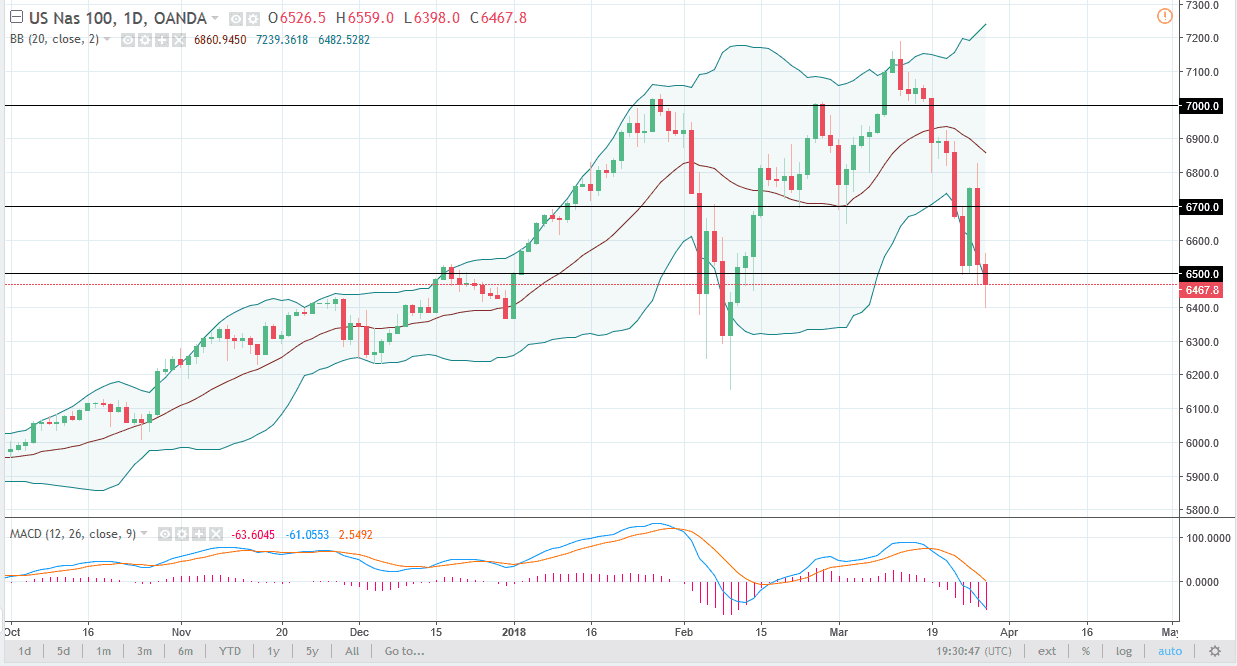

NASDAQ 100

The NASDAQ 100 fell most of the day on Wednesday but found enough support at the 6400 level to turn around and form a bit of a hammer. The hammer of course is a bullish sign, and if we can break above the top of the candlestick for the day, I think the market will probably go towards the 6700 level. It’s going to take a significant amount of momentum to have that happen, but it would show that we have turn things around and found buyers again. I think that the market is trying to make a bit of a stand, but it may take a couple of days for the momentum to finally pick up and rally. I believe that the next major support level is somewhere near 6300