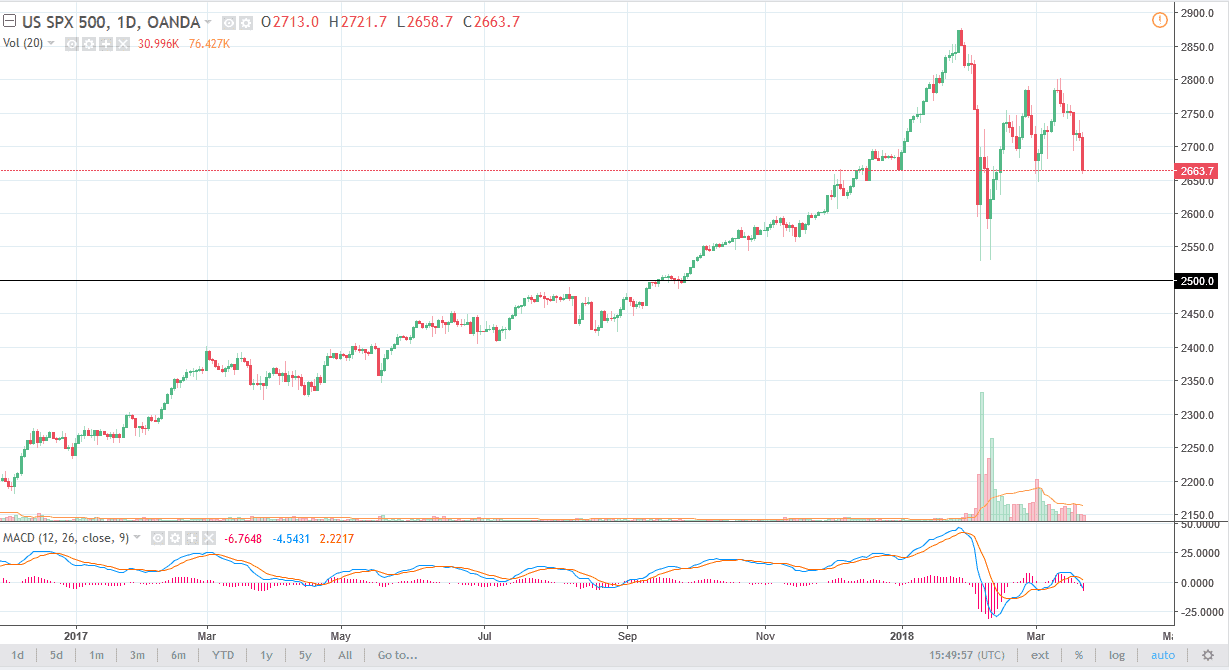

S&P 500

The S&P 500 fell significantly during the trading session on Thursday, as fears of a trade war between the United States and China start to escalate. With the US ready to sign tariffs, it’s likely that the Chinese will retaliate, and that of course could be bad for economic growth in both directions. Stock markets in general have suffered during the day, and of course the S&P 500 was never going to be any different. Currently, there is a significant amount of support just below trading, with the 2650 level offering the initial support, 2600 offering the even more support, and below there we have the 2500 level, which could define the entire uptrend. I think at this point, until we get some type of reconciliation between the Americans the Chinese, the stock markets could continue to offer “sell the rally” opportunities at best.

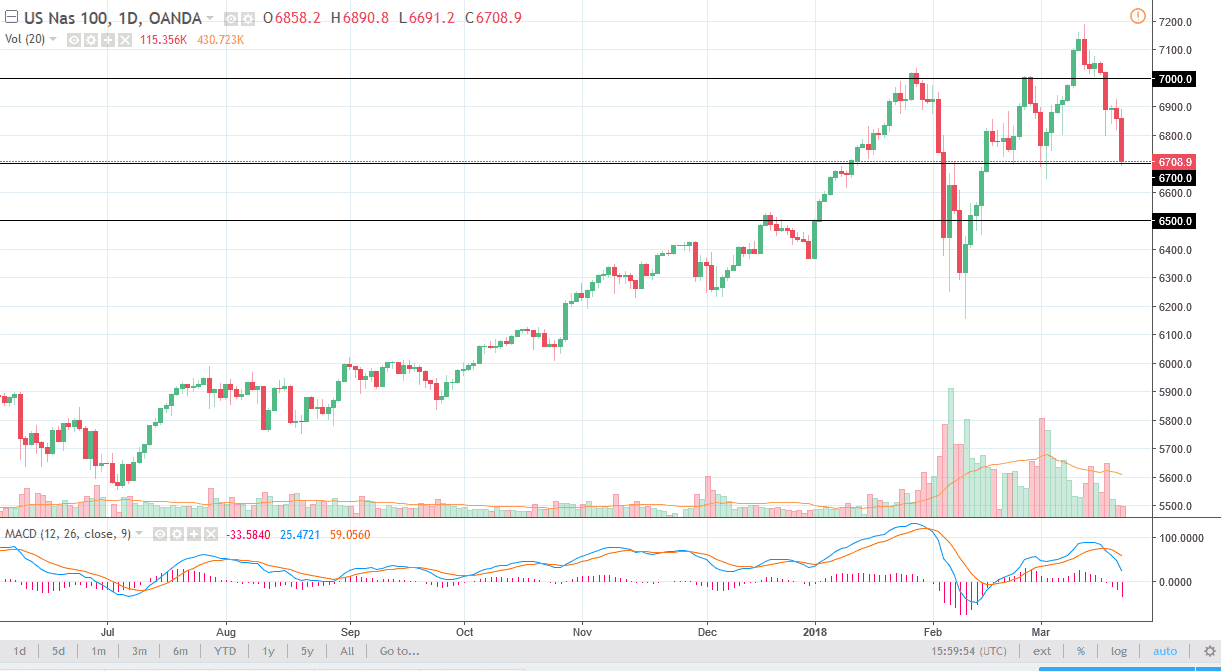

NASDAQ 100

The NASDAQ 100 broke down massively during the trading session, reaching towards the 6700 level. This is an area that is massive support, and if we can continue to break down from here, the market is very unlikely to unwind to the 6500 level. As I record this, we are testing that area, so by the time you put your trade on, we may be ready to start selling off again. I think the 6500 level will be massive, so it will be that easy to break down below, but if we did, it could be lights out for the NASDAQ 100 for the foreseeable future. The next couple of sessions will be crucial, so by all means you may wish to step to the side and let the market prove what it wants to do. Remember, the NASDAQ 100 seems to lead the way for the other indices, so even if there isn’t a trade here, it may give you an idea as to how to trade the other indices.