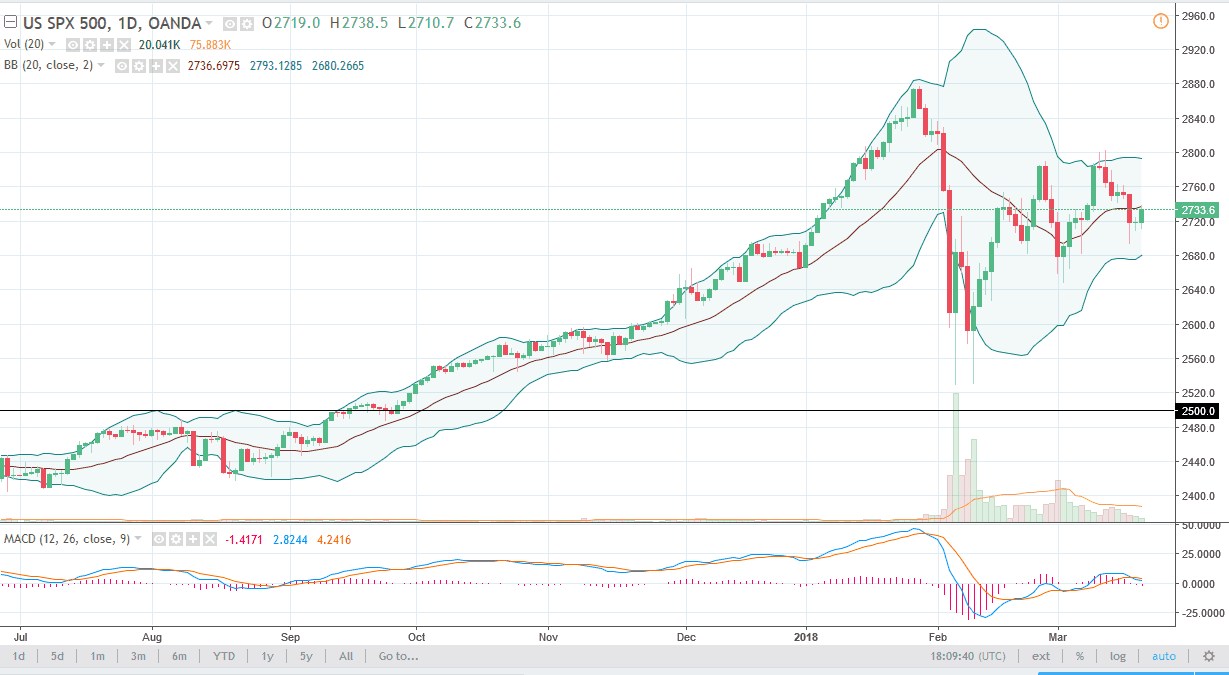

S&P 500

The S&P 500 was a bit choppy over the last several sessions, and of course Wednesday was the same as we have seen a lot of volatility after the Federal Reserve announcement. The fact that the market started to rally into the announcement was followed by a quick pull back, and then to rally again. It currently looks as if the market is ready to go to the 2800 level, an area that I think is significant resistance. If we were to break above that level, we would be free to go to the 2900 level, but at this point I think we are trying to build up momentum to finally make that break out. I don’t think we have it yet, but eventually we should. The candle from the Monday session, should be the place where we see a lot of support, near the 2690 handle. If we were to break down below that candle, that would be negative. Otherwise, I think short-term pullbacks continue to offer buying opportunities.

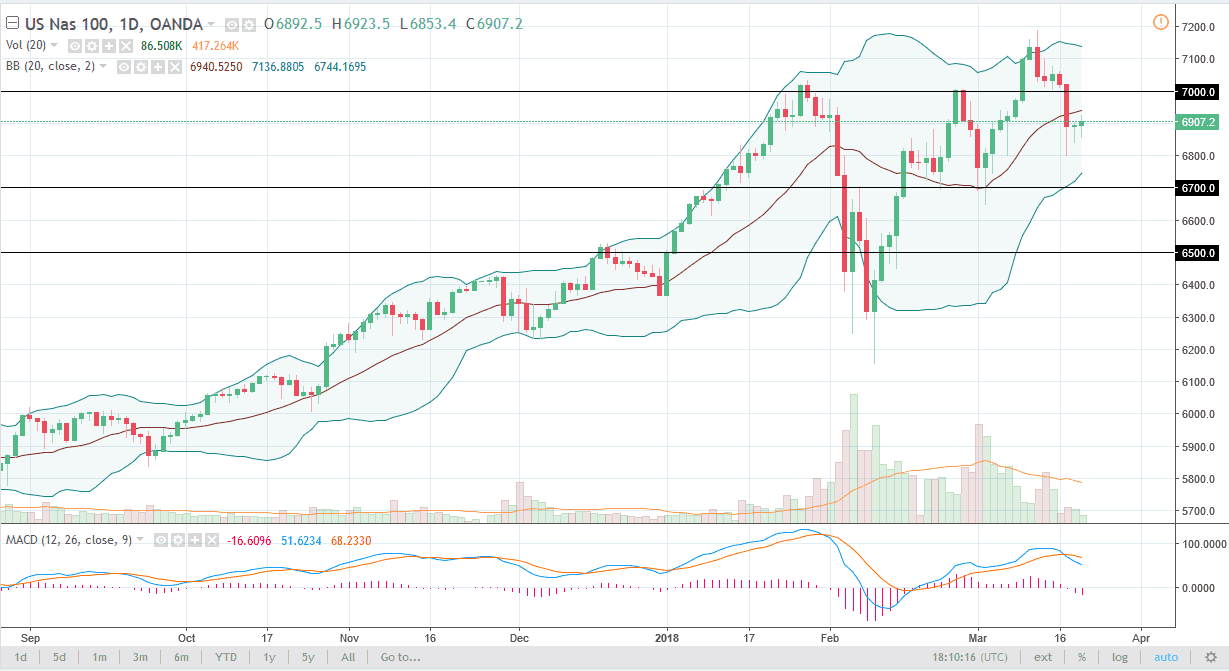

NASDAQ 100

The NASDAQ 100 pull back a bit during the day, only to turn around and show signs of life again. The hammer that formed for the day suggests that we are going to go to the 7000-handle next. That’s an area that I think will be a bit resistive, but if we can clear that area, the market should continue to go higher, perhaps reaching towards the 7200 level. I think that the market continues to find value hunters, and with the Federal Reserve announcement out of the way, it looks likely that we are going to continue the uptrend, and I feel that short-term pullbacks will probably offer buying opportunities. The 6800 level should now be support.