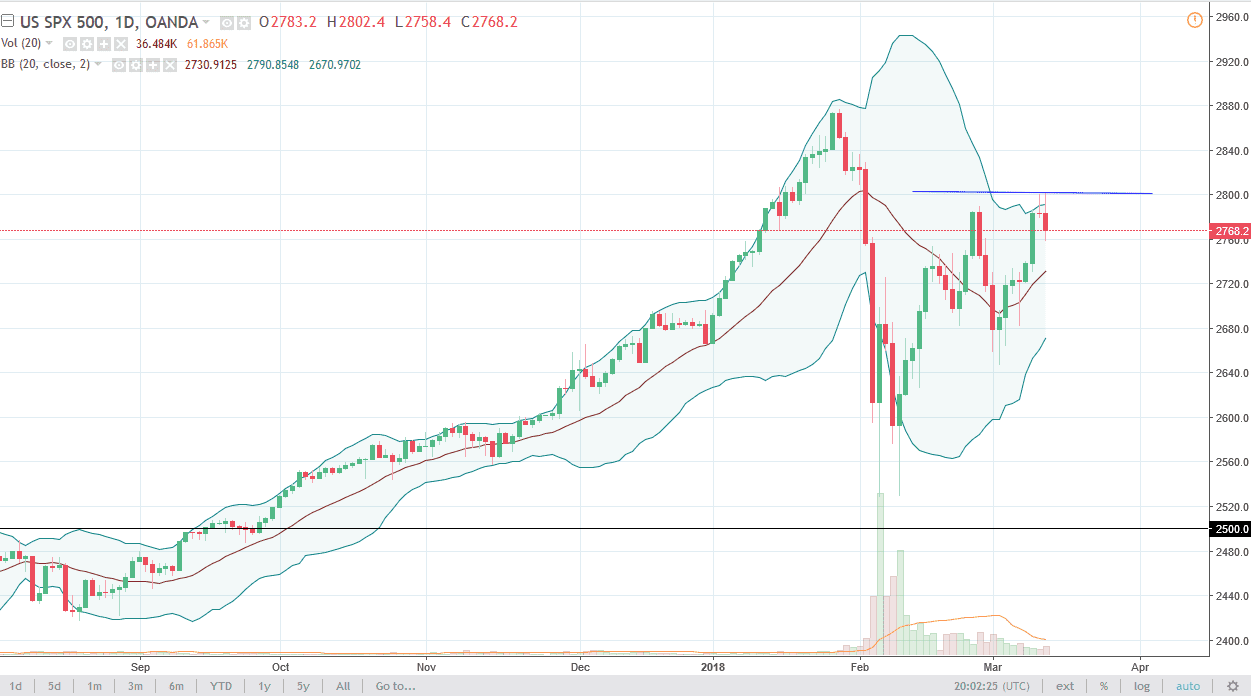

S&P 500

The S&P 500 initially tried to rally during the trading session on Tuesday but found the 2800 level to be far too resistive to continue to go higher. We tested the top of the shooting star from the Monday session, but failed to break out above there. The fact that we have cleared the bottom of the shooting star during the day on Tuesday suggests that we are going to continue to see a bit of negative pressure. However, we have been rallying as of late, so I think that it’s a short-term sell off at best. If we can turn around and break above the 2800 level, the market should continue to go much higher. Ultimately, this is a market that I think is going to be very difficult to deal with, and it is because of that I feel that the NASDAQ 100 is a better trading opportunity right now.

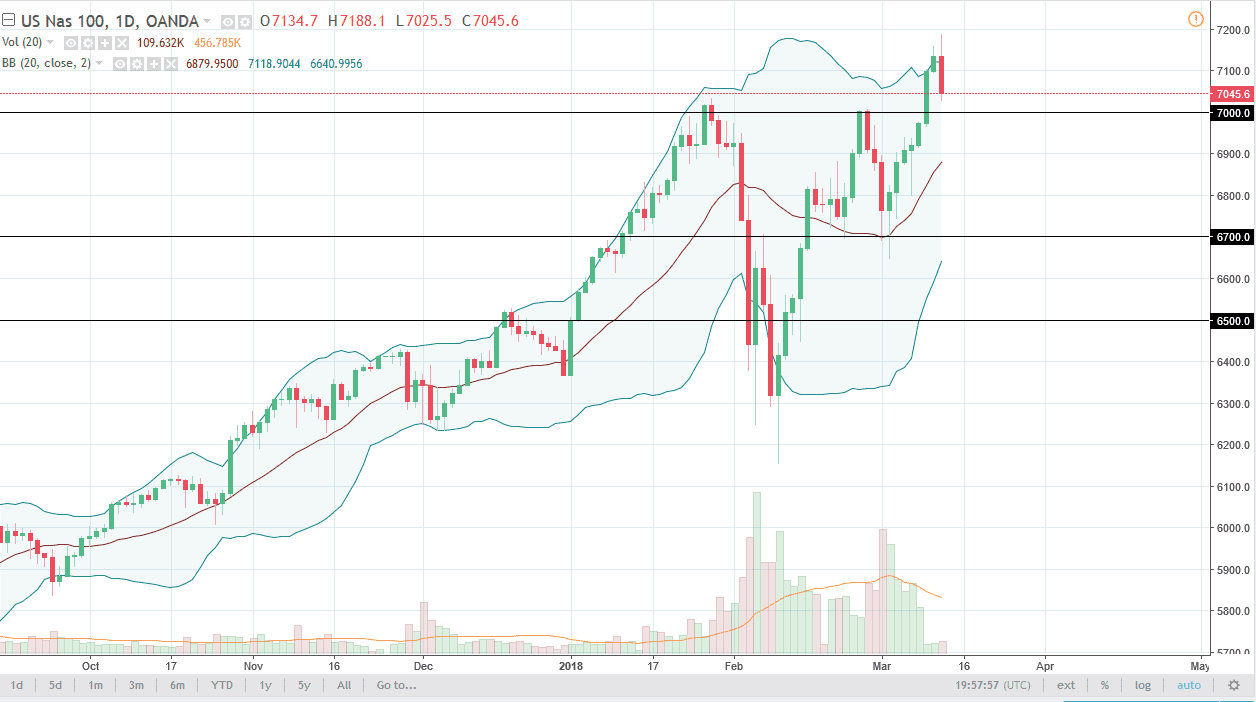

NASDAQ 100

The NASDAQ 100 initially rallied during the trading session on Tuesday, making fresh, new highs again. The 7200 level of course is a large, round, psychologically significant number, and the fact that we failed there is not a huge surprise. However, we have rolled over significantly as we reached down towards the 7050 level, and of course the 7000-level underneath is even more important as it was the scene of a major breakout. It is because of this that I anticipate buyers will come back rather soon. In fact, I believe that if we can bounce from the 7000 handle it will “front run” a potential break out to the upside of the symmetrical triangle in the Dow Jones 30. As things stand right now, I prefer the NASDAQ 100 and I think it is a much clearer signal.