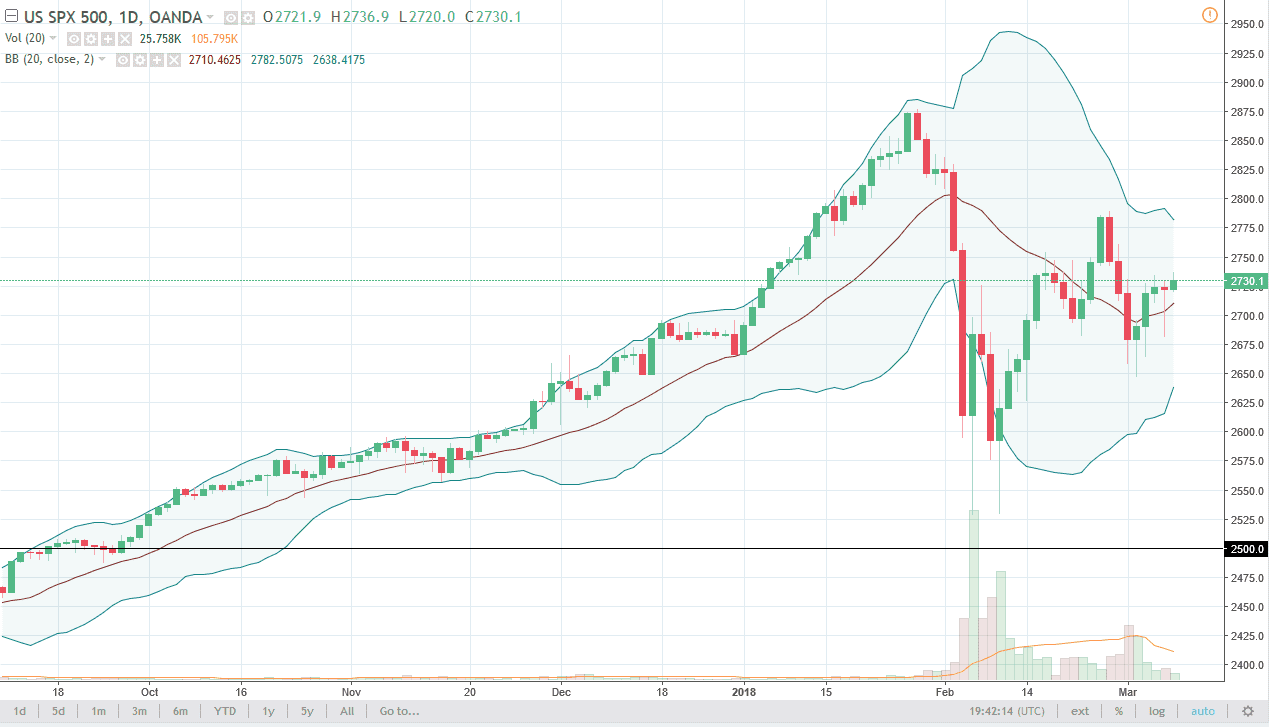

S&P 500

The S&P 500 had a slightly positive session on Thursday, as traders await the jobs number today. The market will get those numbers at 8:30 AM New York time, and I believe that there will be a significant amount of volatility as soon as we get that announcement as per usual. However, to me it looks as if the market is already telling us it wants to go higher based upon the hammer from the Wednesday session, and the relatively stable trading on Thursday. Ultimately, this market will probably go looking towards 2800 if we get a decent jobs number. If we get a bad number, I suspect we will go looking for support underneath near the 2650 handle. I think given enough time, the market continues to find reasons to go higher.

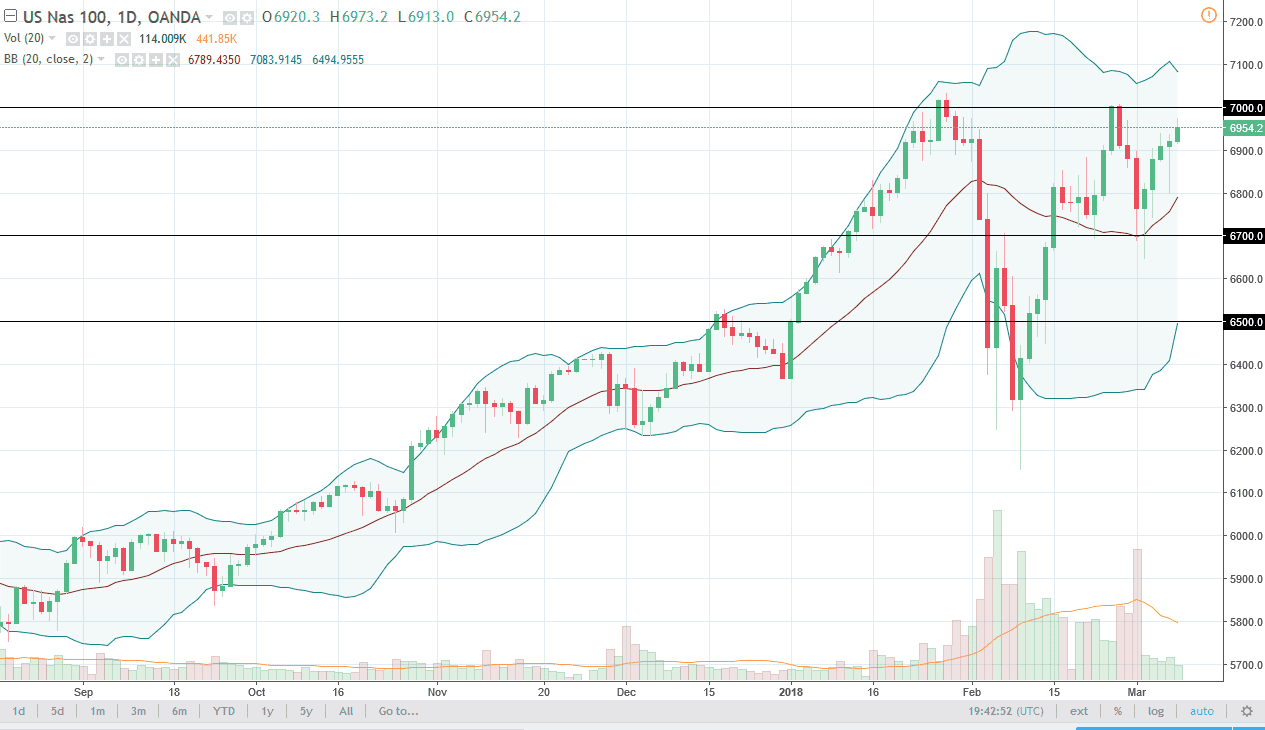

NASDAQ 100

The NASDAQ 100 rallied a bit during the trading session on Thursday, reaching towards the 6950 handle. I believe that the market will continue to grind towards the 7000 handle, an area that has been massively resistive. If we can break above that level, the market should continue to go much higher, perhaps reaching towards the 7250 level. I think that any time we pull back, there will be buyers underneath willing to jump in and take advantage of value when it appears. I think the “floor” of the market is the 6700 level, and as long as we can stay above that level, were in a strong uptrend. At this point, it looks as if the market is “leaning” to the upside going forward. I believe that the market will continue to find plenty of reasons to rally, as it has for months.