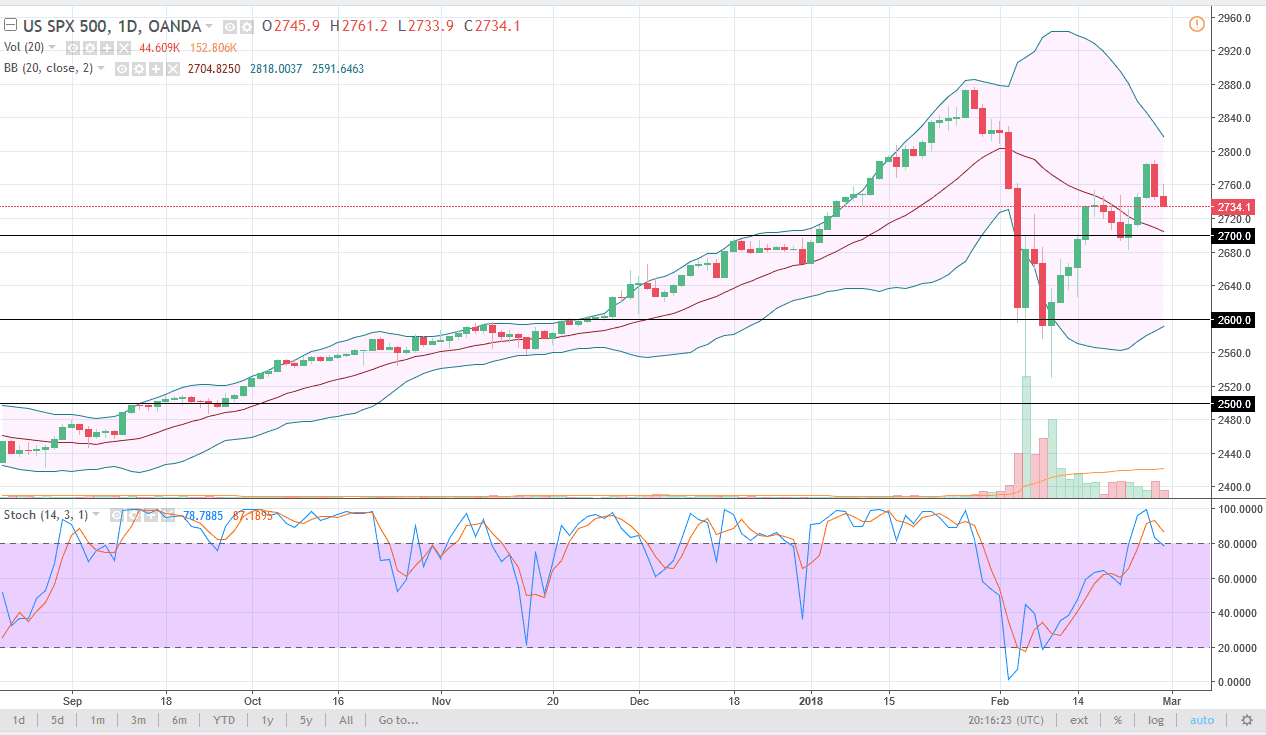

S&P 500

The S&P 500 initially tried to rally during the trading session on Wednesday but turned around at the 2760 level to fall rather significantly. By doing so, the market looks as if it is going to reach down towards the 2700 level. I think there’s a lot of support in that area though, so quite frankly it’s only a matter of time before the buyers return. If we break above the 2760 handle, that is a very bullish sign, perhaps sending the market towards the 2800 level. I believe that the 2700 level underneath will be massively supportive, and if that were to get broken to the downside, the market will probably go looking towards the 2650 handle. There is plenty of noise underneath that I think will continue to push the market to the upside. The 2800 level has offered resistance, but quite frankly it should be short term.

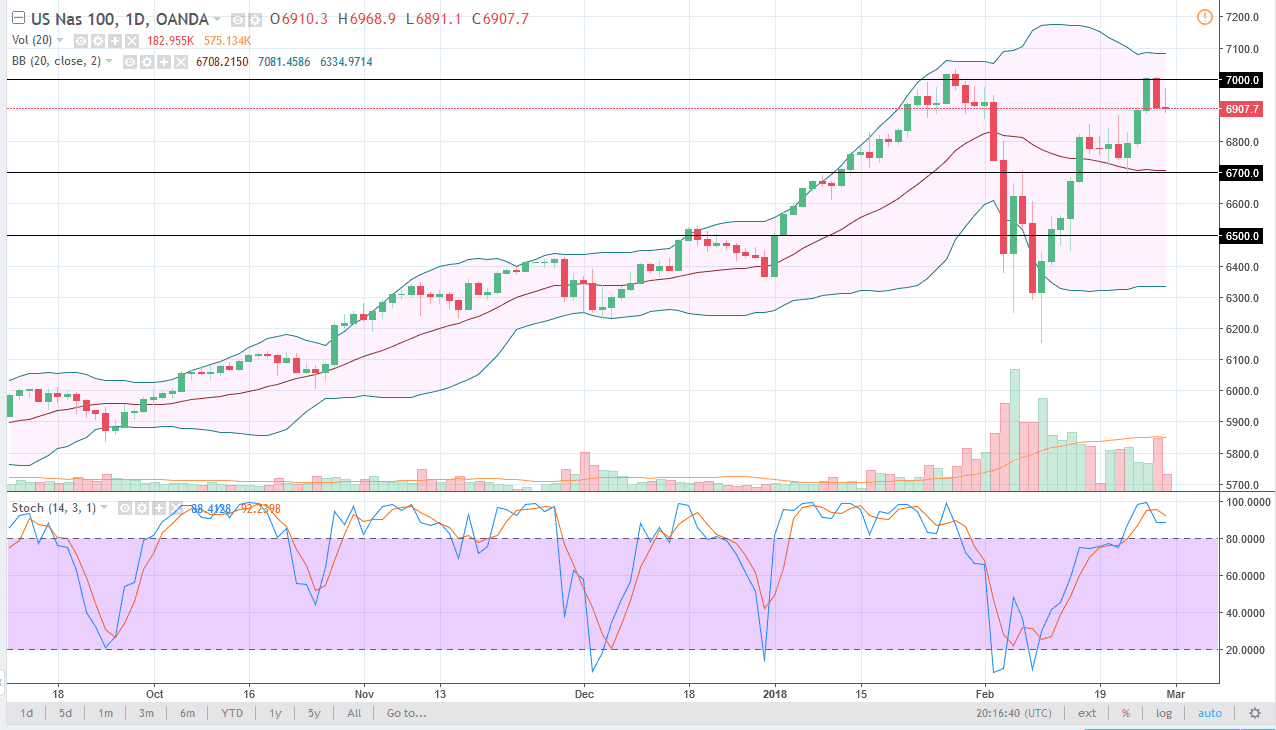

NASDAQ 100

The NASDAQ 100 initially tried to rally during the trading session on Wednesday as well but found the 7000 level to be far too resistant. We have turned around to form a shooting star, and that suggests that we are ready to go even lower. If we can break down below the 6900 level, the market probably goes down to the 6800 level after that, perhaps even down to the 6700 level. That’s an area where I think it is massively supportive, so it’s only a matter of time before we can find buyers to push this market to the upside. However, it looks as if the next couple of sessions could be a bit soft. If we were to break down below 6700, that would be a very negative sign. I think eventually we will build up the necessary momentum to clear 7000 though, perhaps after some “weak hands” get flushed out.