The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 18th March 2018

In my previous piece last week, I saw the best possible trades for the coming week as long of the EUR/USD currency pair, and long of the NASDAQ U.S. stock market index. The EUR/USD currency pair fell by 0.13% while the NASDAQ fell by 1.30%, producing an average loss of 0.59%.

Last week was relatively quiet, with few major developments affecting markets. There is a newly enhanced sense of fragility around the Trump Administration as the President loses more key staff and as the Mueller enquiry and rumblings within the FBI continue. It is seen as increasingly possible that a criminal indictment could be brought against President Trump. As for fundamental economic data releases, last week was dominated by weak U.S. retail sales data, and inflation exactly as expected by the consensus forecast.

The overall effect of these developments was to leave the U.S. Dollar largely unchanged, while the stock market fell a little. The market will now look ahead to the FOMC projections and Federal Funds Rate due from the Federal Reserve later this week, as well as monthly guidance and a rate decision from the Bank of England. This could put the GBP/USD currency pair in strong focus during the second half of the coming week.

There were no major central bank guidance events occurring last week. The Japanese Yen and the British Pound were the week’s major gainers, while the Canadian Dollar is currently the weakest major currency.

Fundamental Analysis & Market Sentiment

Sentiment and fundamentals are easier to read, especially when it comes to the U.S. Dollar which has some strength from strong economic fundamentals, although neither fundamentals nor sentiment give it enough strength to rise as there is no expectation of an increase in the pace of forthcoming rate hikes, which have already been priced in. Another key development which is affecting sentiment is the continuing struggle between the Trump administration and the deep state, as the special investigation into Russian collusion continues towards a path where it seems the object may be to simply land any kind of criminal charge against the President. This is negative for the U.S. Dollar and for the U.S. stock market.

Technical Analysis

U.S. Dollar Index

This index printed a small bullish pin candlestick, which signifies in a quiet way the fact that the consolidation is getting stronger and more bullish. The price was again unable to make a new low, and has consolidated over the past eight weeks now, suggesting that the long-term bearish trend has slowed down considerably. There is a strong, long-term bearish trend, and a bearish trend line dominates the price chart shown below. However, the price seems reluctant to move lower, so the trend is becoming increasingly unreliable. In such conditions, it may be more minor currency crosses which see the most action in the Forex market.

GBP/USD

This pair is in a long-term bullish trend. However, like the U.S. Dollar, it has been consolidating over the past eight weeks, despite the long-term trend. Last week’s candlestick was a relatively small bullish candlestick, it is a little bullish mainly because its close is higher than the previous two candlestick closes. Sentiment seems to be more bullish on the Pound than on the Euro, as last week saw the EUR/USD print a bearish pin candlestick, suggesting that being bullish of this pair over the coming week might be the best “with trend” trade for the week.

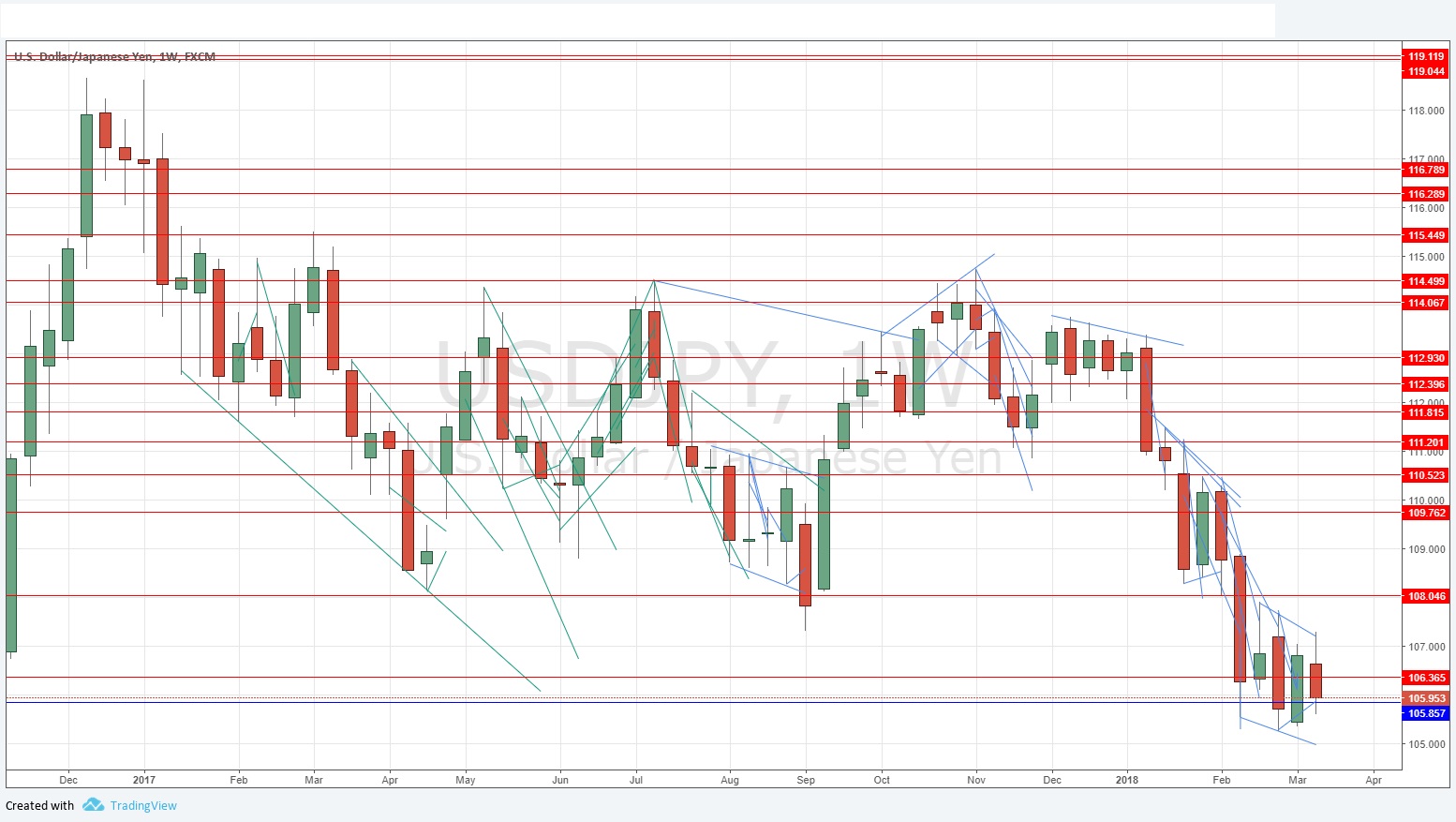

USD/JPY

This pair is in a long-term bearish trend. Unlike the U.S. Dollar, which has been consolidating over the past eight weeks, it is managing to either make new lows or get very close to them, suggesting that this is a relatively good and powerful long-term trend despite its ranging nature which can be seen in the price chart below. Last week’s candlestick was a relatively small bearish candlestick, it is a little bearish mainly because it closes in the lower half of the previous candlestick.

Conclusion

Bullish on the GBP/USD currency pair; bearish on the USD/JPY currency pair.