The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 11th March 2018

In my previous piece last week, I saw the best possible trades for the coming week as long of the EUR/USD currency pair, and short of the USD/JPY currency pair. The EUR/USD currency pair fell by 0.10% while the USD/JPY currency pair rose by 1.04%, producing an average loss of 0.57%.

The most important development in the market last week was the very positive non-farm payrolls data which was released on Friday, which came in significantly above the consensus forecast. The U.S. added another 313,000 new jobs when only 205,000 were expected. However, average hourly earnings came in lower than expected. This produced a combined result of the market seeing the U.S. economy strong, but not overheating to the extent where the pace of rate hikes would need to be quickened. This gave the stock market a boost, with the benchmark S&P Index making its highest close since 1st February. The U.S. technology index of the NASDAQ’s major 100 shares closed at an all-time high, indicating how firmly the technology sector has bounced back.

The Japanese Yen, the Euro, and the Canadian Dollar all saw central bank guidance events occurring last week. The Bank of Japan indicated no change, the Bank of Canada took a slightly more dovish line over the tariffs issue, and the European Central Bank took a slightly more hawkish stance as it removed wording suggesting a willingness to expand QE if necessary. However, it is the greenback which dominates, and it remained mostly unchanged over the week.

Fundamental Analysis & Market Sentiment

Sentiment and fundamentals are easier to read, especially when it comes to the U.S. Dollar which has some strength from strong economic fundamentals, although neither fundamentals nor sentiment give it enough strength to rise as there is no expectation of an increase in the pace of forthcoming rate hikes, which has already been priced in. Another key development which has affected sentiment is the announcement that there will be talks between North Korea and the U.S.A. which has led to some optimism of a prospect of a reduction in tensions which is boosting “risk-on” sentiment in line with more positive economic data. This should be positive for stocks. The U.S. Dollar is due key retail sales due this week, which should be the most important calendar event unless the quarterly Swiss National Bank guidance gives any surprises.

Technical Analysis

U.S. Dollar Index

This index printed a small inside doji candlestick, which signifies indecision. The price was again unable to make a new low, and has consolidated over the past seven weeks, suggesting that the long-term bearish trend has slown. There is a strong, long-term bearish trend, and a bearish trend line dominates the price chart shown below. However, the price seems reluctant to move lower, so the trend is becoming increasingly unreliable. In such conditions, it may be more minor currency crosses which see the most action in the Forex market.

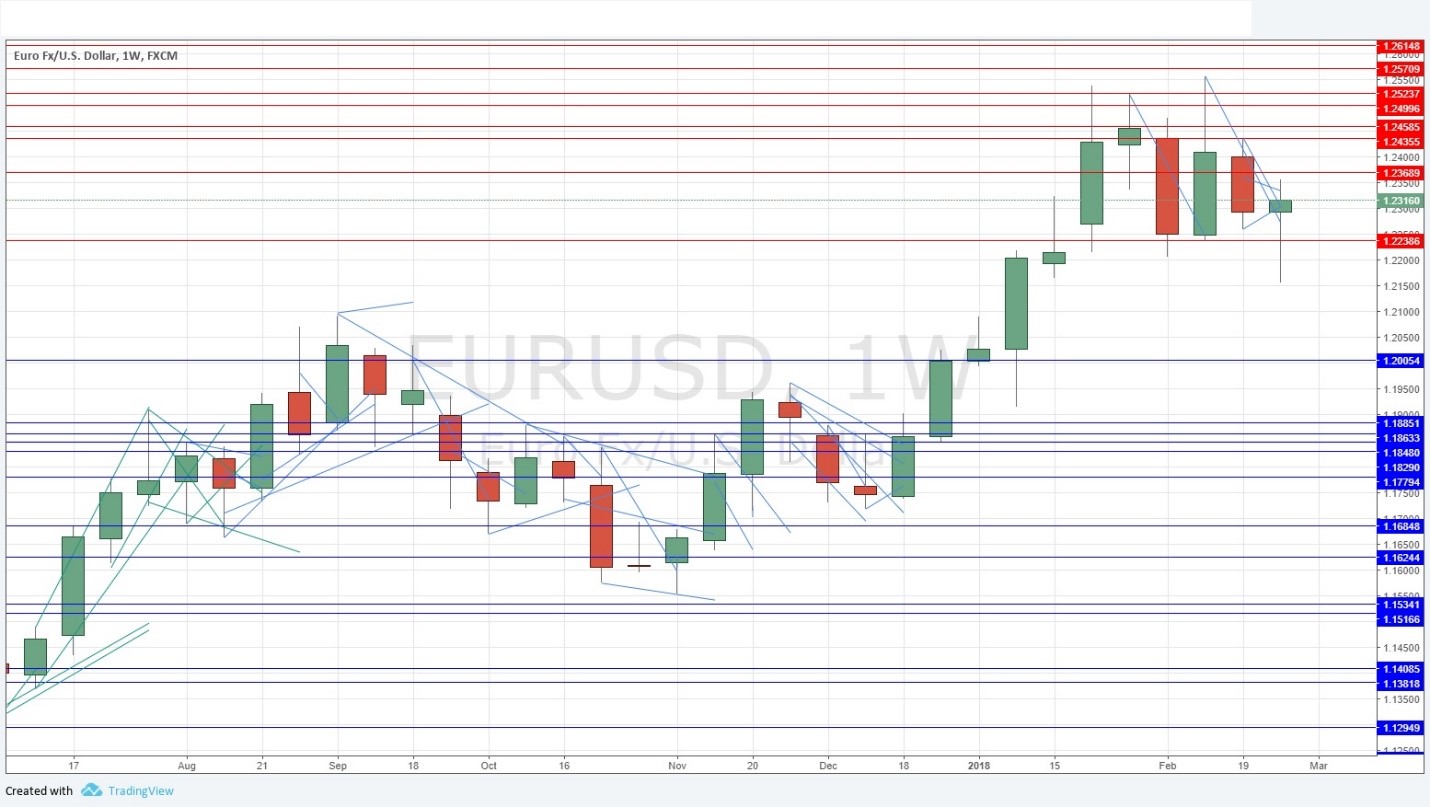

EUR/USD

This pair is in a long-term bullish trend. However, like the U.S. Dollar, it has been consolidating over the past seven weeks, despite the long-term trend. Last week’s candlestick was a small bearish pin candlestick, yet I see the candle as unreliable as the previous week saw a pin candlestick pointing in the opposite direction. I look to use this currency pair to benefit from the long-term trend against the Dollar as sentiment is increasingly bullish on the Euro, more so than on the Japanese Yen or British Pound.

NASDAQ-100

Stock markets in general, particularly the U.S. stock market, have recovered well this week. The technology sector is outperforming every other sector, reaching new all-time highs, which is reflected in the NASDAQ-100 Index. The week saw a long, strong and very bullish candlestick closing at an all-time high. There is no reason not to be bullish on technology stocks.

Conclusion

Bullish on the EUR/USD currency pair and the NASDAQ 100 stock index.