EUR/USD

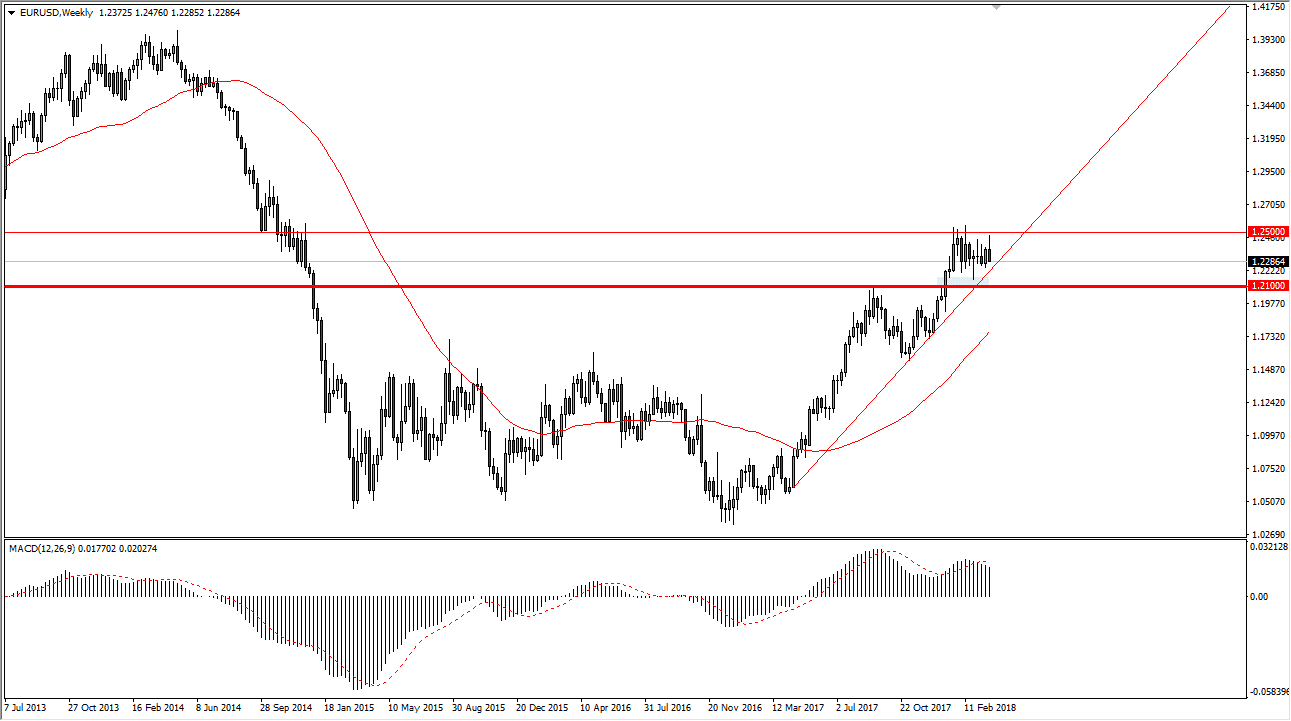

The EUR/USD pair has gone sideways during most of the last couple of months, as we have consolidated between 1.21 and 1.25. I believe this will continue to be the case initially this month, but we are approaching a significant uptrend line that could turn things around. At this point, I suspect that any move above the 1.25 level will be extraordinarily bullish, perhaps sending this market to the 1.32 level, based upon projections from the broken bullish flag a couple of months ago. The 1.21 level underneath should be massive support, it was most certainly massively resistive previously.

The market already knows that the Federal Reserve is looking to raise interest rates, but the more talk we get out of Europe about stepping away from quantitative easing, the more likelihood that this pair will rise. This will also have a bit of momentum put into the market if we have further progress made on the negotiation situation between the United Kingdom and the European Union. Once that situation gets settled, that should help both currencies against the US dollar.

The alternate scenario of course is that we break down below the 1.21 handle, which would be very negative for this market. At that point, I anticipate that the market will probably go down to the 1.17 level. Market participants still seem to be bullish overall though, and I think that although we have been very quiet as of late, this could simply be a matter of trying to build up the necessary momentum to go higher. Remember, markets can’t go in one direction forever, and that’s most of what we have been seeing over the last couple of weeks. Once we get our next catalyst, this market should be free to go but, in the meantime, anticipate choppy trading.