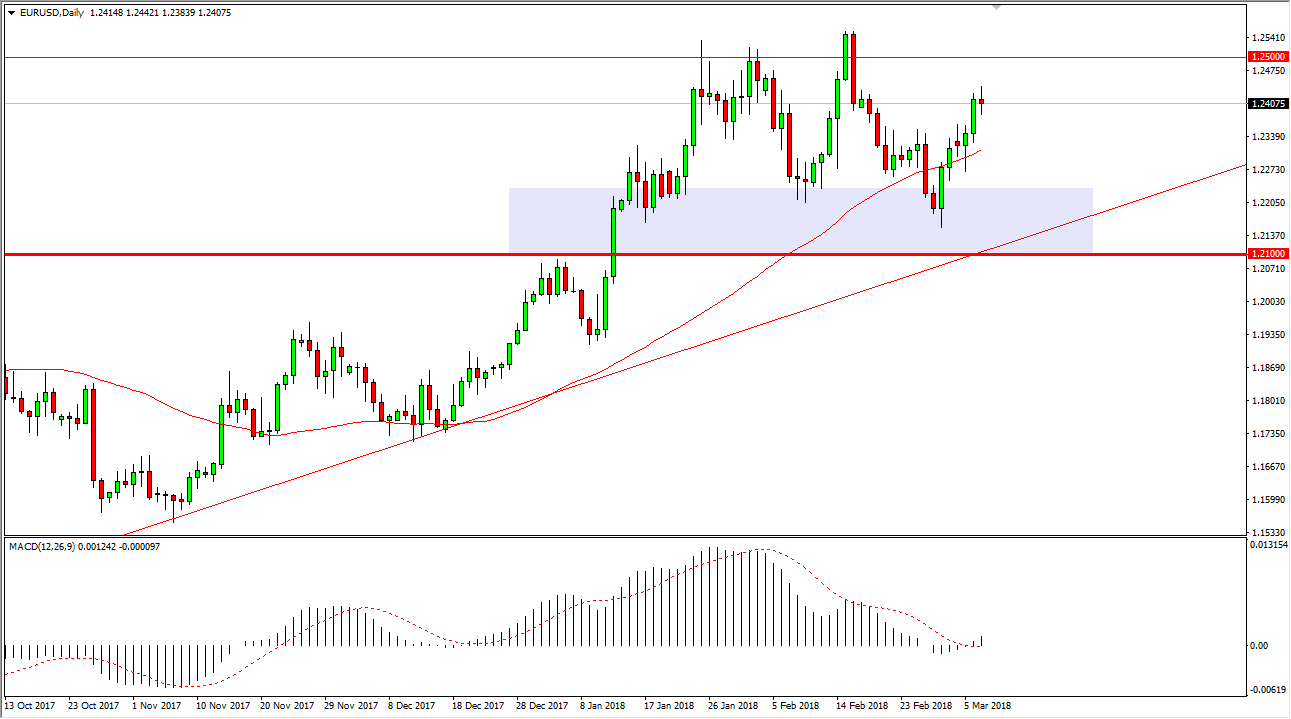

EUR/USD

The EUR/USD pair went back and forth during the trading session on Wednesday, showing signs of exhaustion in both directions. The 1.24 level seems to be a bit of a magnet in the short term, but I also recognize that the 1.25 level above is massively resistive. If we can break above there, then the market is free to go to the 1.32 level longer term. We have broken above the top of a weekly bullish flag, and that measured for a move to the 1.32 handle over the longer term, I think it’s only a general idea at this point though, and I think that eventually we will continue to go towards that area, but it is going to take a lot of momentum building to have that happen. If we stay above the 1.21 handle, I think that this is a “buy only” market, or possibly a “buy on the dips” market.

GBP/USD

The British pound has gone back and forth during the trading session on Wednesday, showing signs of volatility, pressing up against the 50-day EMA. We ended up forming a hammer, and that suggests that if we can break above this EMA that we can rally towards the 1.40 level, which is the next major resistance barrier to overcome. If we can break above that level, then I think the market probably goes to the 1.4150 level, and then eventually towards the 1.43 level. The alternate scenario is that we break down below the bottom of the hammer, which has this market dropping from here. I think the 1.3650 level underneath is the “floor” in this overall uptrend, so as long as we can stay above there, I believe that the buyers will continue to return.